Bitcoin along with the whole crypto market exploded upwards on Monday even though several banks collapsed. The fear in the current market conditions is enormous. Still, Bitcoin jumped back above $23,000. Will the uptrend that has begun in January continue?

Let’s go back to roots

Since the Bitcoin software’s public unveiling in 2009, it has been crucial that new nodes to the network be able to quickly and easily establish a shared history of the blockchain. Bitcoin’s “Genesis block” allowed Satoshi Nakamoto to achieve this goal.

Related article: What should happen for Bitcoin to reach $10 million per coin?

The origin of the Genesis block remains mysterious. Included in the very first Coinbase transaction is the text “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” Almost everyone agrees that Satoshi used this string to date the Genesis block to January 3rd, 2009 and that he did it on purpose.

In fact, banks got a bailout just a few weeks after that, in February 2009. Now the world faces a similar situation as banks are falling like dominos. The Federal Reserve may be forced to save banks again as they plummet one by one. Bankers will brag that banks are safe and Bitcoin is a gamble. But isn’t it the opposite?

Banks vs Bitcoin

While banks have been crashing and shutting down, Bitcoin exploded from $21,700 to $24,600 on March 13th. “How is that possible,” some people may ask. The answer is plain simple. Many shareholders and stock investors dumped stocks for crypto as banks seem “too risky at the moment.”

