According to a regulatory filing, Buffett’s Berkshire Hathaway (BRK.A) has acquired almost 5.8 million shares of oil business Occidental Petroleum (OXY) over the previous several trading sessions, paying between $59.80 and $61 per share between last Friday and Tuesday.

This is Buffett’s first purchase of the stock since September. Berkshire Hathaway now owns almost 200 million shares of Occidental, which are worth $12.2 billion based on Tuesday’s closing price of $60.85 per share. Through a series of acquisitions, Buffett is now Occidental’s largest shareholder.

Buffett bought a $4.5 billion investment in a couple of days following the oil company’s fourth-quarter earnings presentation in February 2022.

“I read every line and thought, ‘This is just what I would do,'” Buffett noted of the earnings report. With reference to CEO Vicki Hollub, he continued, “She’s operating the business properly.”

When Warren Buffett expresses interest in a stock, investors take notice. The most successful investor of our time enjoys buying stocks and holding them indefinitely.

You can also read: More Fed fears are fueling increased volatility

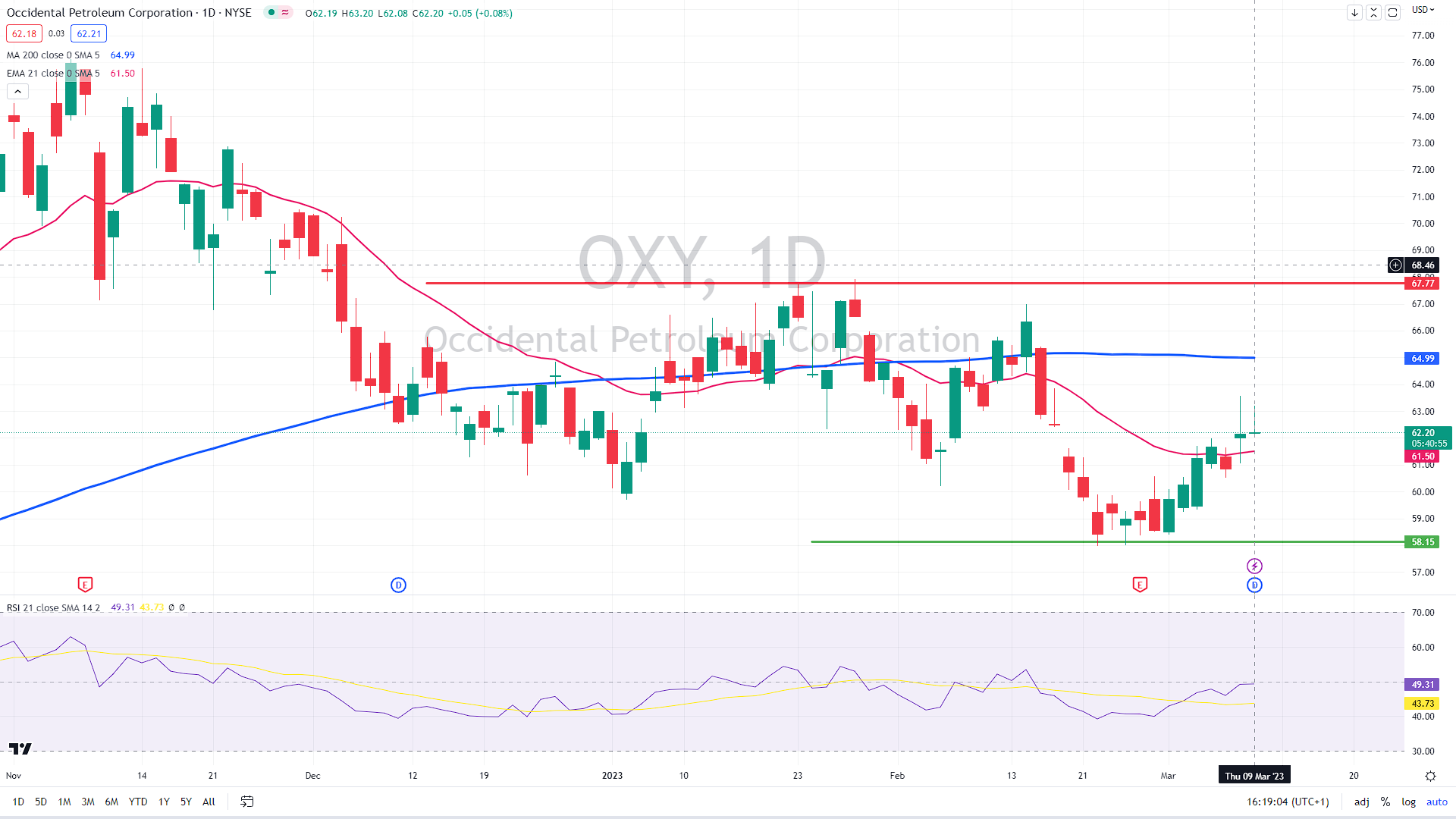

On Wednesday, the stock rose in response to news of the newest acquisition, although it has since retreated somewhat. Nonetheless, this could be a good time to buy the stock at the same price as Buffett (now $61.90).

The next target for bulls should be at the 200-day moving average (near $65). If the price jumps above that level, it could rise toward the previous swing highs near $68.

Alternatively, the major cycle support stands at $58 and the stock must remain above that zone in order to remain in a medium-term uptrend.

OXY daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.