The problem in Europe is much more severe than in the US or other countries. Our latest macro reports mainly focused on the USA or global markets, but the countries of the EU are getting the hardest hit. There are multiple factors, however the biggest are still the price of energy and oil, and the slight tightening process of the ECB. Despite a 50 bps rate hike in July, it will not be enough to fight inflation. that is because inflation is mainly supply-driven.

German energy market

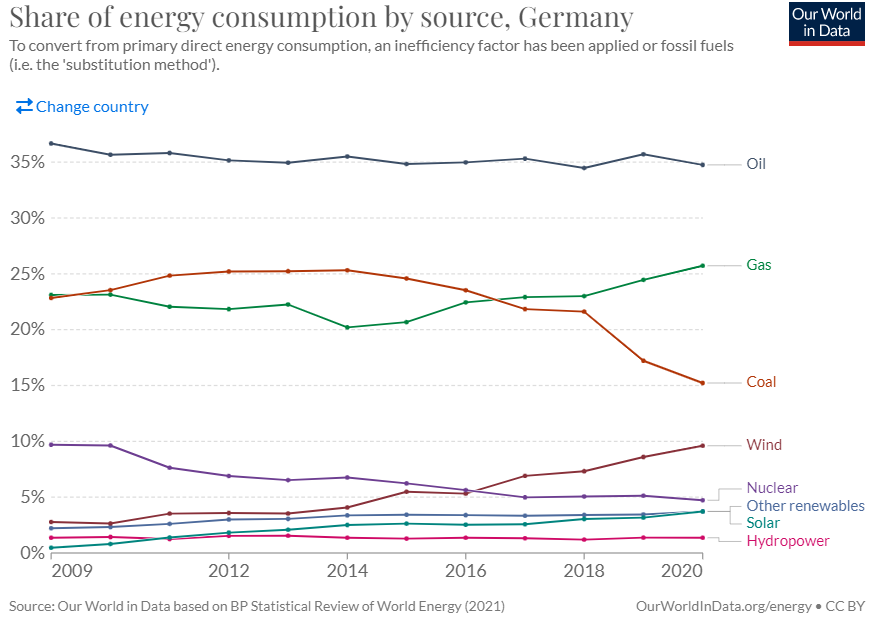

Looking at the share of energy consumption by source in Germany, Our World in Data reveals many interesting outcomes and shares (2021):

- Oil – 33% (decreasing trend)

- Gas – 25.8% (increasing trend)

- Coal – 16.7% (decreasing trend)

- Wind – 8.7% (increasing trend)

- Nuclear – 4.9% (decreasing trend)

The problem is nuclear energy, which is by many considered “clean energy”, and for political reasons, Germany decided to significantly reduce it from 2022. Understandable move is the coal case, which significantly harms the environment and produces many emissions. The “drop-out” in coal, nuclear power, and oil is replaced by an increase in gas and wind. And the problem is that gas is mainly distributed from Russia (in Germany). The problem is also electricity, which can be produced in many ways, but producing inputs (other commodities) are very costly.

Share of energy consumption by source, Source: Our World in Data

How did the inflation appear?

Problem number in inflation is mainly supply-driven. First of all, it all started after the COVID-19 monetary and fiscal stimulus packages, where there was excess liquidity (or liquidity flood) in the markets, in the banks, and in the economy via eased monetary policies worldwide (and its programs). The next factors were lockdowns that led to production limitations, which led to supply-chain disruption.

You may be also interested in: The underrated power of long-term investing

The last and most current factor is the lack of energy in Europe (expensive oil, gas, electricity) and the price surge during the previous months, which led to a massive increase in PPI (inflation on the producers’ side), which created additional inflation pressures via secondary inflation and the shift to the consumer (CPI). The YoY inflation rate in the euro area reached 8.6% and in Germany, it was 8.2%. Currently, it is mainly driven by a significant increase in energy inputs and oil. The war in Ukraine also plays a key role here. On the other hand, energies and oil are rising from 2021.

