The greenback is trying to recover from the recent selling pressure. However, it stays below previous lows, implying the weakness of bulls. On Thursday, the USD/JPY pair traded 0.25% higher during the London session, seen at around 137.

Japanese data remain weak

The QoQ data for Japan’s Q3 Gross Domestic Product (GDP) improved to -0.2% from -0.3%, while the GDP Annualized came in at -0.8% compared to -1.1% predicted and -1.2% before.

You may also read: Does the crude oil bloodbath have an end?

Moreover, the country had an unexpected current account deficit in the third quarter, as exports declined and import prices rose. Nonetheless, Japan continues to suffer difficulties from a weaker yen and increasing inflation, which is anticipated to trend near 40-year highs in November.

US close to terminal rate

In the US, the Goods and Services Trade Balance worsened to $-78.2 billion against $-79.1 billion anticipated and $-73.28 billion before. In addition, the Unit Labor values Costs for Q3 were revised downward to 2.4% from 3.5% in the first estimate.

The money markets anticipate a 91% chance that the Federal Open Market Committee will raise interest rates by 50 basis points at the Fed’s next meeting on December 14. Only a 9% chance is predicted for another 75 basis point hike. In May, rates are projected to reach a maximum of around 5%.

“Uncertainty about the inflation outlook suggests the risk remains high that the FOMC will keep policy at a restrictive level for longer and, in turn, drag the economy into a deeper downturn,” Carol Kong, a strategist at Commonwealth Bank of Australia, wrote in a client note.

Geopolitical issues are still a concern

In other news, due to the pending passage of the most recent laws by the US Congress, Bloomberg reported that tensions between the US and China might rise again. Bloomberg reports that the United States is preparing to enact legislation that would change its stance toward Taiwan and restrict the government’s use of Chinese semiconductors. These steps are guaranteed to anger Beijing despite President Joe Biden’s efforts to reduce tensions recently.

Key technical levels in play

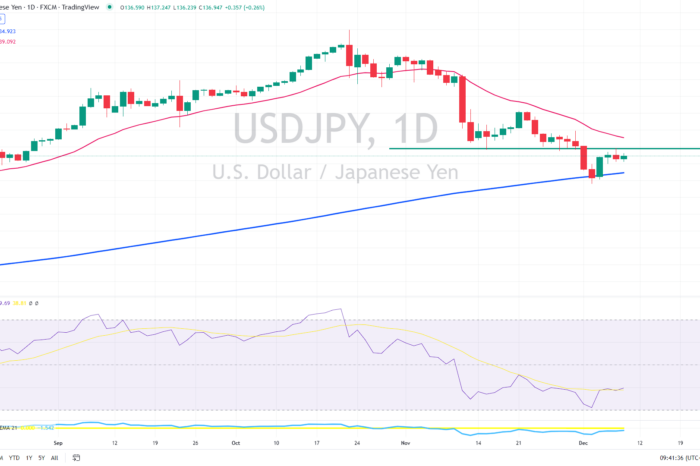

From the short-term perspective, USD/JPY is trying to break above previous support, now resistance, near 138.80. If successful, it could lead to a relief rally, targeting the 21-day moving average (the red line) at 139.20 or the psychological level of 140.

Read more: Do you believe Bitcoin is dead? Think twice!

However, the greenback has recently dropped to the 200-day moving average (the blue line) for its first test of that critical support since February 2021. So far, bulls have defended it, but if the price drops below the average, the long-term uptrend might be over, implying further losses toward 130.

Comments

Post has no comment yet.