Interest rates as expected

Fed´s decision about interest rates was presented on Wednesday. The known consensus was hike by 25 bp to 50bp. As we wrote before, in case that the number will be same as consensus, the price move should be calmer or go up, because markets have already counted with that consensus.

Actual number brought no surprise, since we saw 25bp hike as expected. After initial volatility, day ended in green numbers with +0.43%.

Read more: First Fed interest rate hike is here

Commodities surged

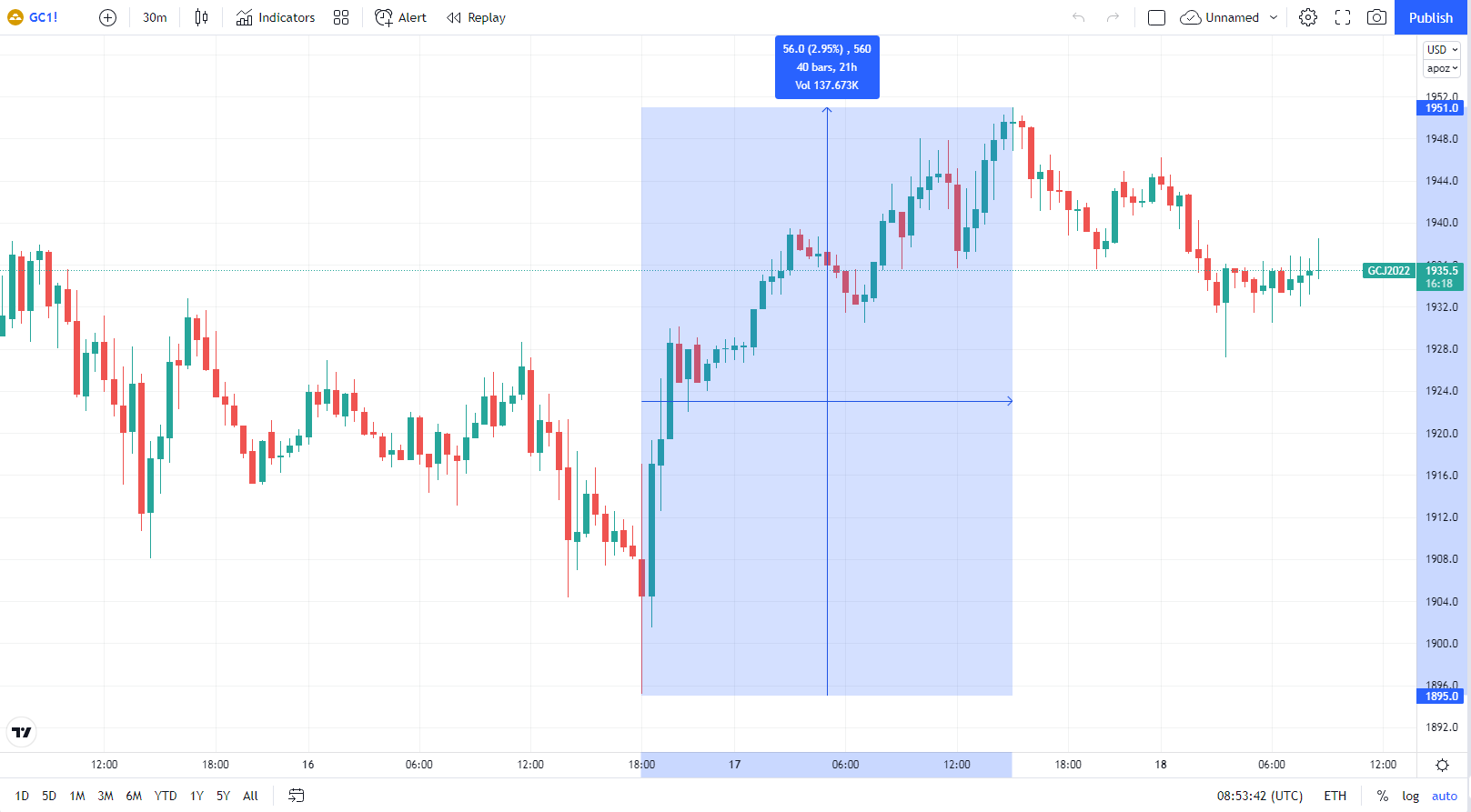

No surprise in decision positively affected commodities such as gold and oil. Next day gold has appraised another +0.84%, in total +1.27%. More visible is the 2-day range, where low is 1895$ and high is 1951$, which means an increase of +2.95%.

