The US dollar continued to decline broadly on Friday as the overall mood in the markets remained anti-dollar amid a possible pivot by the Federal Reserve.

PPI comes above expectations

The year-over-year trend in Producer Prices was anticipated to continue to decelerate in November to +7.2% (from +8.0% in October) with a 0.2% increase month-over-month. However, the headline inflation index came higher than predicted (+0.3% MoM) – the hottest since June. This brought the year-over-year PPI to +7.4%, the lowest level since May 2021.

You may also read: Retail investors expect the bottom in 2023 – warning sign?

Core PPI (Ex Food and Energy) increased 0.4% month-over-month (twice the 0.2% forecast). At the same time as energy costs reached their lowest level since February 2022, food prices reached all-time highs.

Consumer sentiment improves more than projected

The preliminary December University of Michigan Sentiment index rose from 56.8 to 59.1 (better than the 57.0 predicted), with both present conditions (60.2 vs. 58.8 expected) and future expectations (58.4 vs. 54.5 expected) increasing consecutively.

Additionally, after a stronger-than-anticipated PPI reading, all eyes were on Fed Chair Powell’s preferred inflation sentiment indicator – the 12-month short-term inflation forecasts dropped to 4.6%, the lowest level since September 2021. The outlook for medium-term inflation remained unchanged at 3%.

Furthermore, the monetary policy meeting of the Swiss National Bank (SNB) and the Federal Open Market Committee (FOMC) will be key to watch during the next week.

“The SNB is expected to deliver a 50 bps hike bringing the rate to 1.00% at its 15 December meeting. But inflation has never gotten as excessive in Switzerland as elsewhere, and we think that the SNB will leave rates flat at 1.00% after the December meeting.

Any signal that the hiking cycle is close to its end will come as a disappointment to the rates market.” economists at HSBC reported. They expected the Swiss Franc to depreciate against the greenback in the near future.

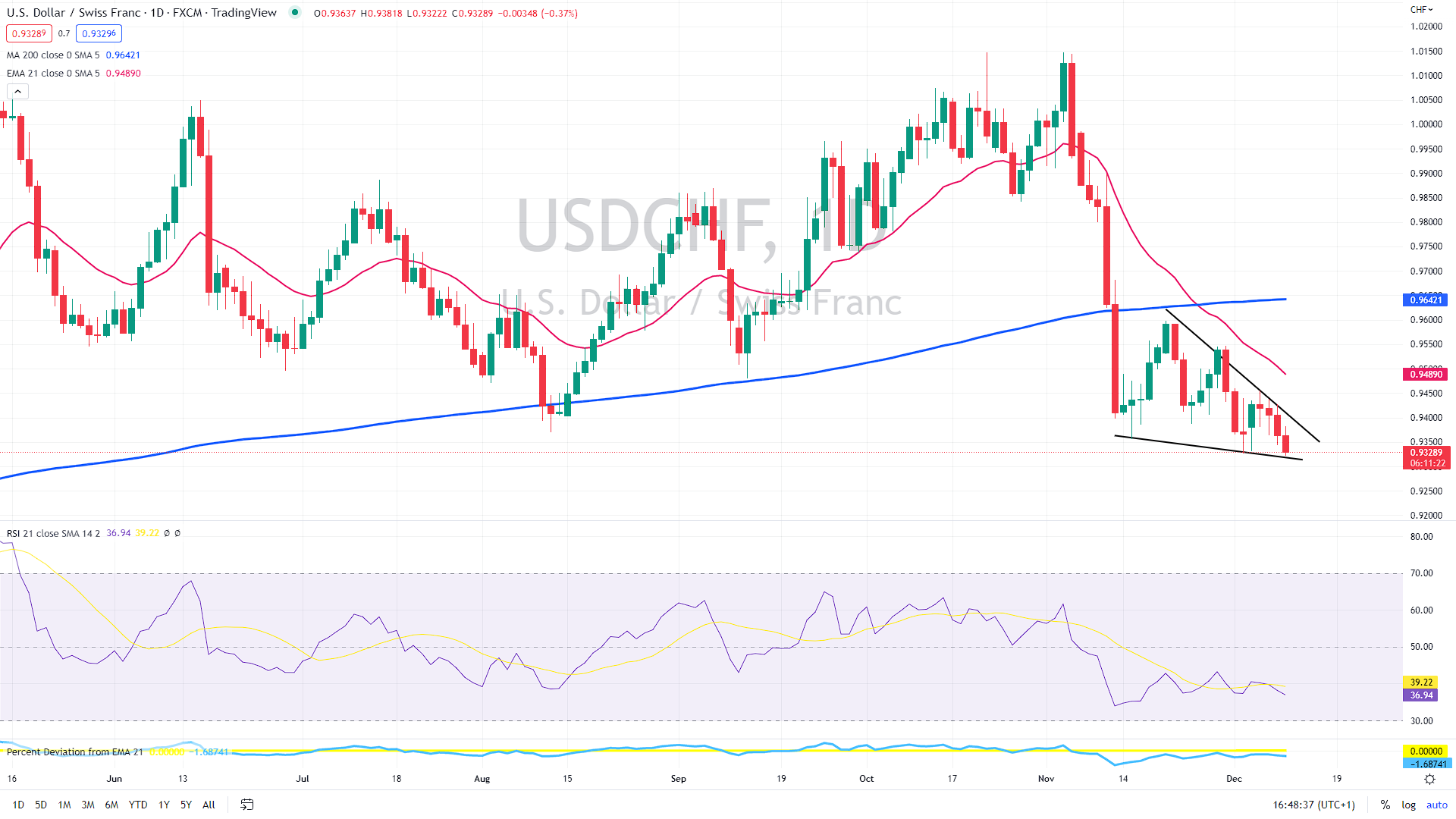

Falling wedge formation

The USDCHF pair has been trending downward recently, but it has failed to produce any significant decline to new lows. The support for the pair is now at the lower trendline, currently near 0.9320, and if broken down, the triangle formation might be invalidated.

Another interesting topic: Wheat continues to fall despite a low supply

On the upside, bulls must push the US dollar above the bearish trendline at around 0.94 in order for the pattern to become valid.

USDCHF daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.