Inflation (HICP) in EA, EU and Germany, Source: Eurostat

However, as we stated in the previous macro reports, on the global markets we can see a commodities “freefall,” suggesting the economic slowdown. It is much more visible in the European markets. However, the copper and metal slump down will only partially affect inflation. The key drivers in Europe are gas and electricity and oil prices. At least, the oil had dropped at the end of June and in July and we will see the impact in the following HICP figures.

Energy background

The EU countries are mainly commodity importers and thus need to rely on foreign arrangements with their suppliers. However, we know the current conflict (Ukraine – Russia) led to many sanctions on Russian commodities (or reduction) as well as other financial ties. The problem is that many countries are importing their oil products from Russia (mainly CEE Europe) and gas as well. The issues with gas already started in the 3Q-4Q of 2021, when Russia started to limit gas deliveries, but still filled its long-term contracts.

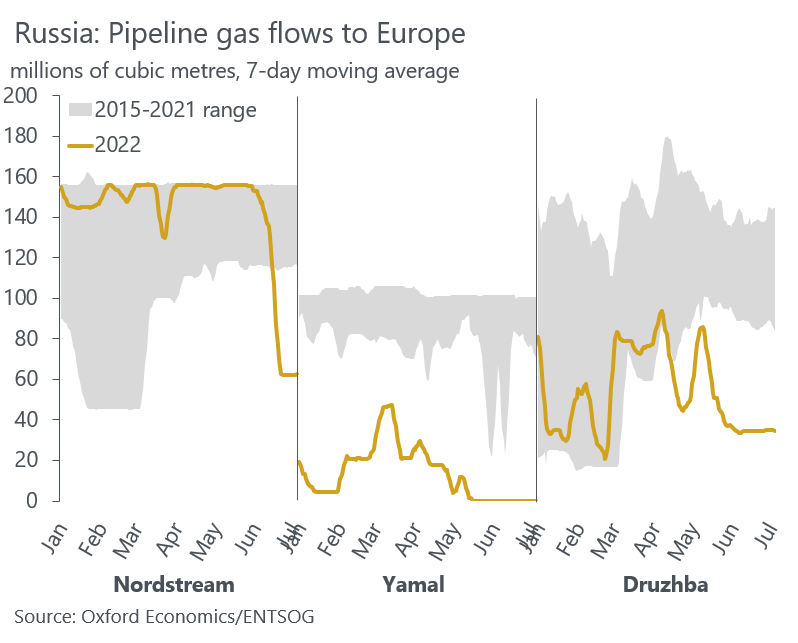

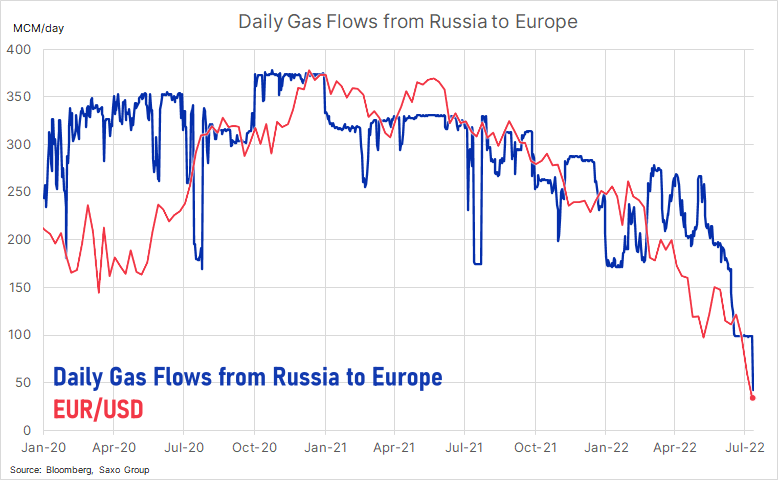

Currently, as the sanctions are making everything worse, these long-term deliveries have started to shrink to the lowest levels. In the chart below, you can see that Russia’s gas flows to Europe are almost stopped, and during the past weeks, there have been some minor flows from Nordstream and from Druzhba.

