The stock price of Delta Airlines (DAL) jumped on Thursday as the company released earnings in line with expectations but guided higher for the rest of the year.

Mixed earnings, with positive commentary

Delta Airlines reported an adjusted EPS of 25 cents earlier this week.The total revenue was $12.75 billion. Analysts polled by FactSet anticipated Delta to turn a profit of 29 cents per share versus a loss of $1.23 per share a year ago.

Revenue was projected to increase by nearly 36% to $12.67 billion. However, this would be the seventh consecutive quarter in which sales growth has slowed.

The results for the first quarter “reflect the strength in the underlying demand environment and the continued momentum in higher-end goods and loyalty revenue,” Delta said in a Thursday morning earnings release. However, increased gasoline and wage costs offset this.

During the first quarter of 2023, TSA passenger volumes averaged above pre-pandemic benchmarks. As tourism and hospitality industries navigate a full recovery from a COVID-caused halt, the tourism sector has benefited from consumers’ decision to invest in the experience economy.

During the first three months of the year, a daily average of 2,114,088 passengers were screened, surpassing the daily average of 2,107,762 passengers during the first three months of 2019.

Bullish guidance

Delta projected a 15%-17% increase in revenue for the current quarter, compared to analysts’ predictions of a gain of 5.6%. In addition, it projected EPS between $2.00 and $2.25, which was also above the consensus estimate of $1.66.

Delta reaffirmed its full-year EPS guidance of $5 to $6, with a midpoint of $5.50. It also endorsed a 15%-20% increase in revenue and a free cash flow of more than $2 billion.

At the midpoint of $5.50, the company’s EPS guidance for 2023 exceeds Wall Street’s estimates of $5.36, representing a nearly 68% increase from 2022. Before Thursday’s report, analysts predicted a 10% increase in annual revenue and free cash flow of $2.016 billion.

“With record advance bookings for the summer, we expect June quarter revenue to be 15% to 17% higher on capacity growth of 17%, year over year,” Delta President Glen Hauenstein said in the statement.

While economists consider the risks of an ever-predicted yet sporadic recession, executives in the travel industry assert that demand is here to stay.

Delta CEO Ed Bastian predicted that the travel industry would experience a multi-year upswing that would persist. And he doesn’t see anything in the economic prognosis that indicates travel will be halted.

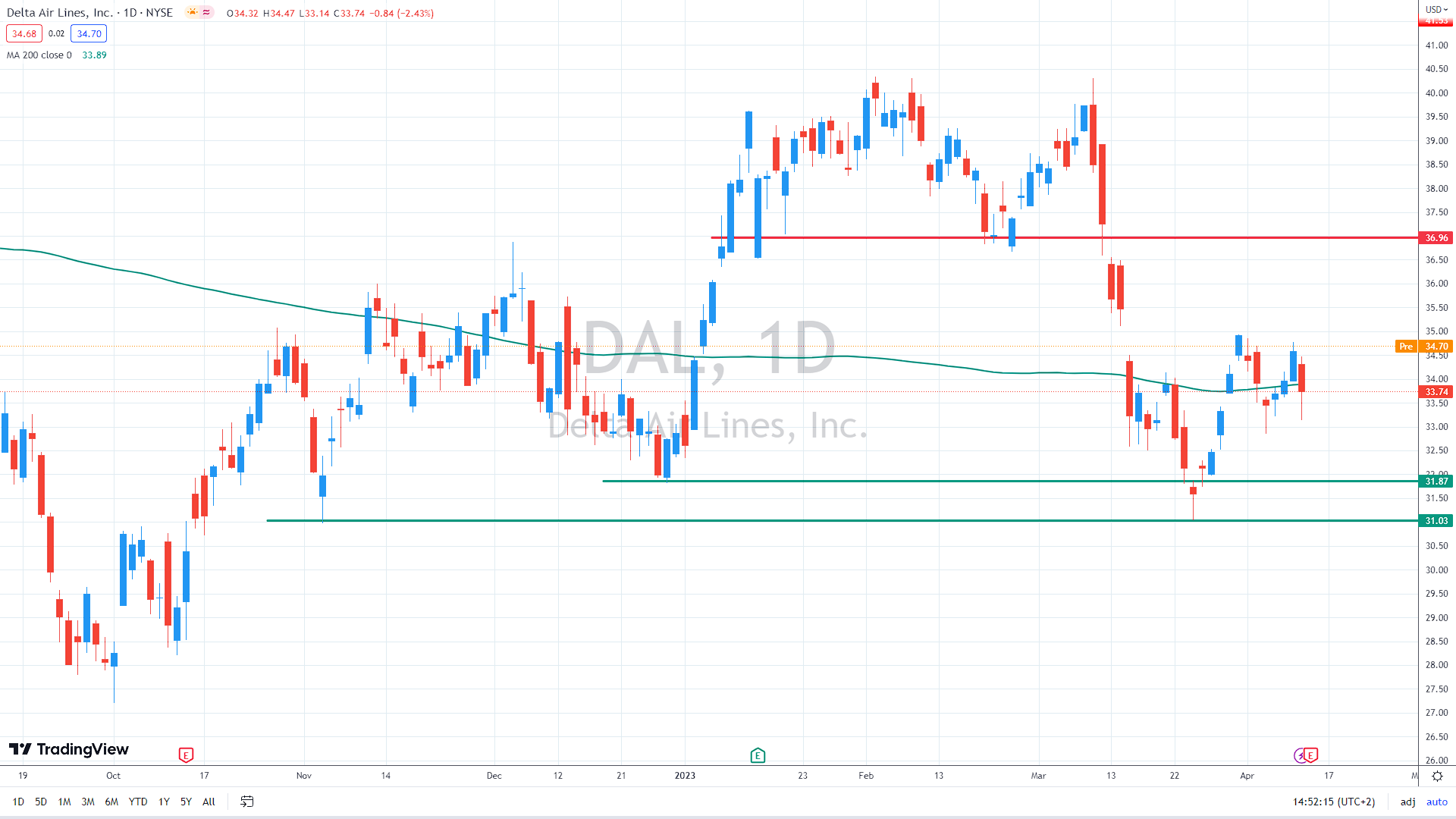

The double line of support is in the $31-$32 area, and as long as the stock price trades above that level, the outlook appears bullish. In that scenario, the next target could be at February lows in the $37 area.

DAL daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.