Staking, like many other crypto concepts, might be as easy or as complex as your desire it to be. Investors might benefit greatly from understanding that staking is a mechanism by which they can receive rewards simply by holding specific coins.

However, even if your only goal is to reap the staking benefits, it is still helpful to have a basic understanding of how and why the system operates in the manner in which it does. Let’s thus break down the basics of crypto staking.

What is crypto staking?

Crypto staking, source: aqru.io

Staking crypto is the practice of temporarily locking crypto assets in order to aid with the maintenance of a blockchain network. The staked crypto can then increase the holdings of the staker. For instance, Ethereum (ETH) transitioned from Proof-of-Work (PoW) to Proof-of-Stake (PoS), allowing investors to stake ETH. It’s important to know that the earnings are in crypto, not in fiat currencies.

You may also like this look at mining: What is crypto mining?

It yields approximately 5% ETH yearly. The process of staking is somewhat similar to dividend stocks. The company benefits from investors who buy and hold their stocks for a long time, delivering steady growth for their stocks. With crypto, many market participants benefit from investors who stake crypto and hold it long-term. This should deliver lower volatility and steady gains over time.

PoS is used as a consensus mechanism by many blockchains. To participate in the blockchain network and help verify transactions and add new blocks, users are required to “stake” a certain amount of money. Valid data and transactions are more likely to be added to a blockchain when staking is used.

Staking is a sort of insurance in which participants lock up quantities of crypto in exchange for the right to validate fresh transactions. They risk losing some or all of their investment if they make an error validating potentially fake data. Nonetheless, they receive additional coins or tokens as a reward for validating correct, authentic transactions and data.

Related article: What is Damus and how is it connected to Nostr?

Some of the most well-known digital currencies, including Ethereum (ETH), Cardano (ADA), or Solana (SOL) use staking as part of their consensus procedures. However, there are hundreds, if not thousands, of other tokens that offer staking. Investors should be aware of projects that offer “get rich quick schemes,” attracting investors with ridiculously high staking rewards (e.g., 1,200%).