30 minutes chart of GC (Gold futures), Source: tradingview.com

Peace talks

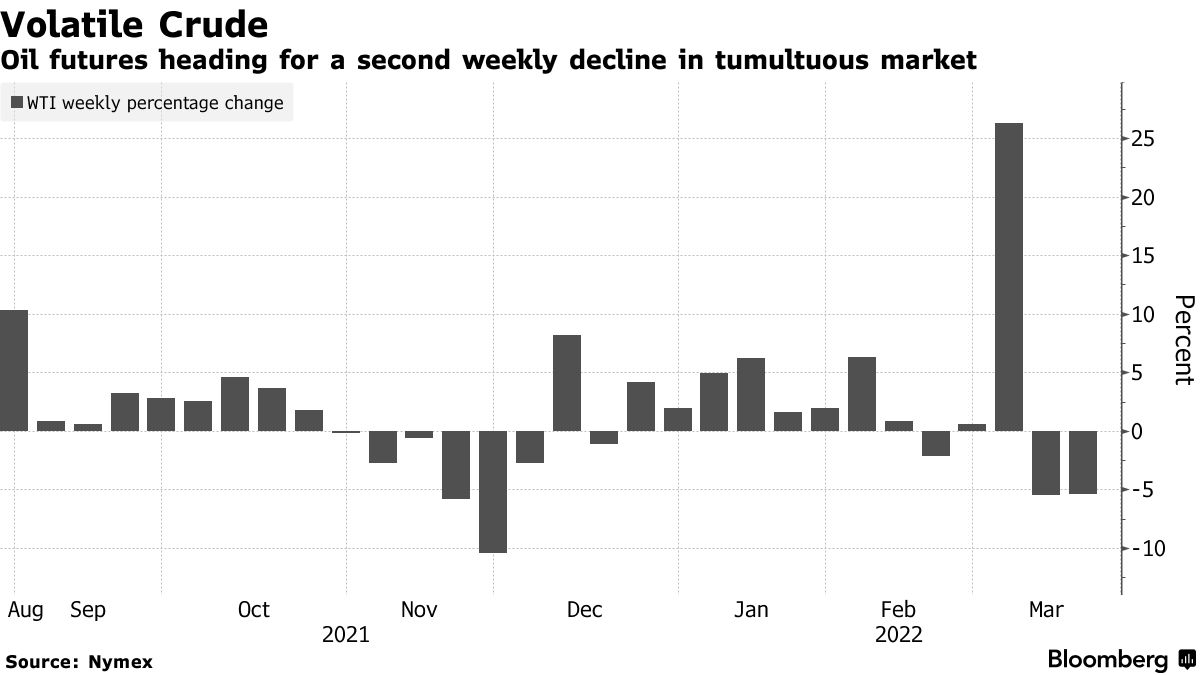

Mixed signals from Ukraine-Russia peace talks elevated crude oil above 100$ level. According to Bloomberg, oil extended gains after the biggest daily surge in 16 months. After Fed´s press conference, it is obvious that crude oil does not respond to this fundament as much as bullion. On the other hand, development in war conflict in Eastern Europe is still the main power for black gold. Chart below shows WTI weekly volatility change, where in the last three bars, the extreme changes the war has been brought are clearly shown.

