The Australian dollar traded higher during the EU session on Thursday, defying the US dollar strength and ignoring today’s worse-than-expected labor market data,

Australian jobs market disappoints

Earlier today, data showed that Australia’s headline Employment Change was -11,500 versus 20,0000 anticipated and -14,600 before, while the Unemployment Rate climbed to 3.47% versus 3.45% predicted and previously.

Furthermore, Australia’s Consumer Inflation Expectations for February decreased to 5.1%, compared to 5.6% of market expectations and prior readings.

Chinese big revival is not happening, so far

In other news, Chinese President Xi Jinping reportedly made some positive remarks on Thursday, as reported by China’s state media.

“Willing to share ultra-large-scale markets, complete industrial systems, and advanced technologies with central Asian countries,” Jinping said.

Intensifying industrial and investment cooperation between China and the five Central Asian nations will preserve the stability of regional supply networks, likely helping the Australian economy, which is dependent on the Chinese economy.

On the other hand, according to a statement issued by China’s Finance Minister Liu Kun on Thursday, the country’s fiscal revenue and spending position remain dire.

Markets reprice Fed’s terminal rate

Following this week’s hotter-than-expected US inflation data, the market’s bets on the Fed’s future movements indicate that US central bank rates will peak at 5.25% in July, as opposed to the Federal Reserve’s December projection of a 5.10% maximum rate.

The US Census Bureau stated on Wednesday that Retail Sales increased by 3% in January, following a 1.1% decline in December. This result exceeded market expectations of a 1.8% gain and helped the US Dollar maintain its strength in the afternoon.

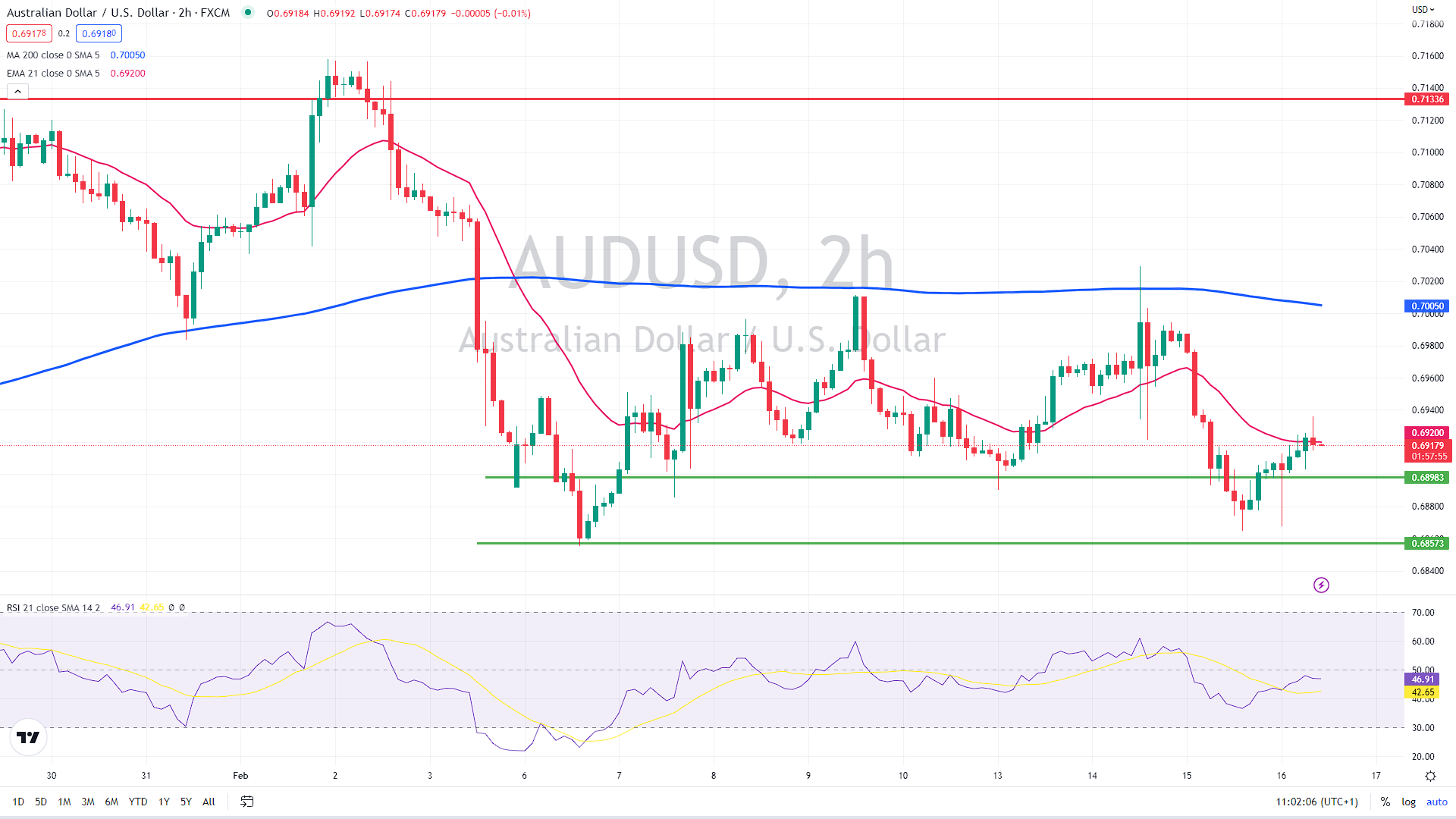

The two-zone support for the Australian dollar is in the 0.6850 – 0.69 region, and as long as the AUD/USD pair trades above it, the short-term outlook seems bullish, targeting the 0.70 level again.

AUD/USD 2h chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.