OFAC advised and urged Americans to refrain from utilizing Tornado Cash and cryptocurrency ecosystems in August 2022. But after the Merge, MEV Boost’s introduction increased OFAC-compliant blocks.

MEV Boost & Flashbots

MEV, or the maximum extractable value, is the compensation validators receive after reordering transactions within a block. In order to address the potential consequences of MEV extraction, an R&D team named Flashbots has been working on MEV Boost.

Other relays are running at the moment, but the one built and run by Flashbots has proven to be the most used. However, the Flashbots relay prohibited transactions on sanctioned blocks.

Related article: What is Cardano – everything you need to know

Yet, the majority of other relays have not implemented this ban. But, when more relays start enforcing the OFAC requirement, it can become more challenging for sanctioned transactions. These include individuals who have successfully reached the Ethereum blockchain.

Censorship concerns grow

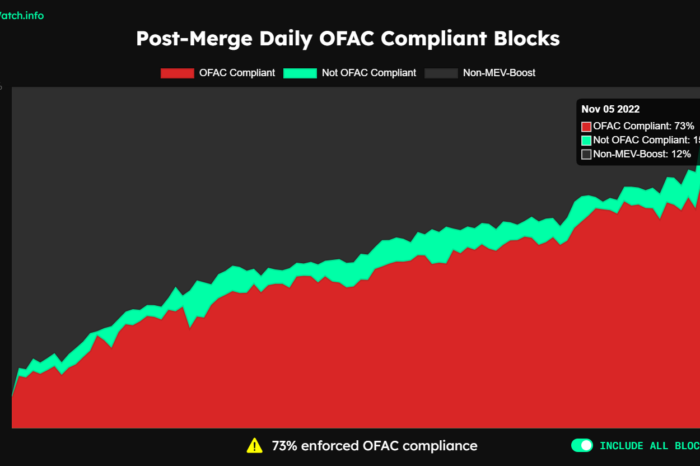

The community has been monitoring Ethereum’s increasing compliance with requirements set forth by the Office of Foreign Assets Control (OFAC) since protocol-level censorship is a deterrent to the crypto ecosystem’s goal of extremely open and accessible finance.

According to data from mevWatch, over 73% of blocks on the Ethereum network on November 5th have been determined to enforce OFAC compliance. This is up from 51% just a few weeks earlier, with the community worrying it will rise to 100% sooner or later.

Certain transactions will be censored by some MEV-Boost relays that are subject to OFAC regulation. The network must therefore employ a non-censoring MEV-Boost relay in order to guarantee the neutrality of Ethereum.

The US government agency is able to impose trade and economic penalties because of compliance with OFAC. Tornado Cash and several Ethereum addresses had already received agency sanctions.

The solution is on the way

Updated roadmap diagram! pic.twitter.com/MT9BKgYcJH

— vitalik.eth (@VitalikButerin) November 4, 2022

The Ethereum roadmap has been updated by co-founder Vitalik Buterin, who announced plans to address censorship, block verification, centralization, and other problems. The Scourge stage, which aims to increase censorship resistance and decentralization of the Ethereum network, was added to the technical roadmap of Ethereum by the project’s creator on Saturday in a tweet.

Also read: Problem for OpenSea – social media giant is joining NFT race

After the Merge, Ethereum started its second stage, the Surge, with the objective of reaching 100,000 transactions per second through rollups. The remaining three stages—the Verge, Purge, and Splurge—made out the previous roadmap’s total of five stages.

The Scourge, however, is a brand new stage that has been added to the technological plan consisting of six parts. It will be followed by the Verge, the Purge, and the Splurge, which are previously known stages. The need to address censorship is high.

According to the Ethereum roadmap, the Scourge’s objective is to provide trustworthy and neutrally included transactions while preventing centralization and other protocol threats from MEV. Since the Merge, Ethereum has come to be linked with a higher level of centralization and censorship, prompting Buterin to call for a more neutral consensus layer. However, only the future will show, if Buterin can win this fight.

Comments

Post has no comment yet.