Decentralized Finance, known as DeFi, is attracting more and more attention from companies involved in cryptocurrencies and blockchain technology. This relatively new term has recently resonated with the crypto community.

However, it is also gaining attention outside of the crypto world. What is DeFi, what problems does it solve, and what is the future of financial products without an intermediary? Let’s describe it a little more extensively for a greater understanding.

What is Decentralized Finance?

Decentralized Finance (DeFi) can be described as a financial superstructure or upgrade of existing cryptocurrencies. With cryptocurrencies such as Bitcoin, Litecoin, or Ethereum, it is possible to receive, pay or save without using any intermediaries or the need to register or prove identity.

Related blog: Crypto adoption increases – investors need to stay vigilant

However, this does not apply if one needs other financial services associated with cryptocurrencies: lending, leverage, or hedging are still primarily the domain of centralized exchanges and other service providers, such as BitMex, Bakkt, or BlockFi. The use of these services carries the risk of losing access to one’s resources.

These services are also unavailable in some parts of the world due to international sanctions. In short, centralized services and privacy, financial inclusion, and self-management do not go hand in hand. One of the motivations for the development of Bitcoin was and still is the effort to remove large financial institutions from monetary relations, which is what DeFi does.

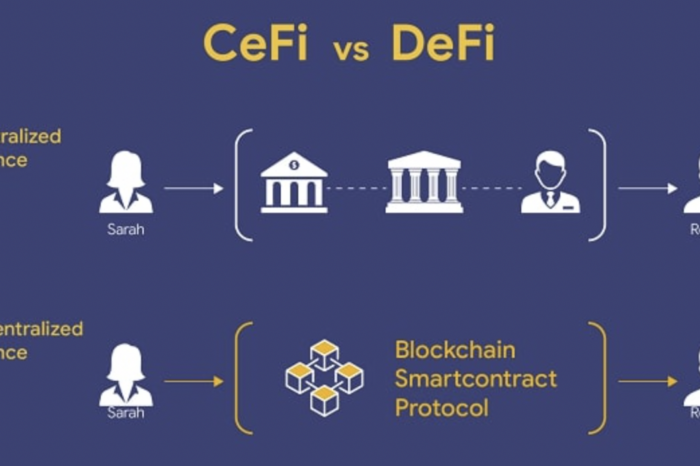

Decentralized Finance vs. Centralized Finance

DeFi vs CeFi, source: link

Compared to centralized providers of crypto financial products (BitMex, Bakkt, etc.), DeFi differs in that they try to maintain the typical characteristics of cryptocurrencies in this area as well. These are in particular:

a) Minimizing the need for trust – DeFi services do not keep user resources on non-transparent wallets, to which only service administrators would have access (as is the case with the largest cryptocurrency exchanges such as Binance, BitMEX or BitFinex).

Instead, users make deposits to the addresses of smart contracts with transparently defined conditions under which these funds can move. Typically, funds can only be handled by depositors and trading robots disposing of insufficiently secured accounts.

b) Openness of code and data – DeFi projects have published source code (or at least the part defining the handling of resources) on GitHub or other platforms. Smart contracts deployed on the mainnet have known addresses on Etherscan.

You may also read: What is Polkadot?

Because the settlement of transactions takes place on-chain (on the public blockchain), fundamental economic data such as the number of users or the volume of invested and traded funds are public. Projects usually facilitate data analysis by publishing a documented API.

c) Financial inclusion – Current DeFi applications do not require any identification from users. Unlike cryptocurrency exchanges, where KYC (know your customer) processes are gradually becoming the norm, within DeFi, the only necessary user identifier is the user himself.

The individual services are then no longer registered, but only connected with a wallet (e.g., with the help of Web 3 interfaces such as Metamask). While within centralized crypto exchanges such as Kraken, for example, people from 36 countries cannot trade Bitcoin futures contracts. This financial exclusion does not take place within DeFi applications.

