Concerns about the safety of banking institutions have increased since the recent failure of several big banks, such as Silicon Valley Bank, Silvergate, and others.

Many people are looking out for new methods to reclaim financial security along with returns to keep up with the high inflation. Bitcoin has been found as the answer to this problem, which sent its price to almost $30,000, beating almost all 500 stocks from the S&P 500 stock index.

Bitcoin as the best-performing asset

Time and time again has Bitcoin proven itself, bringing enormous returns for patient investors. A crypto site cryptomaniaks.com found that the price of Bitcoin increased by over 37% this year, from $20,380 to $27,930 on March 10th. It even rallied to $29,000 on March 22nd.

Related article: Bitcoin: An extraordinary asset class defying traditional labels

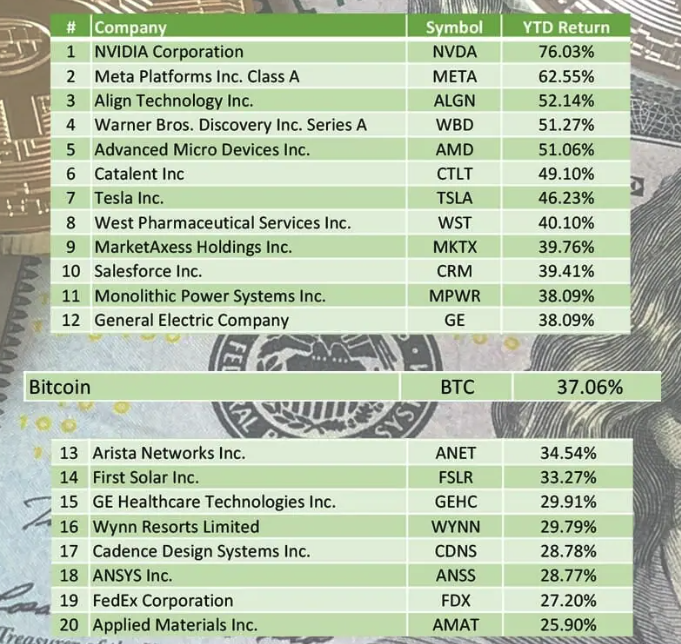

Considering the entire S&P 500, only 12 stocks have beaten Bitcoin so far this year. These are some of the most popular stocks, including NVIDIA, Meta, Warner Bros, or Tesla.

Bitcoin’s performance vs S&P 500 stocks, source: cryptomaniaks.com

All the other stocks are behind Bitcoin’s astonishing performance in 2023. This doesn’t end with stocks. Bitcoin beat the performance of commodities as well. Gold surged amid significant market uncertainty, but only by around 9% so far. Silver, Crude oil, natural gas, and other commodities are even in loss.

What’s next for Bitcoin?

The panic in the banking system definitely helped Bitcoin’s bullish momentum that started at the beginning of this year, but investors need to remain careful. The current price surge sent digital gold 85% higher from its $15,500 bottom in November 2022.

Read more: US President’s Economic Report is wrong about crypto – here’s why

That may make a lot of investors overly optimistic, which usually results in a market crash. That is why it’s important to stick to any set-up investment strategy, ideally dollar-cost averaging over time.

Bitcoin daily chart, source: tradingview.com

Although the price of Bitcoin is much lower than its all-time high (ATH) of $69,000, investors who began dollar-cost averaging (DCA) Bitcoin at its highest price of $69,000 in November 2021 are seeing positive returns currently. This is despite Bitcoin is still down 60%.

Comments

Post has no comment yet.