On Thursday, the United States reached its debt ceiling. This event caused the Treasury to initiate a series of accounting tricks to ensure the federal government can keep paying its bills ahead of what is expected to be a protracted struggle.

Now the question is whether to expand the borrowing cap or not. The national debt ceiling now sits at a whopping $31.4 trillion.

So you’re telling me we can go 30 trillion dollars into debt no problem, but if I make one Venmo transaction over $600 I have 80,000 IRS agents watching me?

— greg (@greg16676935420) January 19, 2023

$31.4 trillion in debt

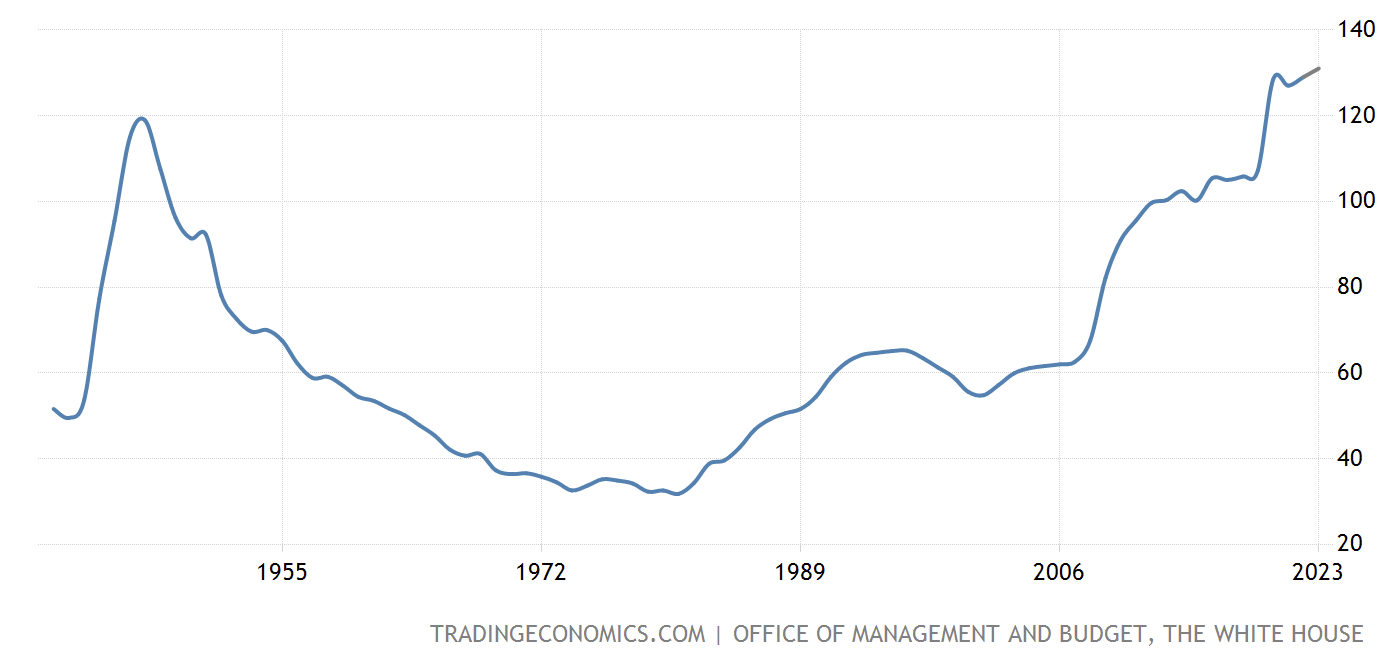

The enormity of the debt is unsettling, and not only because a number like $31.4 trillion is mind-boggling. Gross domestic product (GDP) is the broadest indicator of an economy, commonly used as a benchmark against debt economists.

Also read: Global outlook for 2023: what to expect from markets and central banks

The gross federal debt to GDP is at 129% after a lot of spending on the pandemic recovery. That’s the highest it’s been since World War II. Whether or not that’s a problem is hotly debated.

United States Gross Federal Debt to GDP chart, source: link

Treasury Department will allegedly buy enough time for Congress and President Joe Biden until June to negotiate a debt ceiling increase. Politically, there are hints as to how this situation will play out from other recent debt standoffs. Will this time be different? A larger portion of GOP lawmakers appears willing to allow the country to default.

The last two times there was a significant firestorm over the debt and spending was in 1995 and 2011. This is when Democratic presidents lost control over the House to Republicans. Interestingly enough, we find ourselves in that position right now, albeit with a far weaker Republican majority than former House Speakers Newt Gingrich and John Boehner had.

Debt ceilings in the past

The debt level in 1995 was less than $5 trillion. Back then, it was around 65% of the GDP. The year-long drama ended with a government shutdown but no default on the national debt because Republicans agreed on using the debt. Former President Bill Clinton later vetoed debt ceiling rises after accusing Gingrich of extortion over expenditures. In the end, they compromised and passed a spending bill apart from the debt ceiling increase.

Read more: Genesis goes bankrupt – everything you need to know

In 2011, when the debt was at $16 trillion, Boehner and former President Barack Obama fought for years over spending and the debt ceiling. As an incentive to negotiate a bigger agreement to limit deficit spending, Boehner and Obama agreed on the Budget Control Act of 2011. Surprisingly, for the first time ever, Congress decided to put a hold on raising the debt ceiling in 2013.

Final thoughts

There is an endless fight over suspending and raising the debt ceiling. However, the raising always seems to win in the end. This year will be highly focused on this decision, along with the fact of whether the world officially enters a recession or not.

Comments

Post has no comment yet.