Former Coinbase CTO, Balaji Srinivasan, stated he cut his losses on a wager that Bitcoin would reach $1 million within 3 months. This happened right in the middle of the bet.

Balaji admitted he lost

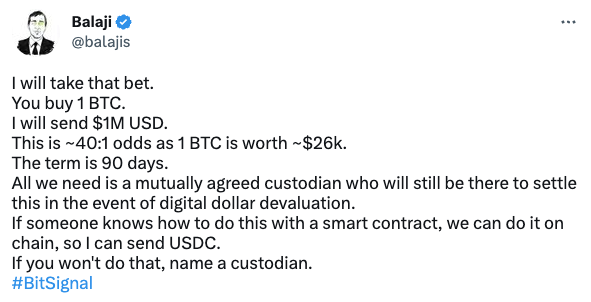

It all started here. Balaji took a bet for $1 million that Bitcoin would hit $1 million in 90 days because the US could enter a hyperinflation state. That, however, did not happen.

Balaji’s tweet, source: twitter.com

He settled a $1 million Bitcoin price bet by donating a total of $1.5 million to three charities, 97% below the original goal price. Balaji announced the bet was “closed out by mutual agreement” 45 days early on May 2nd.

Related article: Recent surge of PEPE brought memecoins back – who are the new players?

The former Coinbase CTO settled with a Twitter user and “hyperinflation doubter” James Medlock for $500,000. He then contributed $500,000 to the developers of Bitcoin Core and gave another $500,000 to the non-profit organization Give Directly.

I just burned a million to tell you they're printing trillions. pic.twitter.com/pX5622rjUO

— Balaji (@balajis) May 2, 2023

From his newly uploaded video, it is almost obvious that he did this on purpose. As Balaji stated in the video, “I just burned a million to tell you they’re printing trillions,” pointing to the central which prints more money with each crisis.

“I spent my own money to send a provably costly signal that there’s something wrong with the economy and that it’s not going to be a ‘soft landing’ like Powell promises — but something much worse,” Balaji explained.

While Balaji has donated $1.5 million, he still believes hyperinflation is inevitable in the United States. His perception is that the price of Bitcoin will soar to $1 million as people race to put their quickly depreciating dollars in the digital gold.

Final thoughts

I am sure his net worth is much higher than this bet, so it’s not such a loss for him. Instead, he created a solid awareness around the government’s setting on printing money whenever needed and Bitcoin’s upsides. Although he lost over a million dollars, he gained more than 100,000 Twitter followers.

Comments

Post has no comment yet.