Fed will likely stick to its strategy

Market participants priced in the January US Personal Consumption Expenditures price index (PCE), the Fed’s preferred inflation indicator. Personal Consumption Expenditure Prices increased by 3.7% quarter-over-quarter and the core reading was 4.3% higher than the 3.9% increase in the third quarter of 2022.

The data increased the likelihood that the Fed would continue to raise interest rates at its forthcoming meetings. Therefore a possible shift in monetary policy remains distant. Also, based on the second projection of Q4 GDP, the country’s annualized growth rate was reduced down to 2.7% versus 2.9% in the last quarter of 2022.

More to read: What is a dividend stock?

The S&P 500 rose 0.47%, while the Dow Jones rose 0.31%, or 69 points, and the Nasdaq rose 0.70%. After quarterly results that outperformed expectations, Nvidia Corporation issued optimistic forecast, causing its shares to surge by almost 14%.

Moderna announced Q4 earnings that fell short of expectations due to growing expenses and decreasing sales of its COVID-19 vaccine. eBay slumped 8% after its Q4 earnings and annual outlook came up short of Wall Street’s expectations.

Risk aversion continued to support the US dollar

On Thursday, US dollar hit fresh February highs against the majority of its main competitors. The dollar index however, remained flat closing with a 0.02% green gain. EUR/USD slipped to 1.0576 and stayed below 1.0600 as the US market day came to a close.

GBP/USD trades at about 1.2020, while USD/JPY has stabilized at approximately 134.50. Prior to the closing bell, commodity-linked currencies regained some ground versus their American counterpart, with AUD/USD hanging around 0.6800 and USD/CAD trading around 1.3540.

Oil regained some of lost footing

The Energy Information Administration reported on Thursday that US crude inventories increased for the ninth consecutive week, leaving the market with 60 million more barrels than at the beginning of the year. Traders successfully ignored this statement and went bullish.

In March, Russia intends to reduce petroleum shipments from its western ports by up to 25% compared to February. WTI, crude for March delivery closed up $1.44, or 2%, at $75.359 per barrel. In the previous session, it decreased 3.4%. Brent for April delivery rose $1.61, or 2%, to $82.21 per barrel. Similar to WTI, Brent declined 3% yesterday.

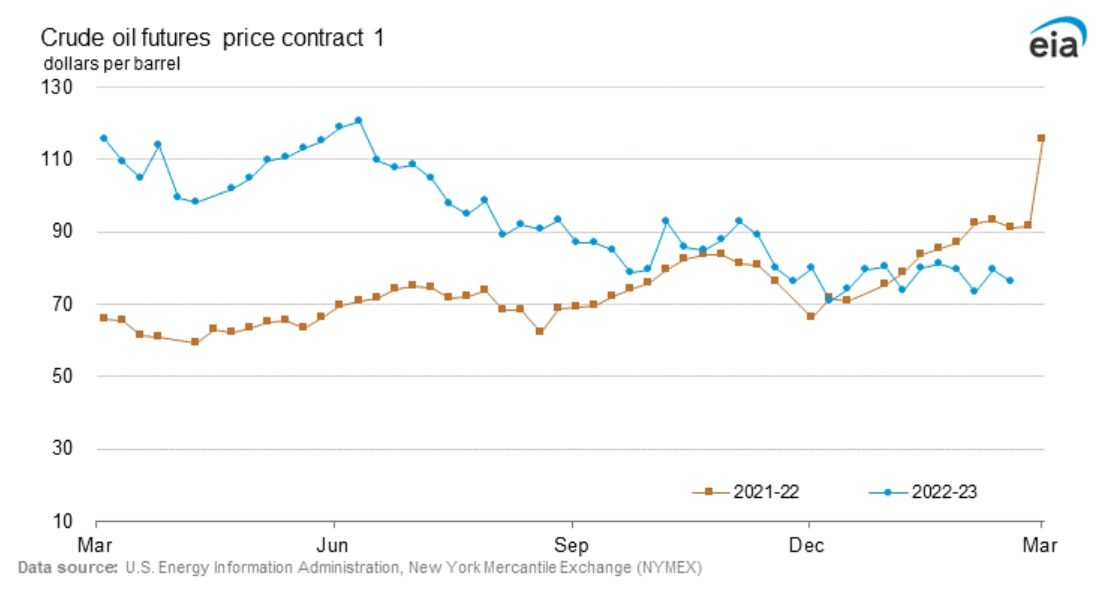

Crude futures price comparison chart, source: US Energy Information Administration

Comments

Post has no comment yet.