The banking crisis may be over

Tuesday saw a decline in the S&P 500 as major companies continued to struggle and Treasury yields increased. Consumer confidence is holding steady and concerns regarding the financial crisis are subsiding.

In response to Silicon Valley Bank’s spectacular collapse, Federal Reserve Vice Chair of Supervision Michael Barr stated to the Senate Banking Committee on Tuesday, that he expects the need to strengthen capital and liquidity rules for some regional banks.

More to read: CFTC is coming after Binance – should you be worried about next FTX?

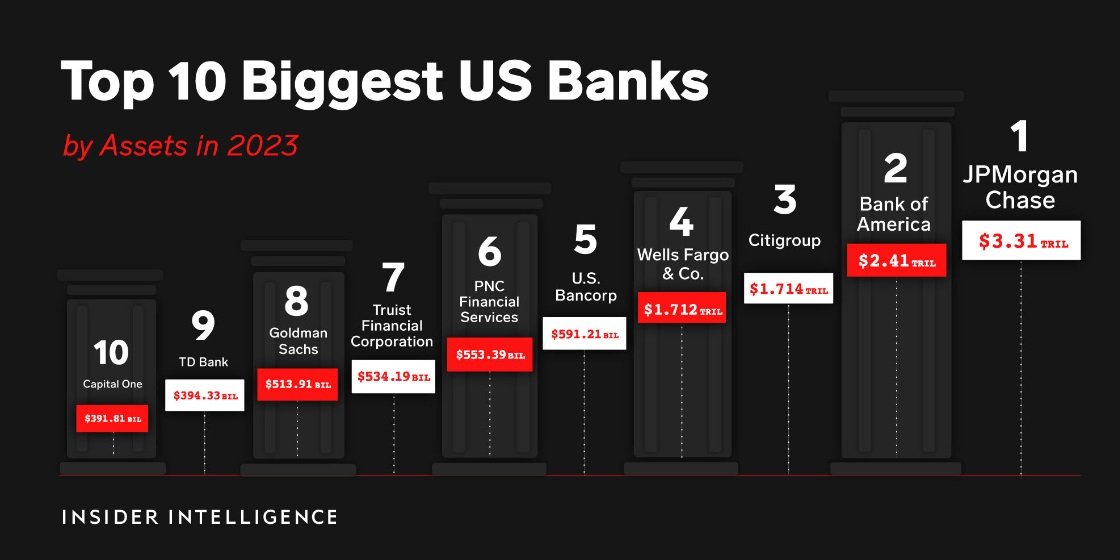

For banks with $100 to $250 billion in assets, the Fed wishes to tighten regulations and standards. As the second-largest bank collapse in American history, Silicon Valley Bank had $209 billion in assets.

Top 10 largest banks by assets, source: insiderintelligence.com

“I anticipate the need to strengthen capital and liquidity standards for banks with over $100 billion,” said Barr, responding to Warren.

The Dow Jones dropped 0.3%, the Nasdaq dropped 0.7%, and the S&P 500 decreased by 0.3%. As statistics revealed that consumers are still optimistic about the economy, 10-year treasury yields extended their gains by 1% from the previous day. This is indicating that the Fed may still have work to do. More than 1% of the market value was lost by Apple, Facebook (Meta), Alphabet, and Microsoft.

The US dollar is struggling to regain footing

After early in the session retreat toward 1.0800, the EUR/USD has recovered momentum and risen to the 1.0850 region. Despite encouraging consumer sentiment data from the US, the US dollar fails to make a significant recovery, enabling the pair to move higher. The dollar index, which compares the value of the dollar to six competitor currencies, fell by 0.31% on the day to close to a low of 101.91.

Also interesting: Forex outlook: Current state of CAD/JPY, EUR/AUD, and AUD/JPY

Better-than-expected retail sales figures gave the Australian dollar, which is used as a liquid indicator for risk sentiment, a boost. AUD/USD closed 0.86% higher for the day.

The dollar dropped as low as 130.415 yen before lastly losing 0.60% to 130.795 as the value of the Japanese yen increased. That largely reversed the dollar’s 0.64% increase against the yen from the previous session, which was accompanied by a sharp increase in the rates on US government bonds.

Oil extends gains aiming for previous highs

Due to problems with supply, WTI, the US standard for crude oil, gained and kept its gains until the end of the day. The supply issue arrived in the shape of an Iraqi export block on 450 000 barrels. Furthermore, a risk-on urge hurt safe haven investments like the dollar.

WTI, oil for New York trading finished at $73.20 up 0.5%. Following a 2.8% increase the day before, Brent oil ended the session up 0.7%, at $78.65.

Despite the risk sentiment, gold has been a star today. The yellow metal extended gains and seems to act as the $2,000 area is the new standard. The June futures for gold ended at $1,990 with a 1% gain. Silver followed suit and ended up 1.32% at $23.450.

Comments

Post has no comment yet.