Silvergate Capital Corporation officially shuts down after a long fight. A big player has been wiped out by the crypto crash. Falling crypto prices, high interest rates, and bankruptcies of crypto companies – all affected Silvergate negatively, resulting in an inevitable collapse.

Silvergate goes down

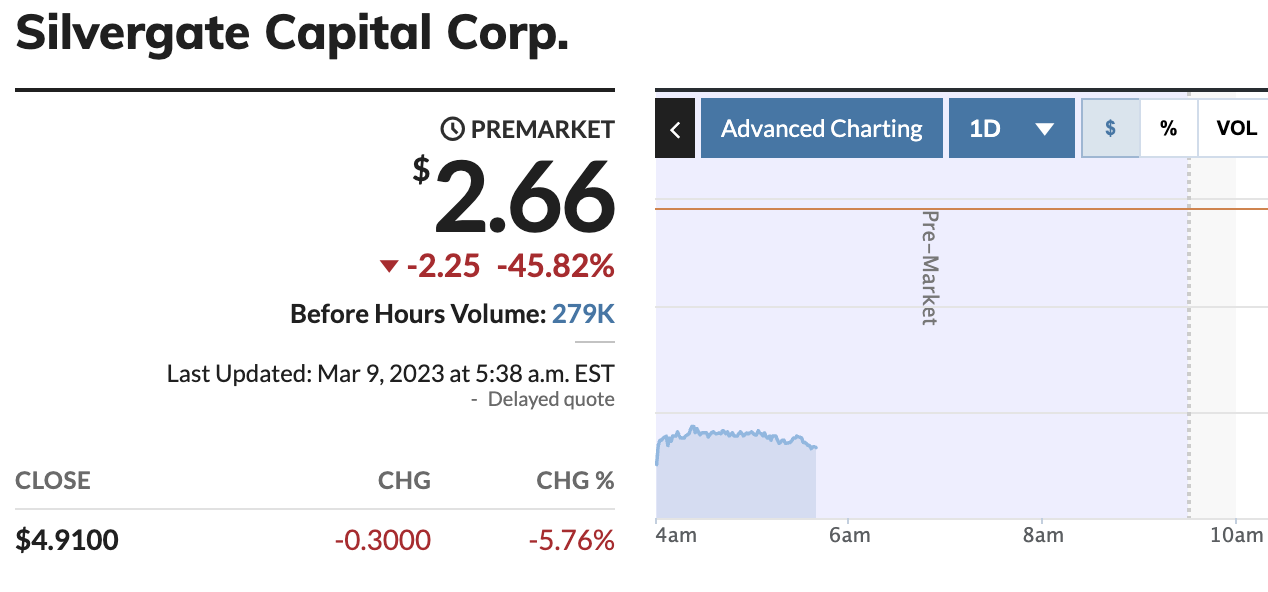

Yesterday, the bank announced it is ending its business operations and liquidating its bank. A major lender in the crypto industry is now gone, with its stock plummeting another 43% in the pre-market. The stock is now down 99% from its all-time high.

Silvergate stock (SI) chart, source: marketwatch.com

Silvergate, along with Signature Bank in New York, has been one of the two primary banks for crypto firms. While Silvergate has around $11 billion in assets, Signature has approximately $114 billion. Silvergate lost a lot of business when the crypto exchange FTX went bankrupt. Since then, it only got harder for Silvergate to stay in bussiness.

Also read: How is Warren Buffett investing – top picks of legendary investor

The company has not disclosed its strategy for resolving allegations against it, although it has promised to return all deposits in full. Silvergate’s collapse comes less than a week after the company ceased operations of its primary payment network, the Silvergate Exchange Network (SEN).

“In light of recent industry and regulatory developments, Silvergate believes that an orderly wind down of Bank operations and a voluntary liquidation of the Bank is the best path forward,” the filing stated.

When announcing its impending liquidation, the company made it clear that all other deposit-related services will continue to function normally. If there are any more modifications, customers will reportedly be notified.

This week, Silvergate announced it would be postponing the submission of its annual 10-K for 2022 in order to address the “viability” of the company. The corporation said that the delay in reporting was in part due to a regulatory crackdown, including an investigation by the Department of Justice.

Read more: When will crypto recover?

As soon as Silvergate expressed doubt about its continued existence last week, cryptocurrency companies like Coinbase and Galaxy Digital scrambled to sever relations with the bank. Now the chaos may reign upon the crypto market as another important industry player goes bust.

Final thoughts

One can only hope this will end up well, with no customers losing their deposits like it was a trend in 2022. Silvergate will have to sell off a lot of assets, which could trigger fear in the crypto market, potentially sending Bitcoin back to $20,000. However, this shouldn’t affect over the long term as we saw with FTX collapse.

Comments

Post has no comment yet.