The Canadian dollar, also known as the Loonie, declined half a percent on Tuesday, undermined by the combination of Canadian and US macroeconomic numbers.

Canadian inflation suggests BoC pivot

Statistics Canada revealed earlier in the day that the headline CPI climbed by 0.5% in January, somewhat less than the 0.6% that was estimated. In addition, the annual rate slowed more than projected, falling from 6.3% to 5.9%.

You may also like: These 5 celebrities lost millions to scams

Furthermore, the Bank of Canada’s (BoC) Core CPI, which excludes volatile food and energy costs, came in at 5% YoY, down from 5.4% previously. The sluggish inflation report reinforces rumors that the Bank of Canada may halt the tightening cycle.

On the other hand, in December, retail sales increased by 0.5% on a monthly basis. This figure was greater than the 0.2% gain forecast by the market.

Statistics Canada also said that core retail sales, which exclude gas stations and auto and parts retailers, grew by 0.4%. Lastly, in December, retail sales grew 1.3% in terms of volume.

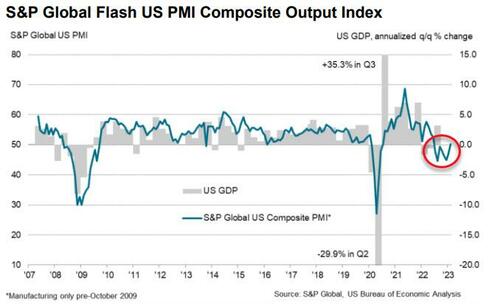

US soft data improved notably

Meanwhile, in the US, S&P Global’s US Services and Manufacturing surveys for February (preliminary) surpassed expectations this morning, with the rise in the headline composite figure being driven by a rebound in the Services sector (50.5 against 47.3 expected and 46.8 prior), while Manufacturing improved but remained in contraction (47.8 versus 47.2 forecasts and 46.9 previously). February saw the fourth consecutive monthly fall in production for manufacturers.

Source: https://www.pmi.spglobal.com/Public/Home/PressRelease/1a48b2fdf6114741aade2fd71f25f4a6

Data from February indicated a faster rise in private-sector production prices. Since October of last year, the rate of growth in selling prices has been the quickest and steepest overall. According to reports, companies passed on cost increases to their clientele. Both industrial and service sector enterprises saw a more rapid growth in output prices.

Another interesting topic: Palantir Technologies: Profitability on the way in 2023

“February is seeing a welcome steadying of business activity after seven months of decline. Despite headwinds from higher interest rates and the cost of living squeeze, the business mood has brightened amid signs that inflation has peaked and recession risks have faded,” Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, commented after the data.

So far, the recent rally has failed at last week’s highs near 1.3530, implying a possible double-top pattern, which is a bearish formation. That is the main resistance for now, while the support is seen near today’s lows of 1.3445.

USD/CAD hourly chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.