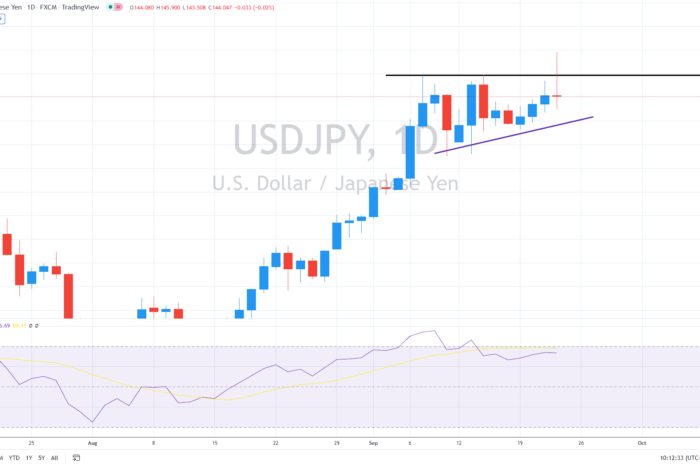

The USD/JPY pair continued in its steep uptrend, rising above 145 for the first time since September 1998. The divergence between monetary policies grew further following this week’s central banks’ decisions.

Fed remains hawkish

As was largely anticipated, the US central bank increased interest rates by 75 basis points on Wednesday, but it also hinted that the policy rate will increase to 4.4% by year’s end and reach a maximum of 4.6% by the end of 2023.

Related article: EUR/SEK jumps to 6-month highs after Riksbank raises rates

This means that interest rates would rise farther and persist for a longer period of time than the markets had first anticipated.

BoJ disappoints hawks

On the other hand, the Bank of Japan decided to keep its ultra-loose monetary policy in place, showing that it is still committed to supporting the nation’s economy despite growing inflation.

During the post-monetary policy decision news conference, Bank of Japan (BOJ) Chief Haruhiko Kuroda reaffirmed that they “would patiently maintain substantial monetary easing.”

By concentrating on a variety of demands rather than just immediate emergencies, the central bank continues to provide businesses with a flexible financial environment.

Additionally, he stated that the central bank will maintain its current forward guidance since the effects of the epidemic are still being felt and because the economy is still vulnerable to a downturn.

Read more: Putin declares partial mobilization and escalates the war

Furthermore, it doesn’t appear that the elimination of negative interest rates is necessary to follow how central banks in other countries have responded to increased inflation rates.

Given the yen’s 20% decline versus the dollar this year, Japanese officials have been discussing intervention. As evidence of this, Masato Kanda, vice minister of finance for foreign relations, stated on Thursday that although Japan has not yet intervened in the currency market, it “very surely” will do so when necessary.

“As long as the monetary policy divide between Japan and the rest of the world remains in place a weaker yen remains fundamentally justified, and the motivation for other central banks to make concerted interventions is likely to remain low.” Economists at Commerzbank believe that a weaker yen is justified.

However, it looks like the 145 level has failed to hold, with the pair quickly erasing all gains during the EU session, posting a bearish reversal pattern. Volatility is expected to remain elevated throughout the day.

Comments

Post has no comment yet.