Guaranteed and secured loans: the building block of DeFi

What is in DeFi, source: link

One of the accompanying characteristics of cryptocurrencies is that they do not need the concept of identity and trust to function satisfactorily. Therefore, the only known way to enable advanced financial functions in the field of cryptocurrencies is with the help of secured loans.

This simply means that if a user wants to borrow a crypto token (e.g., stablecoin), they must cover this loan by backing or locking another cryptocurrency (e.g., Ethereum). Today, many major DeFi applications work on the principle of secured loans.

The fact that DeFi operates on the principle of secured loans has three implications:

- those who provide cryptocurrencies for loans earn interest.

- those who borrow cryptocurrencies pay interest.

- due to the absence of central authority, the interest rate is always variable.

Modern financial system vs. DeFi

DeFi services seek to provide higher monetary functions, such as regular payments and holding, without the compromises that existing centralized providers of these functions make. If we should help by comparing it to the classical financial system, native crypto tokens (Bitcoin, Litecoin, Ethereum) are the monetary base, while DeFi services perform the functions of M1-M3 aggregates.

We can imagine a modern financial system as an inverted pyramid, where at the bottom of the pyramid lies the narrowly defined money in the form of the so-called monetary base. The monetary base is money that does not constitute a claim; the base consists of cash and bank reserves (deposits of commercial banks with the central bank).

Cash does not represent a receivable, as when paying in cash, the transaction is settled immediately (the beneficiary has the financial value immediately in hand). Likewise, provisions do not constitute a claim because the central bank does not dispose of these deposits in any way (it does not lend them further, as is the case with deposits in commercial banks).

On the other hand, higher monetary aggregates and financial instruments always represent a claim – current and term deposits, money market funds, bonds, and derivatives are always the holder’s claim against the counterparty. A simple example: money in a bank account is actually a client’s claim against the bank.

The client does not own the money; the bank actually owes the client the amount it sees in its internet banking. The settlement of this receivable occurs, for example, by the client withdrawing cash from the ATM (i.e., a monetary base that does not represent any other receivable). Why such a comprehensive explanation of what money is?

Because cryptocurrencies, together with DeFi, turn this common model upside down. Coins in a user’s wallet are best compared to the monetary base: they are non-receivables. Sending Bitcoin or Monero represents the same level of compensation as payment in cash (provided when payment is deferred to a sufficient number of confirmations).

As described above, DeFi services operate on the principle of reinsurance. However, unlike the modern financial system, there is no principle of real user identity in the area of cryptocurrencies. Thus, it is impossible to work with the concept of credit and the enforceability of unsecured contracts.

The only thing you can work with is on-chain assets. In contrast to the expanding pyramid of classical monetary aggregates, the “crypto-monetary” pyramid is thus narrowing as a result of the principle of secured loans.

DeFi as a renaissance?

Decentralized Finance is still in its infancy. Therefore, all of the above applications are highly experimental and dangerous. However, the mere fact that the whole financial service architecture of DeFi can be analysed independently is very positive.

We cannot look at today’s banks and financial institutions so simply. As the subprime mortgage crisis of 2007-2008 (excellently portrayed in The Big Short movie) has shown, it is often not even clear what lies in the very financial contracts that these institutions make up.

The Big Short movie scene, source: link

Still, one needs to bear in mind that the DeFi sector is extremely complicated. Not only is it relatively new and faces several risks (such as numerous hacks and lack of sufficient security) it also contains several newly discovered concepts and ideas that need to be tested with time.

Yield farming, synthetic assets, automated market-making protocols, liquidity pools, flash loans, or liquidity mining are new concepts that are not only highly complex but also need time for improvement and testing. Therefore, even though this sector might look very promising, which it undoubtedly is, it also requires a lot of clarity and improvement.

Conclusion

Moreover, we will try to provide the best guidance for those willing to try something new and not afraid of a bit riskier sector with the vision of not only higher returns but also adopting a new financial sector.

While this article was more theoretical and descriptive, the following articles on topics of DeFi will be more concerned with specific projects and how they work and operate, their strengths and weaknesses, and how one can profit from them.

Comments

Post has no comment yet.