Read more: Talks among Ukraine and Russia ease the price of yellow metal

Weekly percentage change of WTI, Source: Bloomberg.com

Chart levels

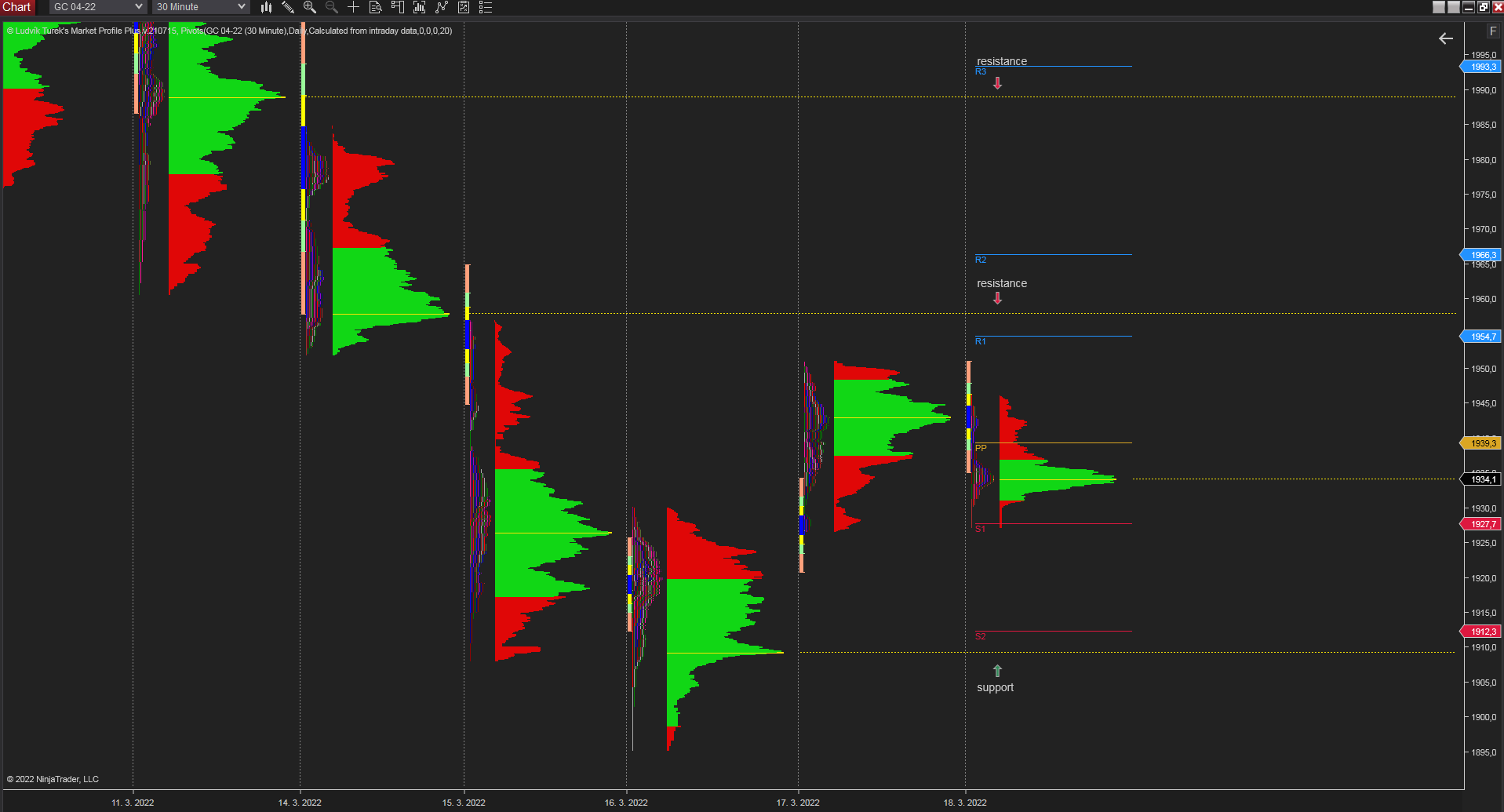

First feasible support level could be on 1915$ for gold futures. It is set by 1st standard deviation of weekly VWAP. Market profile shows another support level at 1909.3$. Resistances are at 1957.94$ and 1989$.