Pipeline gas flows to Europe, Source: Daniel Kral via Oxford Economics/ENTSOG

The Nordstream was “under maintenance” for 7–10 days, and it is not known how gas flows will continue. According to the most current information, gas flows from Russia into EU countries resumed on Thursday (40% of capacity was planned). Putin also revealed that a turbine from Canada is needed to resume gas flows into Europe. If not, the flows will drop to 20% of their capacity.

Read also: The Turkish lira might be on the brink of collapse

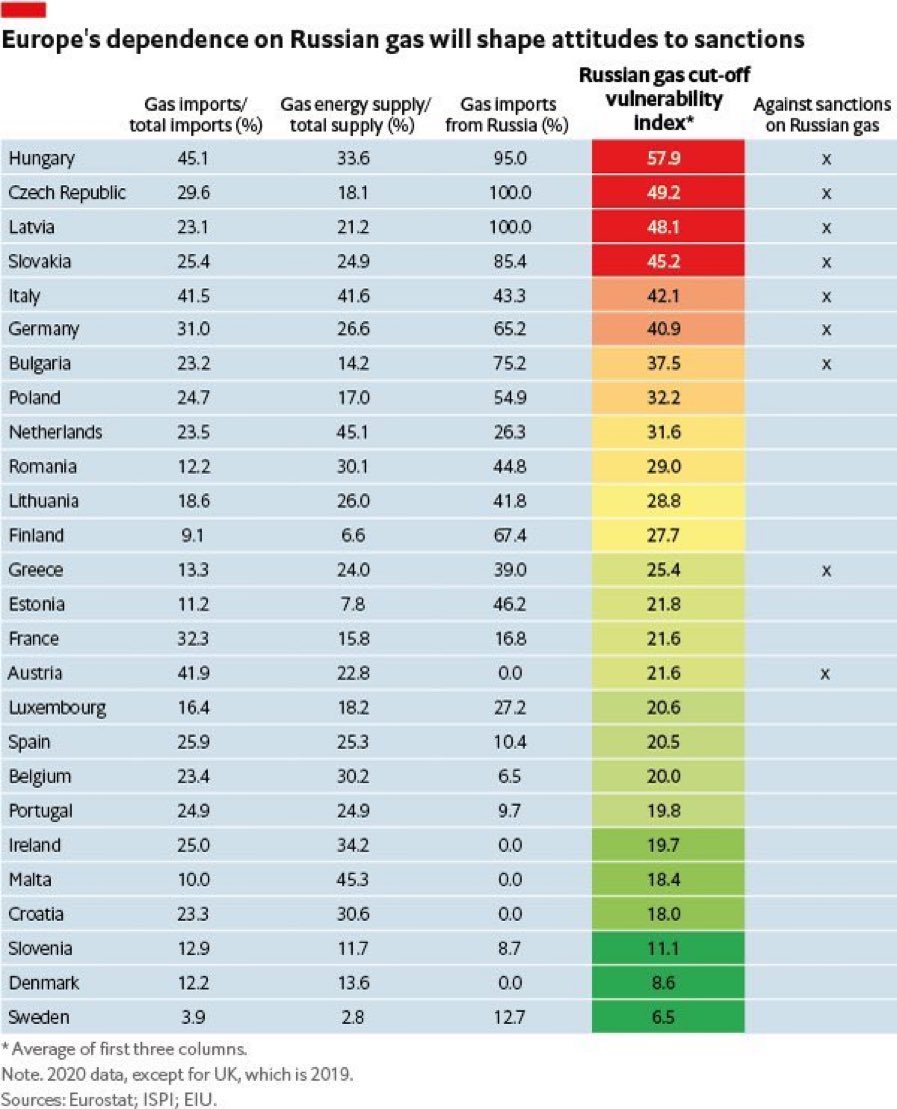

There are some small countries in the EU where the whole oil and gas infrastructure is based on Russian commodities. It is very hard to replace this in the very short term because it takes some time to rebuild infrastructure for the WTI or other oil brands. The dependence of EU countries on Russian gas is shown in the table below:

Europe´s dependence on Russian gas, Source: Radoslaw Bodys via Eurostat; ISPI; EIU.

