Non-fungible tokens (NFTs) have taken the world by storm in the past few years. From artwork to memes, music to sports collectibles, NFTs are revolutionizing how people perceive and own digital assets. In this article, we will explore what is NFT Crypto along with the different types of NFTs. We’ll also explore whether NFTs are just a craze or a useful invention.

What are NFTs?

NFTs, or non-fungible tokens, are a type of digital asset that represent ownership of a unique item or piece of content. Unlike traditional cryptocurrencies such as Bitcoin, which are interchangeable and have equal value, each NFT is unique, without a possibility to replicate it. NFTs are created using blockchain technology, which is a decentralized ledger that records every transaction while ensuring that each NFT is unique and cannot be duplicated or tampered with.

Also read: Stablecoins vs CBDCs – what’s the difference?

NFTs can be screenshotted, but it will always be one person to own that piece, which is verifiable on the blockchain. NFTs can take many forms, including digital art, music, videos, or even tweets. Essentially, any type of digital content can be turned into an NFT and sold as a one-of-a-kind item. NFTs are usually traded on NFT marketplaces using cryptocurrencies, although some platforms allow for fiat currency (e.g. euro) purchases as well.

One of the key features of NFTs is that they allow digital content creators to monetize their work in a new way. Artists, photographers, musicians, and other creators can sell their work as an NFT, which makes them a profit from each sale. Moreover, they receive a percentage of the profits each time the NFT is sold or traded, also called royalty fees (usually a few percent). This creates a new revenue stream for creators as well as helps to ensure that they are properly compensated for their work.

Another feature of NFTs is their ability to provide proof of ownership along with authenticity. Because each NFT is unique and recorded on the blockchain, it can be easily traced back to its original owner. It can be simply verified as a genuine digital item.

This is particularly useful for collectors of digital art or other rare items, as it provides a way to prove that they own the original item, not a copy. However, collectors must be aware of the fact that many scammers imitate popular NFTs or use many different tactics to steal money.