30 minutes chart of GC (Gold futures), Source: Author´s analysis

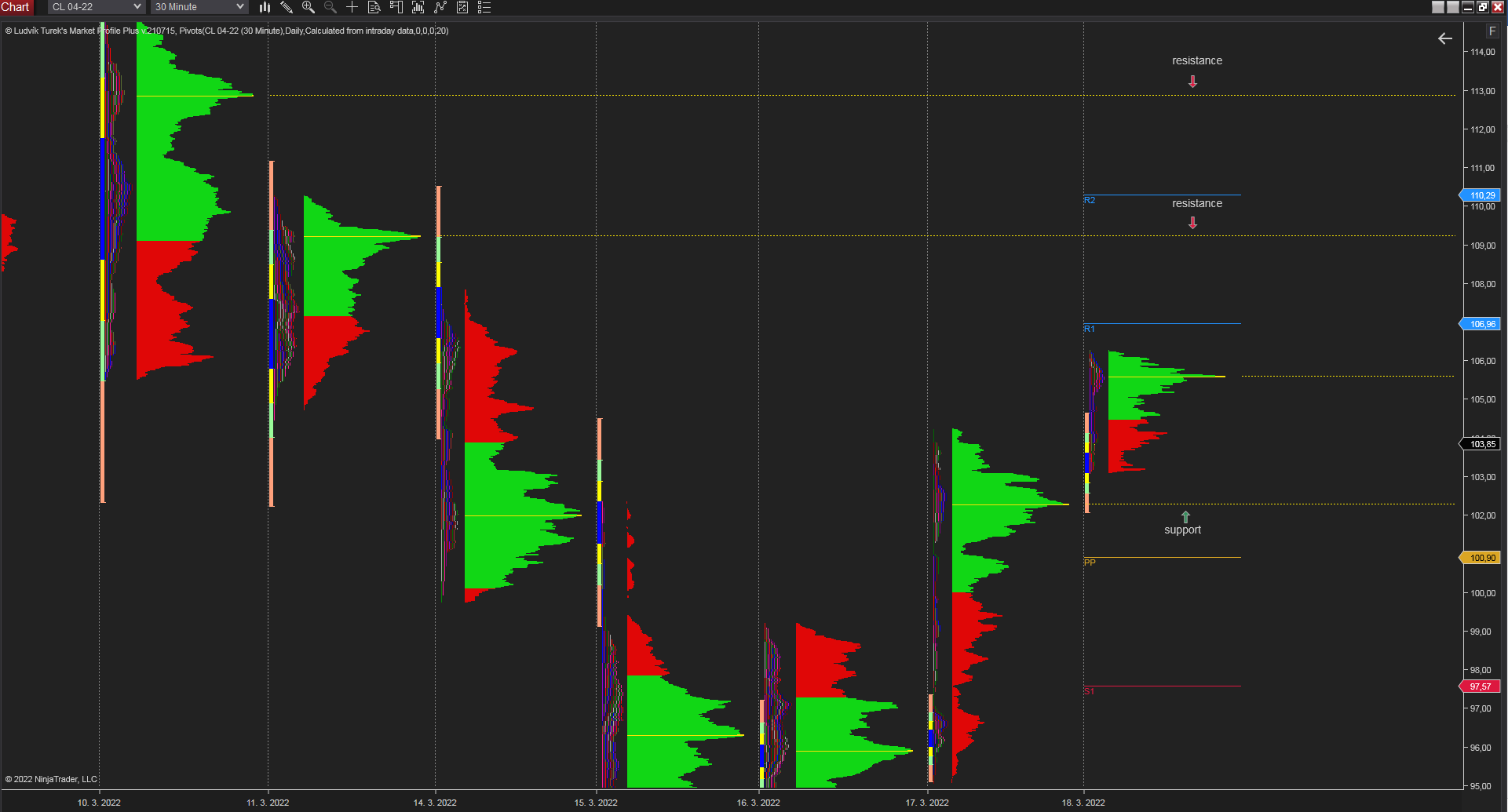

Crude oil has possible support at 102.31$ set by market profile. Next one is set around 100$ level, which is considered as strong psychological level. Earlier downward move on prices has left several possible resistance levels at 109.22$ and 112.86$.

30 minutes chart of CL, Daily Market Profile. Source: Author´s analysis

Comments