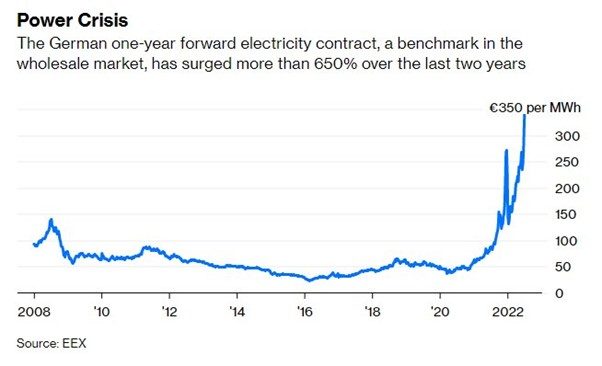

And here is the one-year forward electricity contract, showing the continuing extremes. As gas and electricity prices are very correlated, a similar price trend can be seen in gas spot or forward prices. Electricity can be produced in many ways, but historically, coal and oil sources have decreased. Germany needs to find new ways to replace it. And it will probably be the restart of coal (for the short-term) to successfully produce enough electricity and lower the price for producers and industries as well as ordinary people. The people in Germany have already received recommendations to significantly lower their energy consumption.

German one-year forward electricity contract, Source: EEX

The situation in Europe can get much worse

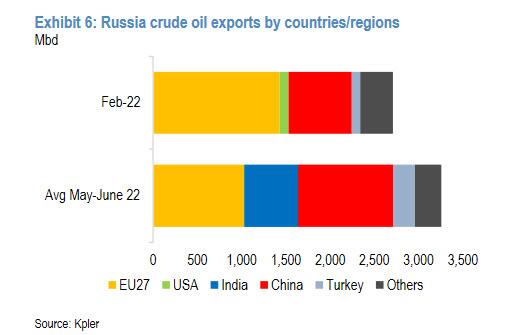

During the last few days, there was a shutdown in the Nordstream pipeline due to “technical maintenance”. However, according to the latest news, there are some indications that Gazprom has resumed some gas flows. Moreover, Russia could also allow the stop-out of gas flows due to sanctions, but they would lose their key partner for gas and oil – the European countries. However, as you can see in the next chart, these deficits via oil and gas were easily replaced by China and India. Thus, Russia can allow it and could create a political pressure on EU economies to ease sanctions. However, it is not gas that is the most important revenue outcome, but oil. Russia is delivering more volume to the world, despite big shortcut from EU27 and USA, replaced by India and China.

Russia crude oil exports by countries and regions, Source: Kpler via Zerohedge

The problem is that when gas flows will be zero, Germany needs to replace them. It can partially replace the gas in case of electricity production via oil or coal, which can lever up the additional demand for oil. The problem is that it could not replace gas with anything else in industries, where gas is highly wanted.

