J. Powell at Jackson Hole (an economic policy symposium) only confirmed our thesis, which we were talking about in our previous reports. Our analytical team was strongly confident about this bear thesis, as growth leading indicators continued to worsen, but labor figures remained strong. The Fed wants to see a substantial portion of stabilization in inflation MoM prints, ideally in core inflation. Let’s summarize what happened in the last week.

The latest asset movements

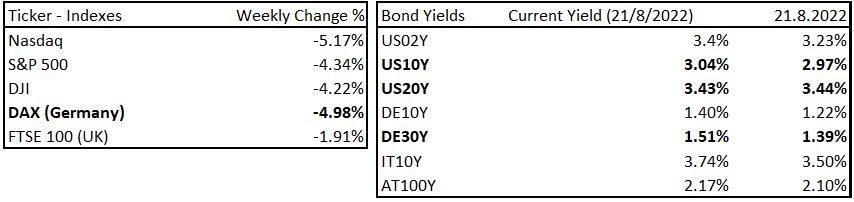

In the previous week, the market significantly dropped at the beginning and end of the week. Friday’s move was caused by J. Powell’s hawkish stance on Jackson Hole and direct comments about inflation. We will make some breakdowns below. Stock indexes dropped quite significantly, as we warned in our previous article, and the front-end of the yield curve started to rise.

Related blog: Three positive cash flow stocks with solid potential

However, the back-end of the yield curve moved sideways. The biggest moves in yields were in Europe, mainly on bonds with short-to-mid-term maturity, but we saw a slight decline in bond prices with great durations as well. However, the situation in Europe is absolutely madness due to the unprecedented surge in energy prices, which in the mid-term are unsustainable. However, a potential rise in the ECB’s main rate won’t solve the problems. Inflation in Europe is purely supply-driven; in the US, the opposite.

Asset movements from the previous week, Source: Investro Analytics Team

Jackson Hole and J. Powell’s statement breakdown

Before we jump in, we clearly monitored FOMC members and their statements in the previous weeks. Most of them were purely hawkish and seemed to be really confident about the tightening process, more than the stock market realized.

Jackson Hole, according to Investopedia:

“The Jackson Hole Economic Symposium is an annual symposium, sponsored by the Federal Reserve Bank of Kansas City since 1978, and held in Jackson Hole, Wyo., since 1981. Every year, the symposium focuses on an important economic issue that faces world economies. Participants include prominent central bankers and finance ministers, as well as academic luminaries and leading financial market players from around the world.”

This year, such an economic symposium is crucially important as the market priced in unclear messages from mixed news. However, the FOMC members clarified different topics and that is why the market significantly dropped on Friday.

We will mention the most important part of J. Powell’s statement and comment it:

“While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.”

- The Fed is aware of the economic slowdown and the pain it will cause the markets and households. We agree that a failure to restore price stability would mean much greater pain. The clear message is that inflation is the first objective right now.

“While the lower inflation readings for July are welcome, a single month’s improvement falls far short of what the Committee will need to see before we are confident that inflation is moving down.”

