Indicies slip after CPI and Fed minutes

The Federal Reserve’s March policy meeting minutes indicated that numerous FOMC members were concerned about the regional bank liquidity situation, which contributed to a decline in US markets on Wednesday. The Dow Jones finished 0.11% down, while the S&P500 lost more than 16 points, falling by 0.41% after an initial gain. The Nasdaq fell by almost 102 points or 0.85%.

The minutes came after a lower-than-anticipated inflation report. This contradicted stickier underlying statistics and increased the chance that the Fed will raise interest rates again when it meets next month.

The CPI report, which examined the prices paid by urban consumers for a selection of products and services, came in below experts’ projections. This is indicating that the Fed’s initiatives to control inflation are beginning to bear fruit.

More to read: Elon Musk rebrands Twitter to X Corp, creating ‘everything app’

However, core CPI, which excludes erratic food and energy prices, reached the consensus target and is still much higher than the Fed’s target rate of 2% on an annual average. Traders are now looking forward to the Q1 earnings season, which begins on Friday.

US dollar declines following Fed minutes

Federal Reserve officials unanimously opted to raise the key interest rate by 25 bps to 4.75%-5.00% as part of the continuous tightening effort to drive inflation back to the 2.0% objective. This happened during the meeting on March 21st-22nd, and the minutes of that meeting were made public today.

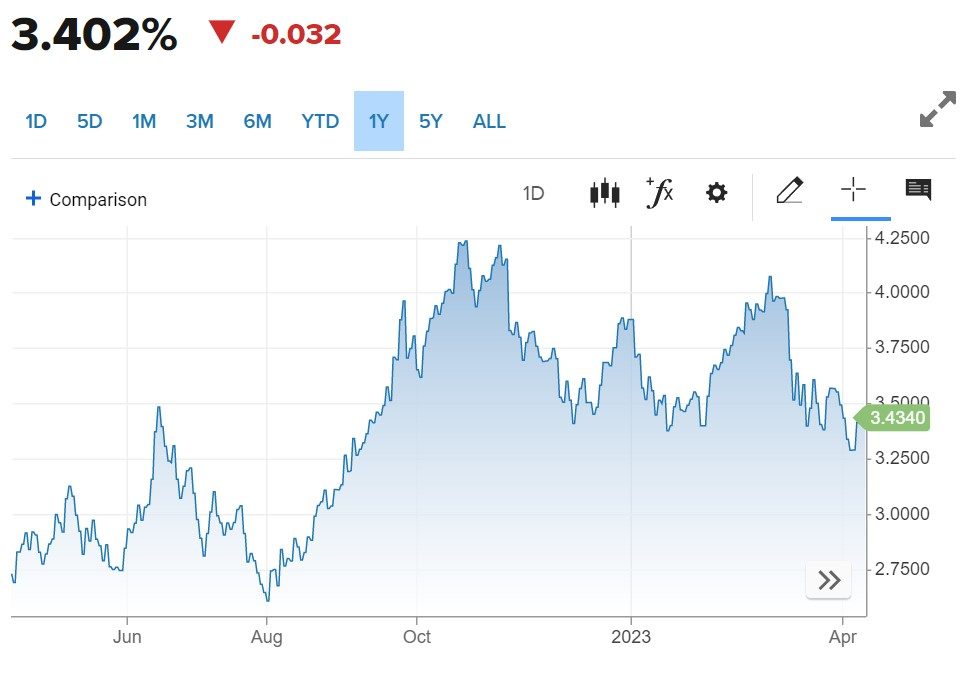

As soon as the minutes were made public, the US dollar, as represented by the DXY index, continued to decline, falling as high as 0.65% to 101.50 for the day. The greenback is under pressure from falling bond rates as well.

US10Y Treasury yield chart, source: CNBC

The euro gained for the second time in a row, closing a hair under 1.1 at 1.099 with a 0.75% gain. The sterling also added 0.5% to close at 1.2485 in the green. The yen has not been far behind with a 0.36% gain against the US dollar at 133.19.

Oil enjoyed another rally

Wednesday saw a 2% increase in crude futures prices for the second day in a row due to increased anticipation for a halt in US rate rises. Despite energy secretary Jennifer Granholm’s declaration that action will only be taken at barrel levels that benefit American consumers, anticipation that the Biden administration may replenish the country’s severely depleted reserve also fueled an increase in oil prices.

West Texas Intermediate finished $1.73 higher by 2.12%, at $83.26. WTI is extending a 2.2% rise from Tuesday. Wednesday’s session high was an 18-week high of $83.53.

Also interesting: MicroStrategy’s $4 billion Bitcoin investment turns profitablev

Brent increased by $1.72, or 2%, to close at $87.33, building on Tuesday’s 1.7% rise. On Wednesday, Brent reached a session high of $87.48.

Gold futures for June delivery are attacking the $2,030 area, with another 0.52% green day, closing at $2,029.55. Silver futures for May shot up more than 1.7% to $25.630, which is a level last seen in April 2022.

Comments

Post has no comment yet.