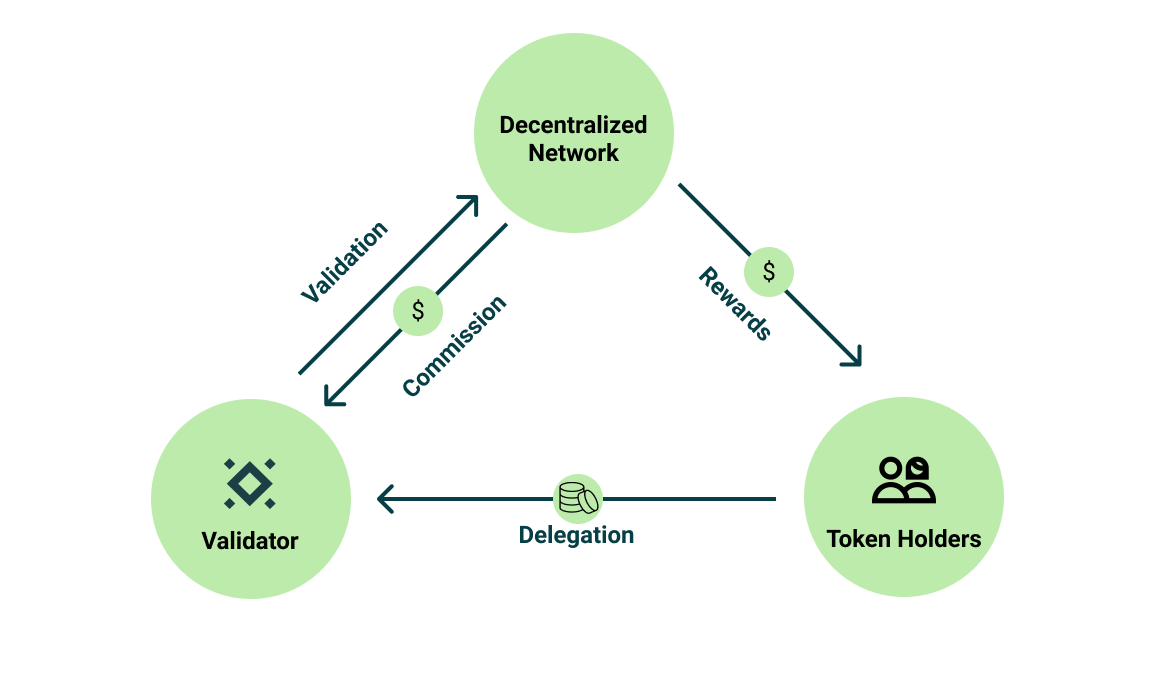

Validators and holders

Crypto staking process explained, source: medium.com

Staking is the method by which cryptocurrency with a PoS mechanism encourages the growth of a thriving ecosystem on its network. In general, the higher the staking, the more likely it is that validators will contribute new blocks and receive rewards. When a validator receives staking delegations from several holders, the network takes this as evidence that the validator’s consensus votes can be trusted, and gives them a greater say in the outcome of votes.

Furthermore, a stake can be made up of tokens from multiple people. A holder, for instance, may join a staking pool in which operators perform all the necessary work to validate blockchain transactions. There is a unique set of regulations for validators in each blockchain.

For instance, Ethereum mandates that all validators have 32 ETH in their accounts. According to current exchange rates, that is equivalent to around $52,585. Not everybody has 32 ETH in their wallets. In fact, most retail investors don’t have that much money. By working together in a staking pool, investors can reduce the amount they need to stake.

The green future of finance

The PoS model is favoured by people who support a green future. For instance, it’s a very well-known fact that crypto mining uses a lot of energy. But as Ethereum transitioned from PoW to PoS, it is reported that its blockchain now uses 99.9% less electricity.

Which 5 crypto billionaires lost over $110 billion in 2022? 👋💰

➡ It is not only Sam Bankman-Fried who lost billions in 2022. Binance CEO, CZ, actually lost the most in this #crypto winter.#cryptocurrency #bearmarket #trading #trader #investrohttps://t.co/qk3BakLui2

— Investro.com (@investrocom) January 16, 2023

This is the reason why many crypto projects are shifting their focus, and PoS is becoming more popular than PoW. However, it’s worth noting that mining is not as bad as people say because many people use sustainable and renewable energies for crypto mining. The PoS model is still likely to gain in popularity over time.

Potential risks of crypto staking

It’s important to keep in mind, though, that the staking pools are almost always constructed using external services. Many of those “third-party solutions” bankrupted (BlockFi, Nexo, etc.) in 2022, causing people to lose their holdings. It’s crucial to be aware of the risk investors are undertaking when relying on companies to pay their yields.

Another risk of staking cryptocurrencies is time. If the tokens are locked and staked for a year when the bull market is at its peak, the investors may find their positions to be worth 90% less in a year. However, if they lock and stake good projects at selloffs, that’s when it may turn out very beneficial in a year or two.

Benefits of crypto staking

The main benefit of staking for investors is a passive income. If they don’t panic sell and plan to hold tokens for the long term, they could enjoy a few percent additional profits on potential future gains. If the token rises 100% in price, with staking giving you another 10%, the earnings increase as well.

Read more: TOP crypto memes that everyone should know

It’s easy to begin staking on popular platforms like Binance, or other crypto exchanges. But this is the risk the investors may undertake for making it easier for themselves. Staking without a third party may be more challenging, however, it is a safer option.

By staking, the users contribute to the security and efficacy of a certain blockchain. This helped Ethereum to accumulate over half a million validators, which makes the Ethereum blockchain almost impossible to hack.

Is staking for you?

Staking is a great strategy for long-term investors who aren’t concerned with temporary price swings and want to generate yields on their holdings. It’s not a good idea to stake money if you’ll require access to it before the staking time ends. If you have the mindset of a long-term stock investor, staking is an option you should seriously consider.

However, you should put safety first. If you have projects you’re holding for the next few years, you should be aware of the possible risks of staking on the aforementioned third-party platforms. Make sure you choose the safest option.

Bottom line

Overall, crypto staking is a wise choice as it produces more profit for investors. But there are some safety measures investors need to think about. Staking may help investors think more long-term, focusing on reality rather than on quick gains – which are essentially a mirage in 99.9% of cases.

Comments

Post has no comment yet.