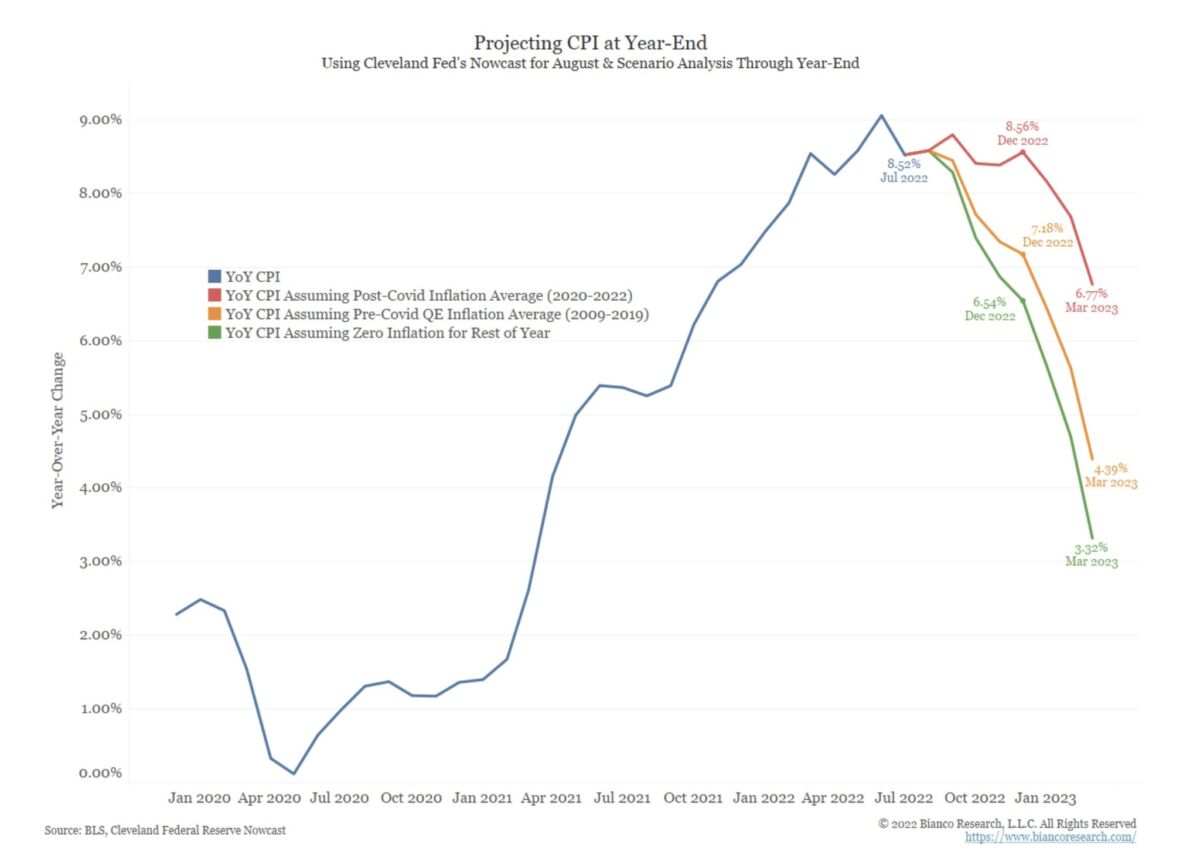

- Here we will post a great chart about inflation to make you understand what is going on.

- The following chart indicates that if MoM inflation, or “additional” monthly inflation, is zero percent, then CPI in December will reach 6.54% and in March 2023, 3.3%. Both are significantly higher than the Fed’s medium-term target. The Fed needs to see a substantial and consistent drop in MoM inflation to even think about easing.

CPI with MoM scenarios, Source: BLS, Cleveland Federal Reserve Nowcast, Bianco Research

“July’s increase in the target range was the second 75 basis points increase in as many meetings, and I said then that another unusually large increase could be appropriate at our next meeting. Our decision at the September meeting will depend on the totality of the incoming data and the evolving outlook.”

- Currently, we do not dispose of the most current data, as maybe only the Fed does. However, inflation expectations rose in the previous weeks, providing support for a more hawkish stance (assuming a 75 bps hike) in September. On the other hand, there is still time for a reversal as the decision will be made at the end of September.

“The historical record cautions strongly against prematurely loosening policy.”

“It is also true, in my view, that the current high inflation in the United States is the product of strong demand and constrained supply, and that the Fed’s tools work principally on aggregate demand.”

- We totally agree, as we stated in the previous text. Inflation is primarily driven by demand in the United States, and the Fed has the tools to control it. The significantly bigger issue is in Europe – supply driven inflation.

“That brings me to the third lesson, which is that we must keep at it until the job is done. History shows that the employment costs of bringing down inflation are likely to increase with delay, as high inflation becomes more entrenched in wage and price setting. The successful Volcker disinflation in the early 1980s followed multiple failed attempts to lower inflation over the previous 15 years. A lengthy period of very restrictive monetary policy was ultimately needed to stem the high inflation and start the process of getting inflation down to the low and stable levels that were the norm until the spring of last year. Our aim is to avoid that outcome by acting with resolve now.”

- The Fed is aware of early easing as it seemed in the seventies and eighties and wants to avoid such a mistake. In the case of a strong recession, we guess there would be a reversal.

The most recent expectations

However, there was no significant increase in the bond yield curve or in the Fed Funds Futures Rate (rate expectations) on Friday. For the stock market, the Fed gave the market a bearish signal. The spread between expected rates in December 2022 and December 2023 has shrunk, which means that the market has priced in almost no rate cuts between certain dates (only -7 bps, not a single 25 bps rate cut).

FFR expectations based on futures, Source: Investro Analytics Team via Tradingview

Trading ideas

As we stated in the previous article, we set a bearish target on the S&P 500 at 4 210 USD with SL at 3.5% (4 357 USD) and take profit at 3.5% (4 060 USD) to 5.0% (3.999 USD). Our first take profit (3.5%) has been achieved, and following the current fundamentals and macro outlook, we still remain bearish. The ideal scenario is to take some small profits at first target and let the position run until we reach 3 999 – 3 990 USD. Maybe the future decline in the stock market will follow this week.

S&P 500 targets, Source: Investro analytics team

In the case of bonds and oil, as we stated 2-3 weeks ago, we halved our position. In the case of bonds with great duration, the risk/reward profile seems really good, but we will wait this week and will closely watch market movements. If there is a potential surge in yields in the case of a back-end of the yield curve, we could reveal the next trade opportunity.

Read also: Europe’s fertilizer situation is worsening

We also remain bearish on oil. Currently, we are searching for set-ups to short the European energy market. We need more data to clarify our thesis, and then we will reveal a potential opinion on the European energy market and positioning in the next week.

Warning: The fully covered text is not investment or trading advice. It represents only the author’s point of view and thoughts, and we do not bear responsibility for your potential loss. The article serves only for analytical and marketing purposes.

Comments

Post has no comment yet.