The last two years saw a surge in the cost of living as inflation went up. However, in the last few months, inflation managed to fall back due to extremely high interest rates set by central banks. While food, gas, and products have gotten more expensive, wages are far from rising.

The cost of work rises

Almost everyone witnessed inflation levels of around 10% on average in Europe or the United States, but employee salaries were only raised by a few percent in a year. The gap between the increasing cost of living and wages have broadened, causing many people to become even poorer.

Also read: Buy the rumor, sell the news: how does this phenomenon work?

Workers’ bargaining power with their employers increased for the first time in decades as a result of the severe labor shortage that followed the Covid pandemic. Millions of people have left lower-paying jobs in search of higher-paying ones, which became possible with tech giants looking to fulfill many positions. Workers had a lot of reasons to demand a raise because of inflation’s rise as their pay increases were not keeping up with inflation.

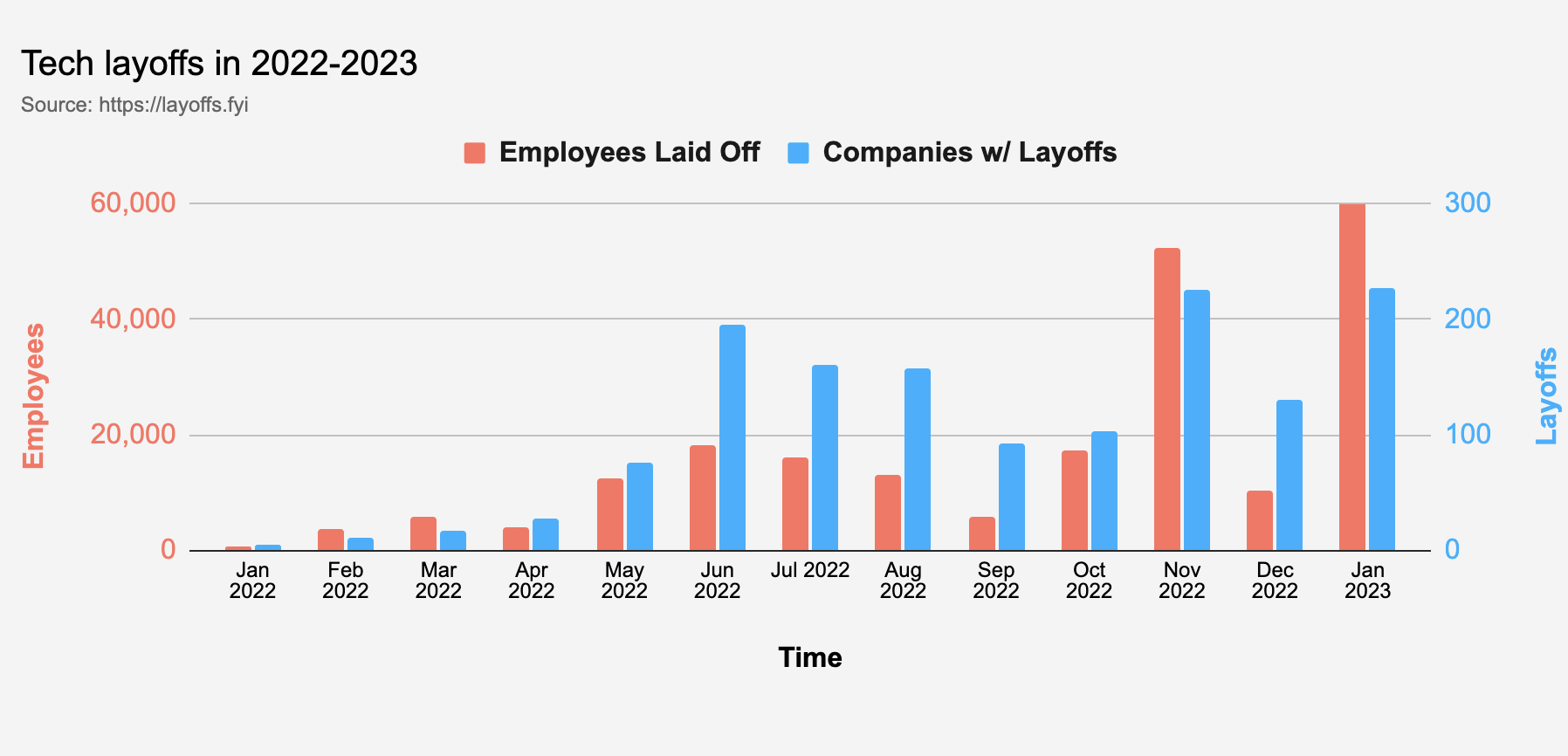

Higher salaries are still hardly wanted despite the fact that they rose 5.7% annually in 2022, the fastest increase since the early 1980s. The last time it happened was when the United States last experienced a period of high inflation like this. You can easily see why tech giants like Google, Amazon, and others, laid off tens of thousands of people recently.

Employee layoffs in 2022 and 2023, source: layoffs.fyi

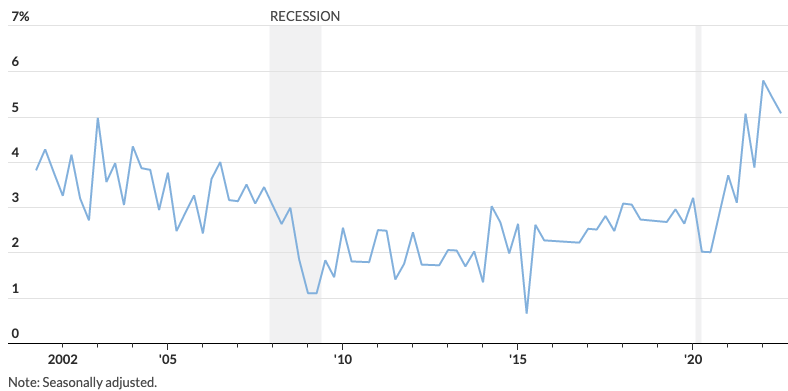

To keep up with the rising costs of products, services, and salaries, companies decided to lay off a part of their workforce. Now problem solved, at least temporarily, as the cost of workers exploded since the pandemic to almost 6%, well above the levels of the last two crises in 2000 and 2008.

Annual rate of growth in employee compensation, source: Haver Analytics, Labor Department

No wonder why companies had to start laying off part of their workforce. If these kinds of wage hikes were to continue, it could become a serious problem for the economy as businesses would struggle to keep up, and would have to cut costs elsewhere.

Read more: TOP crypto memes that everyone should know

Worker compensation increases are generally viewed favorably by Federal Reserve Chairman Jerome Powell, but Powell has stressed that wage growth should not persistently outstrip either inflation or productivity growth. That could be troublesome if it turns out to be the case. The Fed raised interest rates to their highest level since 2008 in an effort to curb wage growth.

US interest rates, source: tradingeconomics.com

Inflation is tamed by higher borrowing rates because they discourage spending and investing. This hasn’t necessarily been the case lately even though interest rates are at their highest in 15 years! But it could come to that in 2023.

Bottom line

The Fed is motivated to keep interest rates high until the economy slows down, unemployment goes up, and most importantly until inflation is back where it used to be (between 2 to 3%). Until that happens, the economy may contract by more than experts might expect, potentially taking the stock market with it.

For instance, Eurozone’s GDP growth was 1.9% instead of the expected 2.2%, just a little below the forecast. However, central banks will probably need a stronger contraction to get everything back to where it was.

Comments

Post has no comment yet.