Enterprise Value (EV) is a financial indicator used to assess a company’s overall value, including both debt and equity. It is a thorough method for assessing a company’s financial health and development potential, as it takes into account all types of capital invested in an organization. Enterprise Value is an essential concept for investors and analysts since it aids in estimating the overall cost of acquiring a firm.

We also recommend: What is a dividend stock?

Calculating Enterprise Value

Enterprise Value may be determined by aggregating a company’s market capitalization (the value of its outstanding shares of stock) and debt, then deducting its cash and short-term investments. Enterprise Value is calculated as follows:

EV = Market Value + Debt – Cash and Short-Term Investments

Multiplying the number of outstanding shares of stock by the current stock price yields the market capitalization. Long-term and short-term debt obligations, such as bonds, loans, and other kinds of financing, comprise debt. The company’s liquid assets include cash and short-term investments, which may be utilized to pay off debt or engage in growth prospects.

Why Enterprise Value is crucial

Enterprise Value is a useful indicator for investors and analysts since it measures a company’s financial health and development potential. Enterprise Value provides a more comprehensive view of a company’s financial status than market capitalization, which simply takes equity into consideration.

Read: TOP 10 dividend stocks

EV can be advantageous in several ways:

- Mergers and Acquisitions: Enterprise Value is a major indicator used to assess the entire cost of purchasing a target firm when corporations consider a merger or acquisition. By including both debt and equity, EV offers a more realistic view of a transaction’s total cost.

- Competition comparison: Enterprise Value may be utilized to evaluate the worth of a firm and compare it to others in the same industry. This can assist investors and analysts in determining if a firm is overpriced or undervalued and in identifying investment possibilities.

- Financial health: Enterprise Value gives insight into a company’s financial health and capacity to pay its financial obligations by analyzing its debt and cash balances. A high EV may suggest that a firm has a high degree of debt, which might hinder its capacity to pay dividends or invest in growth possibilities.

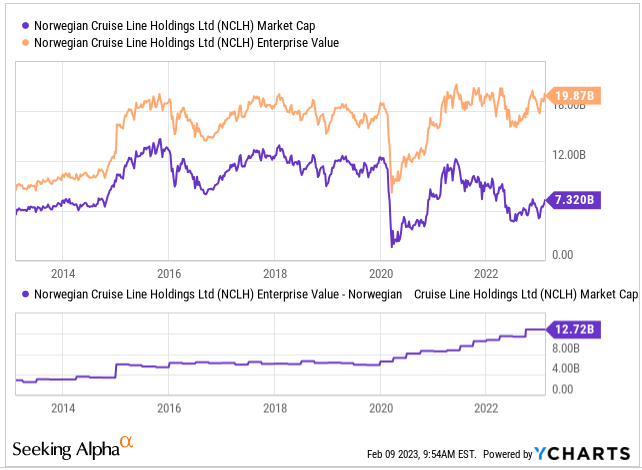

EV can be tricky and high EV absolute does not mean the company is attractive. Below is an example of high EV as a result of significant portion debt. The chart below compares the market capitalization of NCLH with its EV. We also calculated the spread between these two metrics to see the historical development. In summary, the increase in EV is not driven by market cap (or the increase in stock price), but its driven by debt.

NCLH market capitalization vs. enterprise value, source: Investro analytics team

EV/EBITDA

EV/EBITDA (Enterprise Value to Earnings Before Interest, Taxes, Depreciation, and Amortization) is a popular valuation ratio used to determine the worth of a business. EBITDA is an often used indicator of a company’s operating success, since it indicates profits before interest, taxes, depreciation, and amortization.

The EV/EBITDA ratio is determined by dividing the Enterprise Value of a firm by its EBITDA. This statistic is used to compare the worth of a firm to that of other companies in the same industry. A lower Enterprise Value to Earnings Before Interest, Taxes, Depreciation, and Amortization (EV/EBITDA) ratio shows that a firm is less costly than its competitors, while a greater ratio implies that a company is more expensive.

You may also like: What is a trading journal?

Several industries, notably technology, media, and telecommunications, employ EV/EBITDA extensively when valuing businesses. It is especially beneficial for firms in these industries, as their substantial capital expenditures might impact their profitability and make it difficult to compare their valuations to those of comparable companies.

Benefits of EV/EBITDA:

- Compensates for Non-Cash Expenditures: EBITDA adjusts for non-cash expenses such as depreciation and amortization, which helps to offer a clearer view of the underlying financial performance of a firm. Using solely cash-generating operations, EV/EBITDA can offer a more realistic valuation of a business.

- EV/EBITDA is a frequently used statistic, which makes it simple to compare the valuation of one firm to that of others in the same industry. This can assist investors and analysts in determining if a firm is overpriced or undervalued and in identifying investment possibilities.

- EV/EBITDA reflects a company’s debt level, which can have a substantial effect on its value. By factoring in debt, EV/EBITDA offers a more complete view of a company’s financial status.

Disadvantages of EV/EBITDA:

- Capital Expenditures Are Ignored. EBITDA does not account for capital expenditures, which can be a considerable portion of a company’s spending. Consequently, EV/EBITDA may not adequately reflect the real cost of operating a business.

- Because EV/EBITDA only analyzes earnings and ignores other crucial financial variables like sales growth and profitability, the ratio might be deceptive.

- EV/EBITDA is most effective for comparing firms within the same industry, as various industries may have varying capital expenditures and depreciation and amortization procedures. It´s not appropriate to use EV/EBITDA or forward EV/EBITDA for comparison in the pool of companies from many industries. It will give the investor zero added value.

Conclusion

EV/EBITDA is a helpful tool for investors and analysts because it allows them to analyse the value of a company and compare it to the value of other firms in the same industry. However, it is essential to analyse both the benefits and drawbacks of the ratio and to use it in conjunction with other financial measures to provide a complete view of a company’s financial status.

Comments

Post has no comment yet.