Types of NFTs

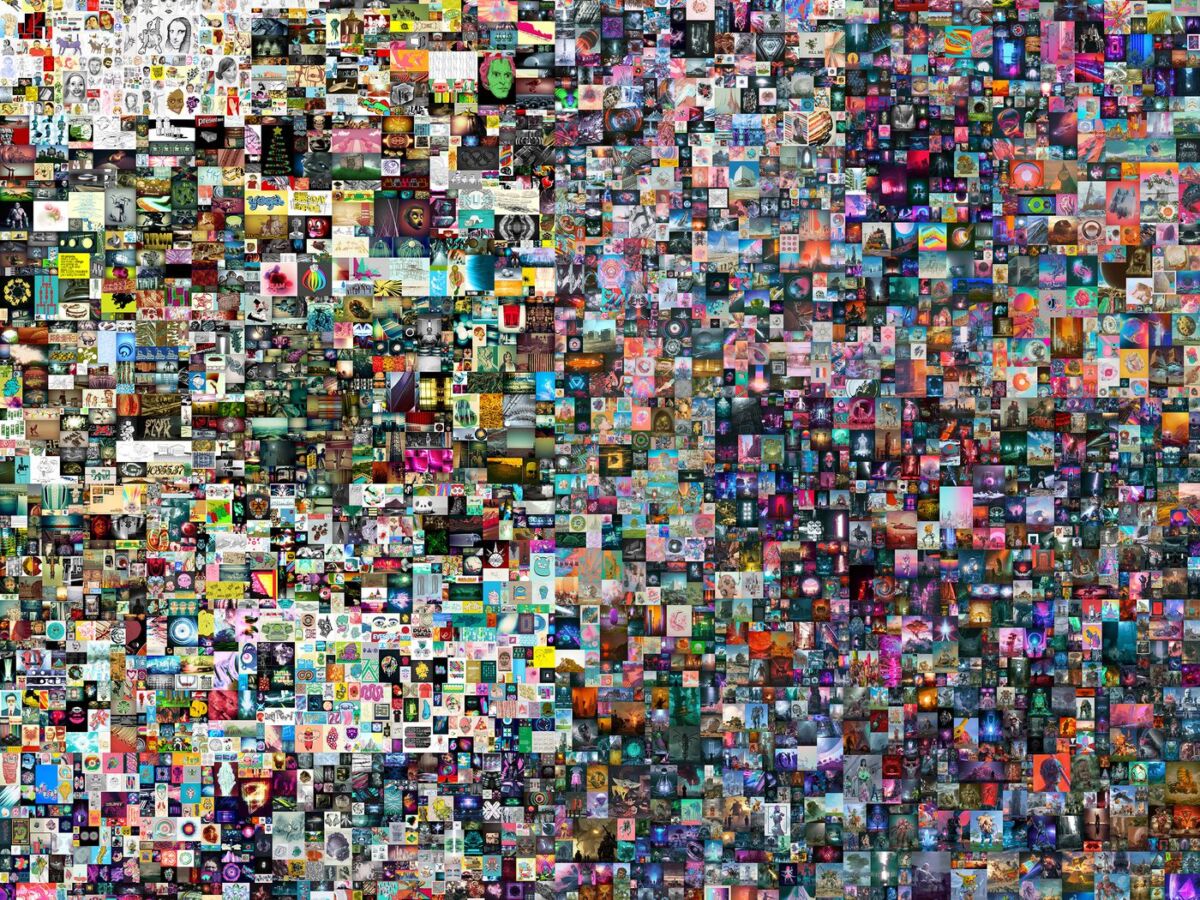

Everydays- The First 5000 Days by Beeple, source: theverge.com

NFTs come in different types, ranging from images, gifs, songs, videos, and even tweets, as mentioned before. The most common type of NFT is digital art. Many artists have used NFTs to sell their digital art as unique collectibles, with some pieces selling even for millions of dollars. One example of such art is “Everydays: The First 5000 Days” by digital artist Beeple, which sold for $69 million at a Christie’s auction.

You may also like: What do you need to know about crypto trading fees?

That was the event that started the NFT boom in early 2021. Another popular type of NFT is sports collectibles. NBA Top Shot, a blockchain-based platform that sells officially licensed NBA collectibles in the form of NFTs, has gained a massive following. Users can buy, sell, and trade moments from NBA games, such as a LeBron James dunk or a Steph Curry three-pointer, as unique collectibles. The platform has seen over $1 billion in sales since its launch in 2020.

Music is also an emerging category for NFTs. Many musicians have used NFTs to sell unique pieces of music, such as unreleased tracks or concert recordings. In March 2021, Grimes sold a collection of digital art and music NFTs for nearly $6 million, including a one-of-a-kind video called “Death of the Old” for $389,000. Other types of NFTs include virtual real estate, domain names, and even tweets. Twitter CEO Jack Dorsey sold his first tweet as an NFT for $2.9 million in March 2021.

NFT blockchains

Blockchain types by logos, source: pixelplex.io

A crucial thing to understand is that NFTs are basically tokens (ERC-721), but not like cryptocurrencies. The underlying technology called blockchain makes it possible to transfer or own NFTs. While NFTs can be created on any blockchain network, some blockchains are better suited for NFTs than others.

One of the main advantages of putting NFTs on the most popular blockchains, such as Ethereum, is the network effect. These blockchains have a large user base and ecosystem of developers, making it easier to create, buy, or sell NFTs. Ethereum blockchain is by far the most popular and established blockchain. This also means that NFTs created on these blockchains are more likely to have higher liquidity, meaning they can be bought or sold more easily.

Read more: A complete guide to Ordinals (Bitcoin NFTs)

Another advantage of using popular blockchains for NFTs is the security or reliability of the network. Ethereum, for example, has a high degree of security due to its consensus mechanism and smart contract technology. This makes it difficult for anyone to hack or manipulate the network, ensuring that NFTs created on the blockchain are secure, but trustworthy as well. On the other hand, Solana NFTs are also very popular, but the blockchain suffers outages from time to time.

However, there are also some drawbacks to putting NFTs on popular blockchains. One of the main issues is scalability. As NFTs become more popular, the demand for transactions on the blockchain increases, leading to slower transaction times or higher transaction fees. This can make it more difficult as well as expensive to create and trade NFTs on the blockchain.

While all created NFTs are stored on servers, the arrival of 2023 has brought the possibility to create Bitcoin NFTs or Litecoin NFTs that are stored on-chain. This has brought some criticism as well as the hype around “new kinds of NFTs.”

Are NFTs just a crypto craze?

Many people see NFTs as a speculative bubble, similar to the initial coin offering (ICO) craze in 2017. However, NFTs have several use cases beyond speculation or investment. One potential use case is for digital identity or ownership. NFTs could be used to prove ownership of digital assets, such as software licenses, domain names, virtual real estate, and much more.

Another use case for NFTs is for creators and artists to monetize their digital creations directly, without intermediaries such as record labels, art galleries, or auction houses. NFTs allow creators to sell their work as unique collectibles, with the potential for ongoing revenue streams in a form of royalties.

Suggestion: How to invest in Bitcoin?

However, investors and collectors need to stay cautious as the space is currently unregulated, with a lot of scammers looking to make a profit. The number of NFT scams that are being done could be covered in a single article, but recognizing green flags and red flags could save investors some trouble.

Conclusion

NFTs are a new innovative way of owning and trading digital assets. They have brought a new level of transparency along with authenticity to the world of digital art, collectibles, and music. While some view NFTs as a speculative craze, they have the potential to revolutionize digital ownership and monetization for digital content creators.

Comments

Post has no comment yet.