The USD/JPY pair posted a 1.5% gain on Friday as investors sold the Japanese Yen following a relatively dovish BoJ monetary policy decision.

BoJ refrains from tightening

As was widely anticipated, the Bank of Japan (BoJ) kept its benchmark interest rate constant at -0.10% while also maintaining the most recent 0.50% range of the Yield Curve Control (YCC). The current strength in USD/JPY may be traced back to the BoJ’s reassurance that it will take more easing moves without hesitation, if necessary, in its pursuit of market stability. Furthermore, the central bank intends to keep increasing the money supply size until the inflation rate consistently surpasses 2% annually.

You may also read: The green is back – hurray for big tech

In its quarterly outlook, the Bank of Japan’s real GDP fiscal 2024 median forecast is at +1.2% vs. +1.1% in January, while the Board’s real GDP fiscal 2023 median forecast is now at +1.4% versus +1.7% in January.

Moreover, the bank still must keep a vigilant eye on the financial and currency markets and their potential effects on the Japanese economy and consumer pricing.

Inflation expectations are moving sideways after having heightened. However, after suffering from the effects of past increases in raw material costs and a downturn in outside markets, Japan’s economy is expected to rebound somewhat.

Dont miss: Market optimism is back: Matrixport expert predicts $45,000 per BTC

Lastly, sustainable price hikes and wage growth are on the horizon for Japan in the second half of the three-year prediction period. By the middle of the current fiscal year, consumer inflation in Japan is expected to have slowed to below 2%.

US economy slowed more than expected

In the US, the dollar (index) remained on track for a monthly loss of just under 1% after falling about 2.3% in March, as traders worried about the health of the US banking system and the probability of the Federal Reserve finishing its tightening policies as the nation’s economic expansion wavers.

Real GDP in the world’s largest economy grew at an annual pace of 1.1% from January through March, down from 2.6% in the last quarter of 2022, according to statistics released on Thursday, the latest indication of the US downturn.

The Fed’s favored gauge of inflation, the March core personal consumption expenditures index, will be released later in the day. Finally, the most significant economic indicator, Core PCE monthly, is forecast to show a 0.3% growth in March, matching the increase in February. Annually, the rate is predicted to decline from 4.6% to 4.5%.

Another great topic: GBP/JPY with a bullish bias, bounces off major support

It’s largely anticipated that the Federal Reserve will raise interest rates by another quarter of a percentage point next week and then hold off on any increases until at least June.

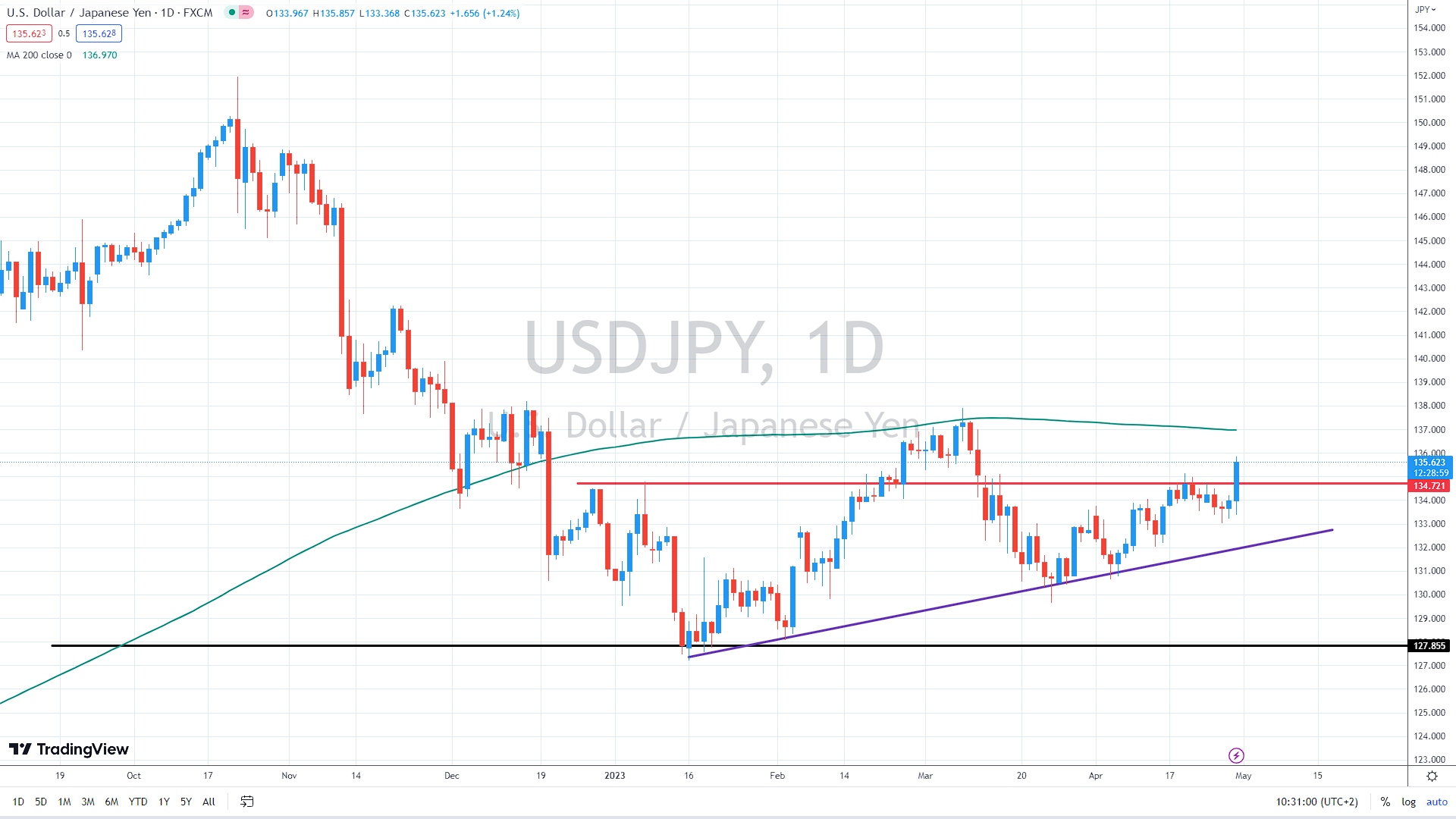

Having jumped above previous highs of 134.70, the trend changed back to bullish, with the next target at the 200-day moving average near 137. Should the greenback settle above the 200DMA, it might start another rally toward 140.

USD/JPY daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.