It has been an optimistic week for equities so far as the Dow Jones Index is up every day this week, pushing the Dow index to 35,450 USD for the first time since February 10.

Nevertheless, concerns about rising inflation remain, likely capping any meaningful long-term rallies in the near future.

Earlier today, US initial jobless claims improved slightly to 184,000 from 186,000 previously, while continuing claims also dropped from 1.475 million to 1.417 million.

Additionally, the Philadelphia Fed Survey, a spread index of manufacturing conditions (manufacturing movements) within the Federal Reserve Bank of Philadelphia, fell more than expected, printing 17.6 in April, down from 27.4 in March.

You may also read: Norway wealth fund with huge losses

Fed speakers in focus

Chicago Fed President Charles Evans noted that he was not expecting inflation to drop back to 2% next year but added that there was good reason to think that certain factors driving inflation higher would ramp down.

Commenting on the interest rate outlook, San Francisco Fed President Mary Daly noted that it would be “abrupt or surprising” to see the policy rate rising to 2.5% this year.

Later today, Federal Reserve Chair Jerome Powell will participate in a panel discussion titled “Debate on the Global Economy” at the Spring Meetings of the International Monetary Fund and World Bank Group in Washington DC; His remarks might cause some volatility in the financial markets.

Investors now expect the Fed to raise rates by 50 bps at its next two or three meetings.

Economists at Deutsche Bank expect further advances in equity markets in 2022, before a typical recession correction of 20% in late 2023.

“In 2023, we expect equity markets to hold up well through the summer before the US falls into recession. This should see equities correct by a typical 20% as it begins, before bottoming halfway through and recovering prior levels.”

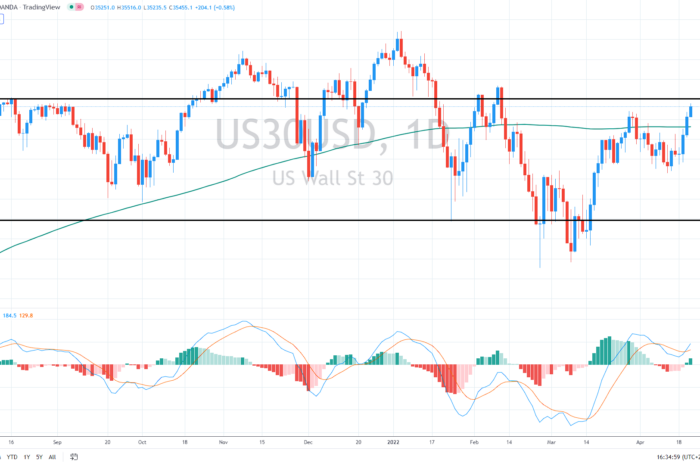

Daily chart looks bullish

Since the index has jumped above the 200-day average (the green line) at 35,050 USDI, the short-term trend has become bullish. The following key resistance could be in the 35,620 – 35,700 USD zone. If the price jumps beyond it, the medium-term outlook could turn bullish too.

Alternatively, the support is at the mentioned 200-day average, and if not held, we might see a decline toward the base near 34,400 USD.

Comments

Post has no comment yet.