ECB surprised with 50 bps hike, but nothing more

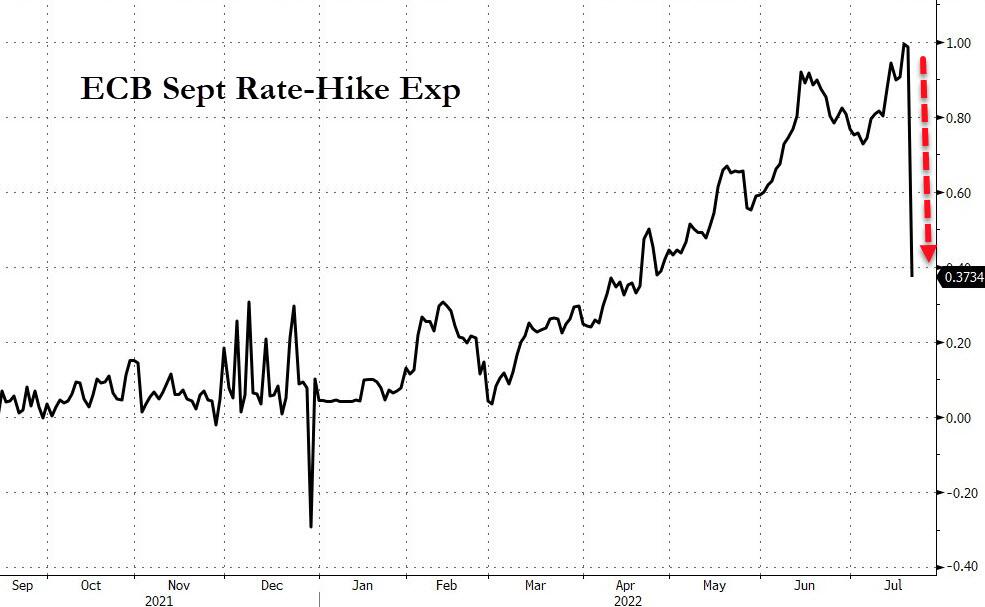

According to Zerohedge:

“Initially, both European bonds and the EURUSD moved higher after the ECB unveiled a higher than expected 50bps rate hike (although the same as leaked, so the ECB effectively destroyed any remaining credibility its forward guidance may have had).

However, barely had the EURUSD hit session highs when the doubts started to spread, starting with Lagarde confirmation during the ECB presser that the central bank’s prior guidance for a September rate move no longer applies, and as we showed earlier, the market immediately started pricing in a much lower rate hike in two months as it priced in a much more rapid onset of the recession thanks to the ECB tightening conditions more than expected just as the economy contracts.”

ECB September rate hike expectations, Source: Zerohedge

The expectation for a September rate hike has fallen significantly as the market understood that the ECB’s recently disclosed Transmission Protection Instrument (TPI) is designed to frighten markets, but is questionable if it will be applied in practice. Lagarde clarified that all members of the EA are eligible for the TPI and only the ECB will determine where to use this tool.

No matter how bad the situation is, it still could be worse. In recent weeks, the EUR/USD has traded near parity at 1.00 EUR/USD and has already tested areas below 1.0. However, in Europe, the euro suffers more due to the energy crisis than a monetary or inflation one. The problem is that the ECB can nothing to do with this. Increasing costs due to surging energy prices are already harming the economies and companies’ margins, while another round of tightening will only worsen consumer spending as well as the GDP outlook. However, high inflation can lead to an inflation spiral or the creation of demand-driven inflation (maybe already created). The additional rate hikes as well as continuing energy price pressures are the main determinants of rising recession risks.

Daily gas flows from Russia to Europe, Source: Saxo Group via Bloomberg

Trading idea

As we noted previously, we still remain very bullish for European (as well as the USA) bonds with great maturities (mainly German Bunds) as there are recession fears. The current ECB meeting and forecasted forward guidance—played by the market—still confirm our thesis. As inflation is driven mainly by energy commodities and oil, these are the inputs we need to see fall to expect a decrease in inflation. At present, we are not bullish on the DAX, nor are we bearish. We are neutral. However, as energy prices will continue to go up, so will inflation, thus destroying consumer confidence and we can not be bullish. In our opinion, it is still more comfortable to be more bullish on bonds with great maturities rather than stocks. However, we still remain bearish on oil, where Brent crude oil is only slightly above $100.

Comments

Post has no comment yet.