High volatility continues

Crude oil remains in high volatility mode. Monthly is -3.68% down, weekly -6.00%, but the high/low range is enormous at -14.64%. This volatility could be defined by different looks on its pricing or better to say the look of what has a more significant impact on the oil price. Moreover, there persists backwardation in oil prices, pressures from the Covid-19 situation, and fear of recession or war conflict. All of these mentioned market movers have eminently strong share on price volatility.

Read more: Norway strike could cut oil output by 15%

1-hour chart of CL (Crude Oil Futures). High/low monthly range. Source: tradingview.com

The dislocation between the financial and physical oil market

Mixed signals from the global market are for investors very hard to read. Firstly, the physical oil market is priced from insufficiency. This means higher demand for crude, especially in China’s economy after Covid-19 lockdown policy, signs of higher prices. Secondly, the financial oil market is pricing in a recession. Higher inflation, possible lower demand, lower consumption, and recession, all of these push the price of black commodity down. And it could be again in China. Analysts and financial institutions have different looks at the future price of oil. And this could cause higher volatility in the overall pricing of crude oil on markets.

Moreover, there is backwardation, which is the situation where near-term prices are trading above long-term ones. And it has raised from 2.69$ to 3.69$ this month. Backwardation is theoretically a bullish pattern, because it means that traders do not want to store the oil and sell it later, but sell it immediately. It occurs predominantly in commodity markets, when countries keep the oil prices up to boost their revenues during a time of supply shortage or recession.

You may be also interested in: Gold is in free fall, attacking 1750$

Levels of interest

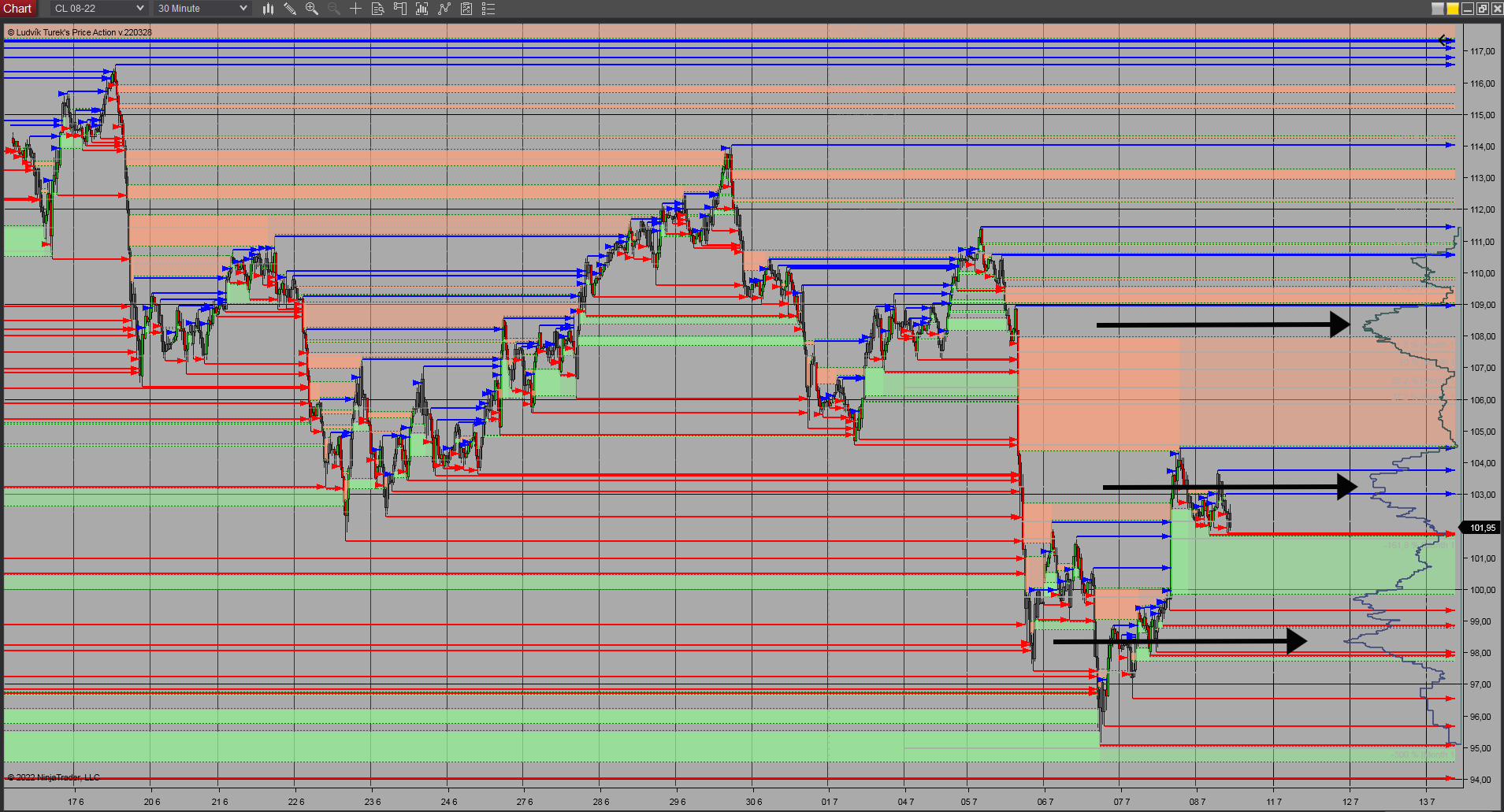

Volume this month has shown three main areas of interest (black arrows pointing to them). The current price of crude oil is in the first volume area of 102$ -104$. The resistance area could be in the area of 107$ – 109$, where the drop has started and 123 gap formation started (108$). Support area could be between 100$ price tag and 98$. In consideration of high volatility, it is important to say that these levels are definitely not for a longer time frame.

30 minutes chart of CL, Monthly volume areas, and 123 gaps. Source: Author’s analysis

Be careful and patient

Volatility brings numerous opportunities to make a trade with a high profit. But on other hand, there is an equation where the probability of high profit brings the same probability of high loss. And backwardation of oil markets is an infrequent occasion. It could show mixed signals and the probability of losing money raises. The situation is underlined by price predictions, where JP Morgan predicts oil price in 2022 at 380$ per barrel. And Citigroup predicts 65$ per barrel. Therefore it is good to be careful, vigilant and patient.

Comments

Post has no comment yet.