Bitcoin 1-hour chart, source: tradingview.com

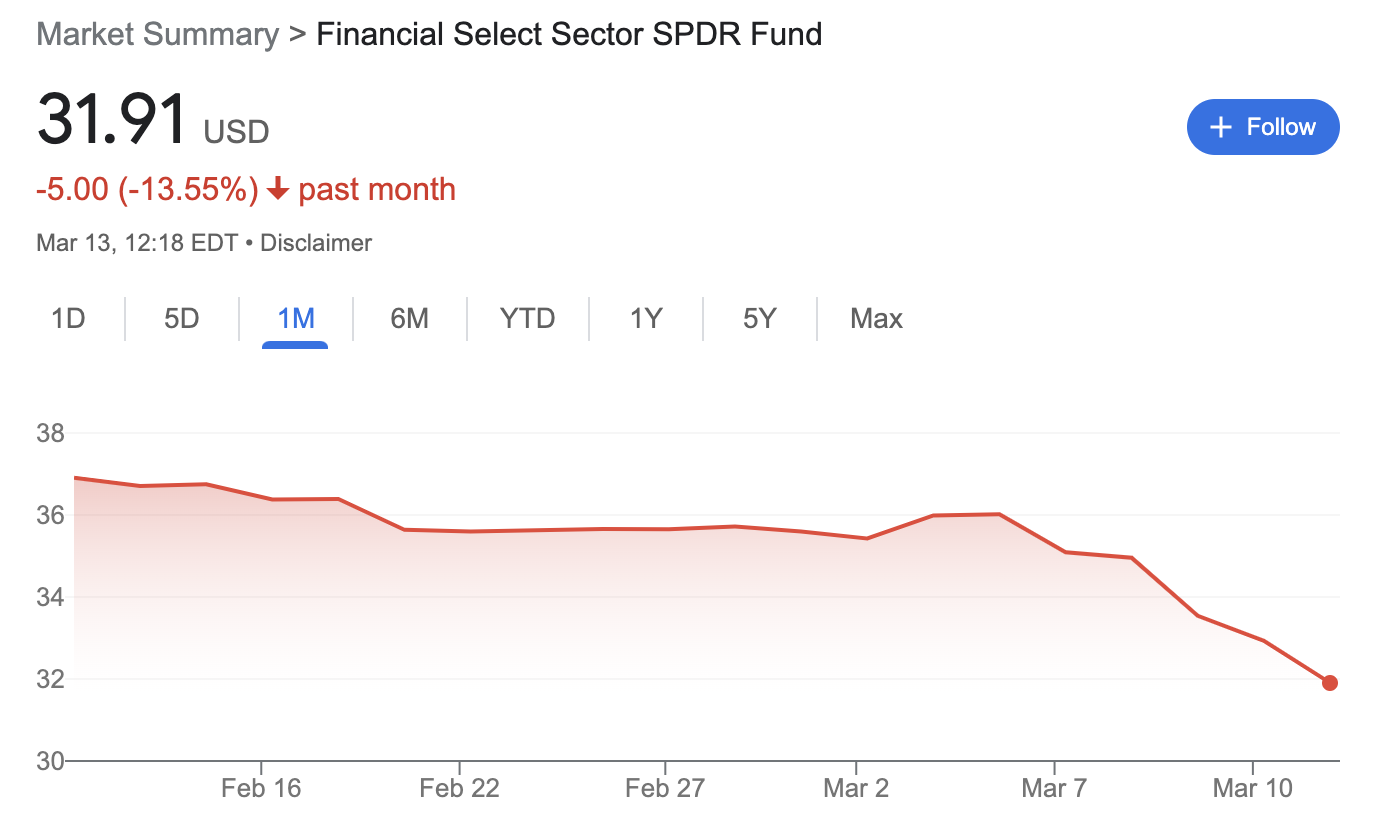

Bankers have been after Bitcoin ever since it has gotten the media’s attention. Even the CEO of JP Morgan, one of the largest banks in the world, Jamie Dimon, thinks “Bitcoin doesn’t do anything, it’s a fraud.” Even the financial ETF XLF took a big hit, falling by over 13% in just a week. Why is it then that banks are collapsing while Bitcoin skyrockets?

Financial Select Sector SPDR Fund (XLF), source: google.com

Think of Bitcoin as a new financial instrument. Think of it as it actually is, a cryptocurrency. Not a commodity or security like regulators try to label it. There’s a government behind fiat currencies, there are companies behind stocks, but there are people behind Bitcoin. It is a blockchain, a network, a protocol – something that thrives with the onboarding more users.

It has proven itself numerous times in the past despite massive crashes when its price dropped 80%. And most importantly, no bailout was needed to save Bitcoin. On the contrary, banks face such enormous troubles that only a bailout can save them. This may not be the case for industry leaders like JP Morgan or HSBC, but you can never know.

Also read: Depegging of stablecoins – what does it mean and why is it happening?

Even the biggest banks in the world were on the brink of collapse in 2008. There’s always the government that needs to help banks to survive in the long run when troubles arise. However, Bitcoin needs no one.

It survived China’s crypto mining ban, FTX crash, Silvergate collapse, Silicon Valley Bank shutdown, and much more. It is likely to continue to be like this because of Bitcoin’s virtues.

Why Bitcoin will survive

Unlike the traditional banking system, Bitcoin allows you to be your own bank. No limits, no specific opening hours, no inflation, and no racism. There are certain rules and regulations in the banking system, but you can send or spend as much Bitcoin as you’d like if you’re using your own crypto wallet.

Jack Mallers tweet, source: twitter.com

Its usage is not limited by race or time. The network runs 24/7. CEO of Zap, Jack Mallers, shows that it is not possible to inflate or change Bitcoin. Moreover, there’s no need for trust as blockchain takes care of that. Despite Bitcoin’s volatility, it always rises higher every few years.

“It is the only instrument in history with an absolute fixed supply and incorruptible monetary policy,” he stated in the tweet.

Bitcoin makes wealth storage a reality without any counterparty risk. Bitcoin enables you to sidestep banks and take direct ownership of your wealth. With each passing year, more and more user-friendly technologies are introduced to the market and accelerate the mainstream adoption of Bitcoin.

Read more: What is portfolio diversification?

