Yield farming has become an interesting way for investors to earn high returns on their cryptocurrency investments by providing liquidity to decentralized finance (DeFi) protocols.

In this article, we will explain what yield farming is, how it became popular, its pros along with cons, and the possible future of yield farming.

What is yield farming crypto?

Yield farming, source: kryptokava.sk

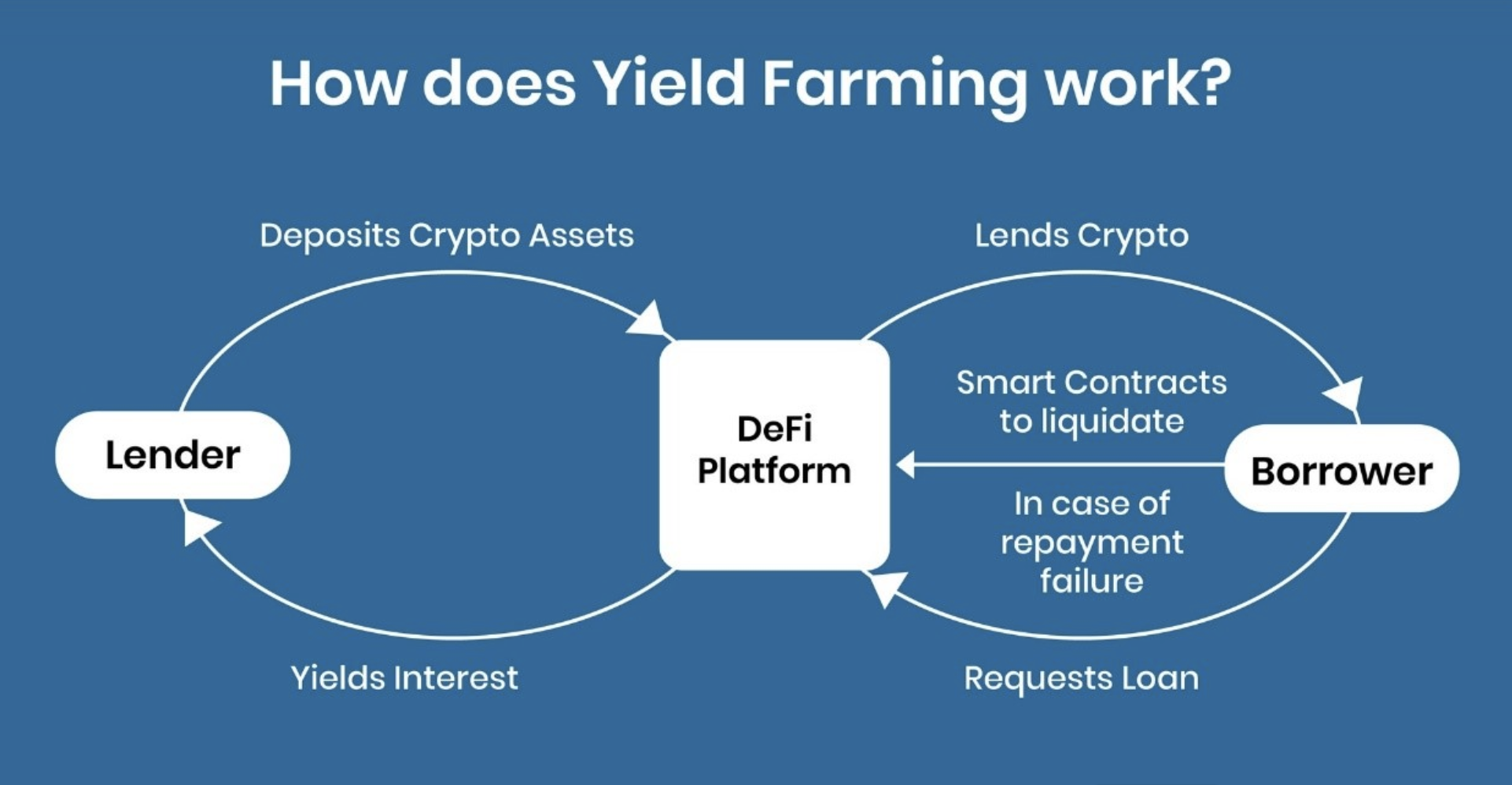

Yield farming crypto is a way to earn rewards in the form of cryptocurrency tokens by lending or staking digital assets in a DeFi protocol. DeFi protocols are decentralized applications (dApps) built on blockchain technology that enable users to transact with each other without intermediaries like banks or financial institutions.

