Wild market swings have characterized this week’s trading as investors digested much labor market data and Powell’s testimony.

US labor market updates

Friday, the US Bureau of Labor Statistics (BLS) reported that Nonfarm Payrolls increased by 311,000 in February. This result exceeded the market’s forecast of 205,000 and followed January’s result of 504,000. (revised from 517,000).

According to the report’s additional data, the Labor Force Participation Rate rose slightly to 62.5% in February from 62.5% in January. In addition, the Unemployment Rate jumped to 3.6%, and annual pay inflation, as measured by Average Hourly Earnings, went from 4.4% to 4.6%.

You may also like: Silicon Valley Bank tanks 60% – another bankruptcy on the way?

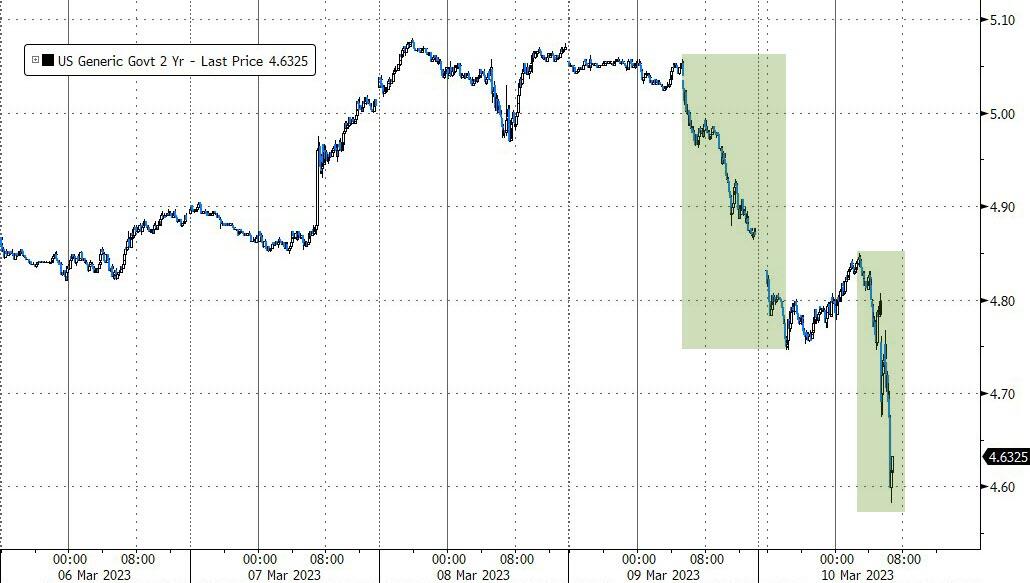

However, the data were not taken positively by the markets (despite the stock market soaring), as the market’s forecast for Fed action has become significantly more dovish, with the terminal rate falling by almost 40 basis points and a complete 25 basis point rate cut by the end of the year being priced in.

Moreover, the 2-year Treasury yield is down 45 basis points from yesterday’s highs, marking the worst 2-day decline in the 2-year yield since Lehman Brothers (Sept 2008).

Source: Bloomberg

In other news, Thursday’s initial unemployment claims increased from 190,000 to 211,000 (above the 195,000 forecast) last week, the highest level since December (but still extremely low historically). In addition, continuing claims increased to 1.718 million (around cycle highs) and were significantly higher than the anticipated 1.66 million.

Another interesting update: 2-year yield jumps above 5.0%, the highest level since 2007

Finally, Automatic Data Processing (ADP) reported that private sector employment in the United States expanded by 242,000 in February, above expectations of a gain of 200,000. In addition, the United States Bureau of Labor Statistics (BLS) reported that the number of job openings in January reached 10.8 million, above market predictions of 10.6 million. The facts continue to point to a robust employment market.

Powell sounded hawkish

Earlier in the week, Chairman of the Federal Reserve Jerome Powell testified before Congress and reiterated his hawkish stance. He stated that, in order to battle consistently growing inflation, the central bank will ultimately have to boost its interest rate by a larger amount than anticipated.

“The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes,” said Powell.

Comments

Post has no comment yet.