Central banks all over the world hike interest rates to stop the raging inflation by tightening the economy. However, this caused a lot of damage as most currencies besides the US Dollar weakened along with the stock market.

UN urges central banks to change their policy

In order to prevent a global recession and protracted stagnation, the United Nations Conference on Trade and Development (UNCTAD) is urging central banks in key economies to stop raising interest rates. In its 2022 Global Economic Outlook report, UNCTAD predicts that global economic growth will slow to 2.5% in 2022 and fall to 2.2% in 2023.

“Supply-side shocks, waning consumer and investor confidence and the war in Ukraine have provoked a global slowdown and triggered inflationary pressures,” the report states.

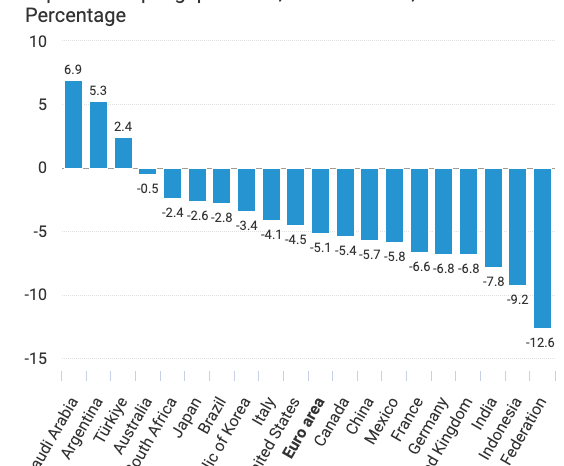

The rise in interest rates in advanced economies disproportionately negatively impacts the most vulnerable ones. Ninety developing countries’ currencies have depreciated versus the dollar this year, and more than one-third of those have witnessed declines of more than 10%.

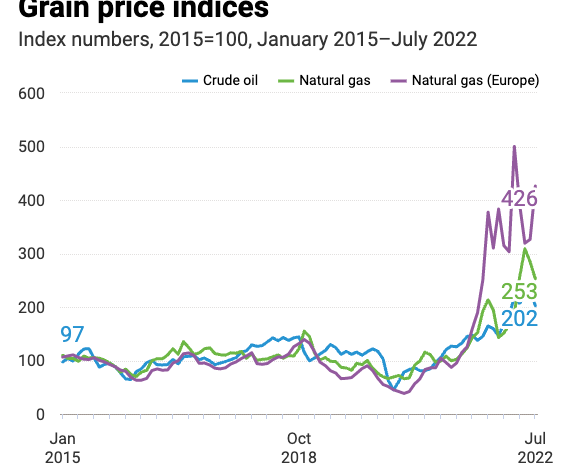

The very basic commodities like food and energy are now extremely expensive as a result of the situation in Ukraine. Furthermore, a strong dollar makes the issue worse by increasing the price of imports in developing countries, and it is the only currency to appreciate so far in 2022.

According to UNCTAD, countries should enhance public spending, tighten regulations on the commodity market, and apply smart price controls to avoid extreme price spikes that negatively affect consumers in the developing and developed world. However, Powell stays committed to raising interest rates for now as taming inflation is his number one priority.

“We’re very conscious of what’s occurring in different economies all over the world, and what it means for us, and vice versa,” Powell stated. “The forecast that we put collectively, that our employees places collectively and that we put collectively on our personal, all the time take all of that—attempt to take all of that under consideration.”

In one month, on November 2nd, FOMC will have another meeting where a new rate hike is likely, and there is very little the UN can do about it. It is predicted that the average growth rate for developing economies would fall below 3%, and that is too slow for sustainable development. It may further strain public and private finances and will harm employment prospects.

For the last two years, commodity prices (mainly food and energy) have increased, causing serious problems for people all around the world. Given that fertilizer is the most expensive input for many small farmers worldwide, increased pressure upward on fertilizer prices indicates that the harm could be long-lasting.

Bottom line

The UN points to important facts that if they become true, there could be a massive worldwide slowdown with long-term consequences. However, central banks need to stop inflation from advancing first. The next few years will surely be interesting because if that inflation doesn’t come down, the situation will get even worse.

Comments

Post has no comment yet.