Also read: Decentralized vs centralized crypto exchanges – which one is better?

Yield farming involves depositing cryptocurrency assets, such as Bitcoin, Ethereum, or stablecoins like USDT, into a smart contract-based protocol. The smart contract then uses the assets to facilitate transactions on the blockchain.

In return, users receive rewards in the form of the protocol’s native token or other cryptocurrencies. Those who participate in yield farming crypto are also referred to as “liquidity providers.”

How has yield farming become popular?

How yield farming works, source: blockchainsimplified.com

Yield farming gained popularity in mid-2020 when the decentralized exchange (DEX) platform Uniswap introduced its liquidity mining program. Uniswap incentivized users to provide liquidity to its protocol by offering UNI tokens as rewards. Since then, numerous DeFi protocols have implemented similar programs to attract users to their platforms.

One of the reasons why yield farming crypto has become so popular is because it provides users with a way to earn passive income without actively trading or managing investments. Yield farming has also become more accessible to a wider audience due to the increasing number of DeFi platforms that offer yield farming programs.

Pros of yield farming

The primary benefit of yield farming is the potential for high returns. By staking assets in DeFi protocols, users can earn rewards that far exceed traditional investment strategies. Additionally, yield farming provides users with a way to earn passive income without actively trading or managing investments.

Read more: Top crypto memes that everyone should know (part II.)

Another benefit of yield farming is that it can help increase the liquidity of DeFi protocols. By providing liquidity to a protocol, users help ensure that it has sufficient funds to facilitate transactions. This can also help reduce the volatility of the protocol’s native token in the long run.

So, the main benefits of yield farming are:

- High returns: Yield farming can offer much higher returns than traditional investments.

- Passive income: It is a passive income source, as investors do not need to actively trade or monitor their investments.

- Flexibility: Yield farming allows investors a chance to earn rewards in the form of different cryptocurrencies, giving them more flexibility in their investment strategy.

- Decentralization: It is a decentralized investment strategy, meaning there is no central authority controlling their investments. This makes it less vulnerable to fraud or corruption.

Cons of yield farming

While yield farming can be lucrative, it also carries significant risks. The value of the cryptocurrency assets being staked can fluctuate rapidly, which can result in substantial losses when the bear market enters the scene.

Additionally, many DeFi protocols are still in the experimental stage and may be vulnerable to hacking or smart contract bugs, which can also result in the loss of assets. In reality, millions of dollars are being lost due to DeFi hacks on a regular basis.

Another potential risk of yield farming is impermanent loss. Impermanent loss occurs when the value of the cryptocurrency assets being staked changes in relation to each other. This can result in the value of the rewards earned through yield farming being less than the value of the assets initially staked.

This is the main set of risks of yield farming:

- Smart contract risks: Yield farming involves depositing cryptocurrency assets into smart contracts, which can be vulnerable to bugs or hacks.

- Impermanent loss: If the price of the token an investor provided liquidity for changes significantly, they may experience impermanent loss, which can erode returns.

- Volatility: Cryptocurrencies are highly volatile, and their prices can fluctuate rapidly, which can drastically affect returns.

- Regulatory risks: The cryptocurrency market is largely unregulated, and regulatory changes can affect the value of investors’ investments.

Possible future of yield farming

As DeFi continues to grow, yield farming is likely to become even more popular.However, it’s important to note that regulatory scrutiny of DeFi protocols may increase, which could impact the future of yield farming. Additionally, the high fees associated with using DeFi protocols may limit the accessibility of yield farming to those with significant cryptocurrency holdings.

Another potential development in the future of yield farming is the emergence of cross-chain yield farming. Currently, most yield farming programs are limited to a single blockchain network, such as Ethereum.

However, there are efforts underway to create cross-chain interoperability between different blockchain networks. This could enable users to earn rewards by providing liquidity to DeFi protocols on multiple blockchain networks.

Final thoughts

Yield farming can be an effective way to earn high returns on your cryptocurrencies, but it also carries significant risks. It’s important for investors to carefully research the DeFi protocols they plan to stake assets in and to assess the potential risks as well as rewards before participating in yield farming.

Also interesting article: Best crypto apps

Despite the risks, yield farming has gained popularity due to its potential for high returns and its accessibility to a wider audience. As DeFi continues to grow and evolve, yield farming is likely to play an increasingly important role in the ecosystem. With the right approach as well as a solid understanding of the risks involved, yield farming can be a valuable addition to any investor’s portfolio.

Comments

Post has no comment yet.