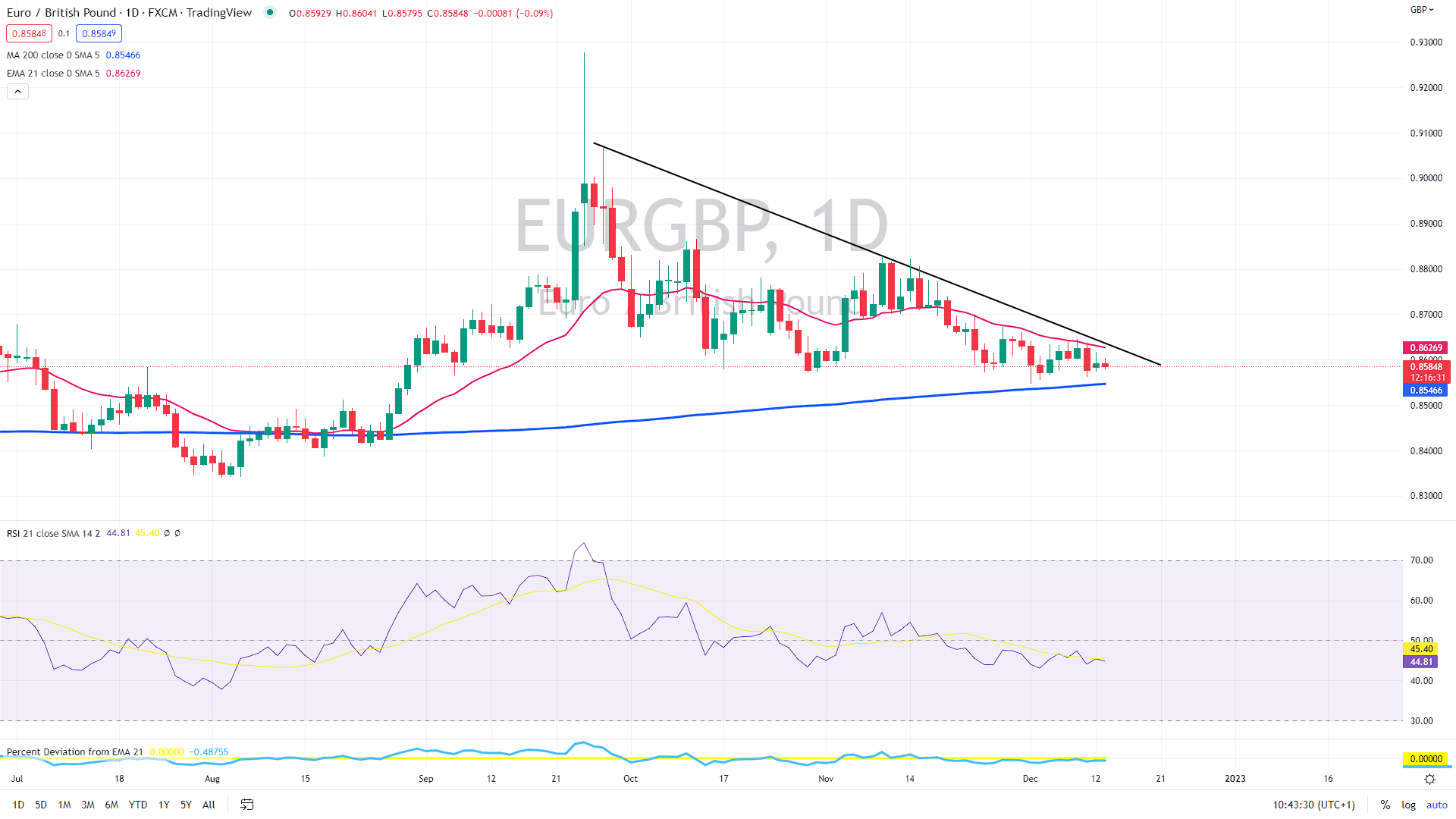

The EUR/GBP cross has remained in a narrow range recently, but still trading above its 200-day moving average, waiting for this week’s BoE and ECB monetary policy decision.

UK labor market is worsening notably

According to the most recent statistics issued by the Office for National Statistics (ONS) on Tuesday, the UK’s ILO Unemployment Rate jumped from 3.6% to 3.7% in October, compared to the 3.7% anticipated, while the claimant count change revealed an unexpected increase in the month.

The number of individuals collecting unemployment benefits increased by 30,500 in November, compared to the -6,400 previously reported and the -13,000 anticipated.

The UK’s average weekly earnings, excluding bonuses, reached +6.1% 3Mo/YoY in October, compared to +5.8% the previous month and +5.9% projected, while earnings, including bonuses, reached +6.1% 3Mo/YoY, compared to +6.0% the previous month and +6.2% expected.

In October, the ONS reported that 417,000 working days were missed due to labor conflicts, the highest number since November 2011. This week, rail employees, nurses, and postal workers are all scheduled to go on strike over wages and working conditions.

You may also read: Should Sam Bankman be active in business or in jail?

Compared to October 2022, payroll employment grew by 107,000 (0.4%) in November 2022, albeit this estimate should be considered preliminary and is likely to be updated as additional statistics are received the following month.

“Today’s wage growth data adds to thoughts of a full employment recession and supports some of the more hawkish pricing of the Bank of England (BoE) policy cycle. It is probably not enough to prompt the BoE into another 75 bps hike on Thursday but will support Sterling.” economists at ING reported after the data.

Focus on ECB also

In Europe, the annual German CPI reading came in at 10.0% for November, down from 10.4% the previous month.

Ahead of Thursday’s European Central Bank meeting, investors will also focus on the German ZEW economic sentiment survey, which is expected to reveal a minor gain in confidence in the largest economy in the Eurozone.

Also an interesting topic: Silver ahead extreme macro data week – where is it headed?

However, market players are generally in a state of limbo ahead of the US consumer price index for November, which is projected to show a reduction in the annual rate to 7.3% from 7.7% in the previous month, while core inflation will likely remain unchanged at 0.3% month-over-month.

As long as the price remains above the mentioned 200-day average (the blue line), currently near 0.8550, the immediate outlook seems somewhat positive, with the following resistance at around 0.87.

However, volatility is expected to pick up notably throughout the week. Thus, the technical analysis might not be that helpful in the days ahead.

EURGBP daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.