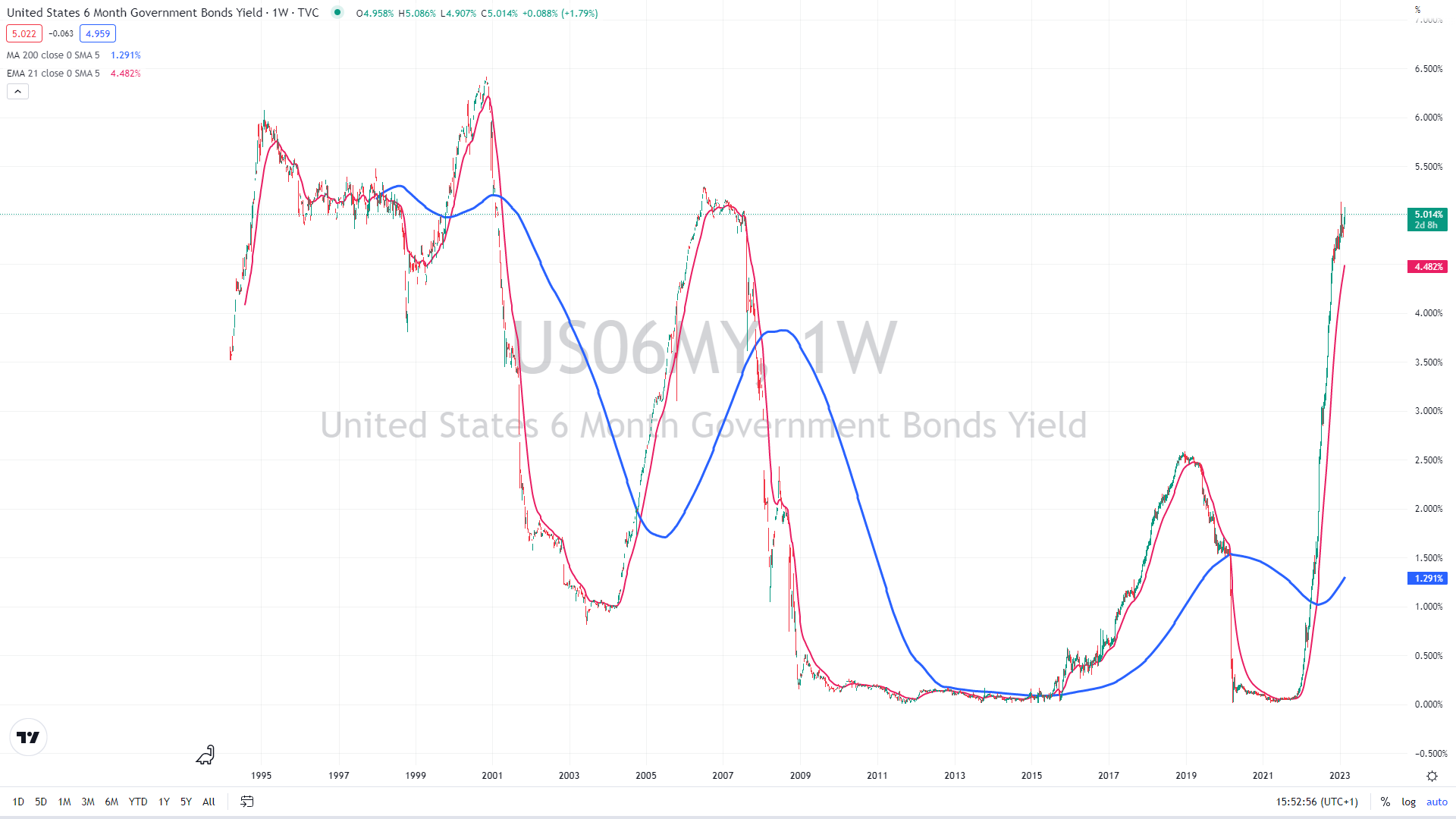

The short-term yield curve continues to jump as investors expect the Fed to hold rates “higher for longer,” pushing up yields of short-term bonds.

If the current yield persists for a more extended period of time, it is hard to envision a soft landing for the US economy.

US retail sales printed strong

January retail sales in the United States increased by 3% to $697 billion, according to data released by the US Census Bureau on Wednesday. This figure followed December’s decline of 1.1% and above the market’s projection of 1.8% growth.

Comparatively, Retail Sales excluding Automobiles increased by 2.3% over the same month, above analysts’ expectations of +0.8% growth. The control group, which feeds directly into GDP, had a 1.7% increase (far better than the expected +1.0%).

Another exciting article: US inflation slows down – but the expectation was not met

Last month (for the first time since Covid), all thirteen retail categories increased, led by automobiles, furnishings, and restaurants. The study indicated that car sales increased by 5.9% in January.

Secondary macro data remain weak

Furthermore, the leading General Business Conditions Index of the Empire State Manufacturing survey of the Federal Reserve Bank of New York improved to -5.8 in February from -32.9 in January. This figure exceeded the -18 forecasted by the market.

“Delivery times shortened, and inventories edged higher,” the NY Fed noted in its publication. “Employment levels declined for the first time since early in the pandemic, and the average workweek shortened for a third consecutive month”

In terms of inflation-related events, both input and output prices increased. Companies anticipate a little improvement in business conditions during the next six months.

You may also read: TOP 10 dividend stocks

Lastly, industrial Production in the United States remained steady in January, following a 1% decline in December, the Federal Reserve announced on Wednesday. This number was smaller than the 0.5% gain anticipated by the market.

“In January, manufacturing production increased 1.0% and mining output increased 2.0% after two months of large declines for each sector,” the Fed added in its release. “Capacity utilization fell 0.1 percentage point in January to 78.3%, 1.3 percentage points below its long-term average (1972–2022).”

US 6-month yield weekly chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.