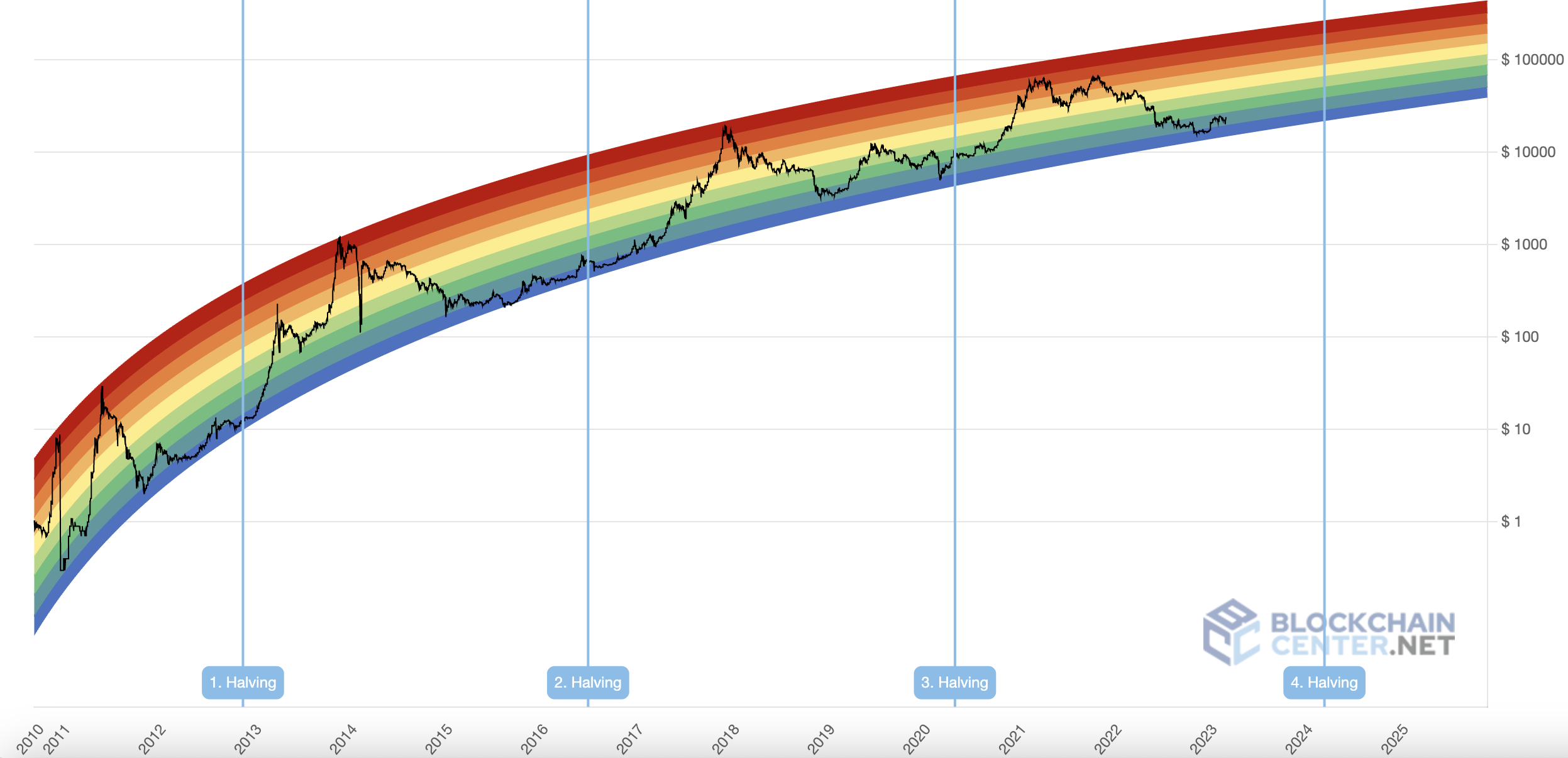

It is estimated there are now over 420 million crypto users worldwide. This is despite the fact that Bitcoin is only 14 years old. Store your bitcoins safely on cold wallets and don’t share your private keys with anyone. Bitcoin is going up every now and then and no event was able to stop it yet. Take a step back. Look how it has been performing since its creation.

Bitcoin rainbow chart, source: blockchaincenter.net

Comments

Post has no comment yet.