Bumpy season continues

Volatility in crude oil futures continues at high intensity. This week started in green numbers, but the commodity erased -4.23% last week. The bumpy season continues in advance with hopes of higher demand in China.

The end of covid zero policy aims to boost China’s economy, and demand for crude oil. On the other hand, Fed monetary policy tries to tame inflation with higher interest rates, which support the US dollar. Stronger dollar as denominated currency for crude oil has a negative impact on the price of a black commodity.

See also: Oil is heading for a red weekend due to Fed fears

Commodity traders hedge less

Commodity traders fear the high volatility in markets. The Financial Stability Board – a group representing the world’s top bank regulators stated that commodity traders are hedging less than last year based on the unprecedented market situation. A higher volume of margin calls among physical commodity traders has the subsequent impact of the fear of further development. Traders hedge less and stash the cash.

Traders tend to operate more with derivatives on leverage than to be more exposed in physical trading. In other words, their effort is to reduce the collateral to backstop their trades. The report stated that:

“The purported cutting back of hedging activity, and a possible reduction in the quality of hedges, have likely increased market risks in the commodities sector. This could reduce the resilience of commodity traders’ and producers’ balance sheets as they could become more exposed to losses from fluctuations in commodities prices.”

Right in the middle of the chart

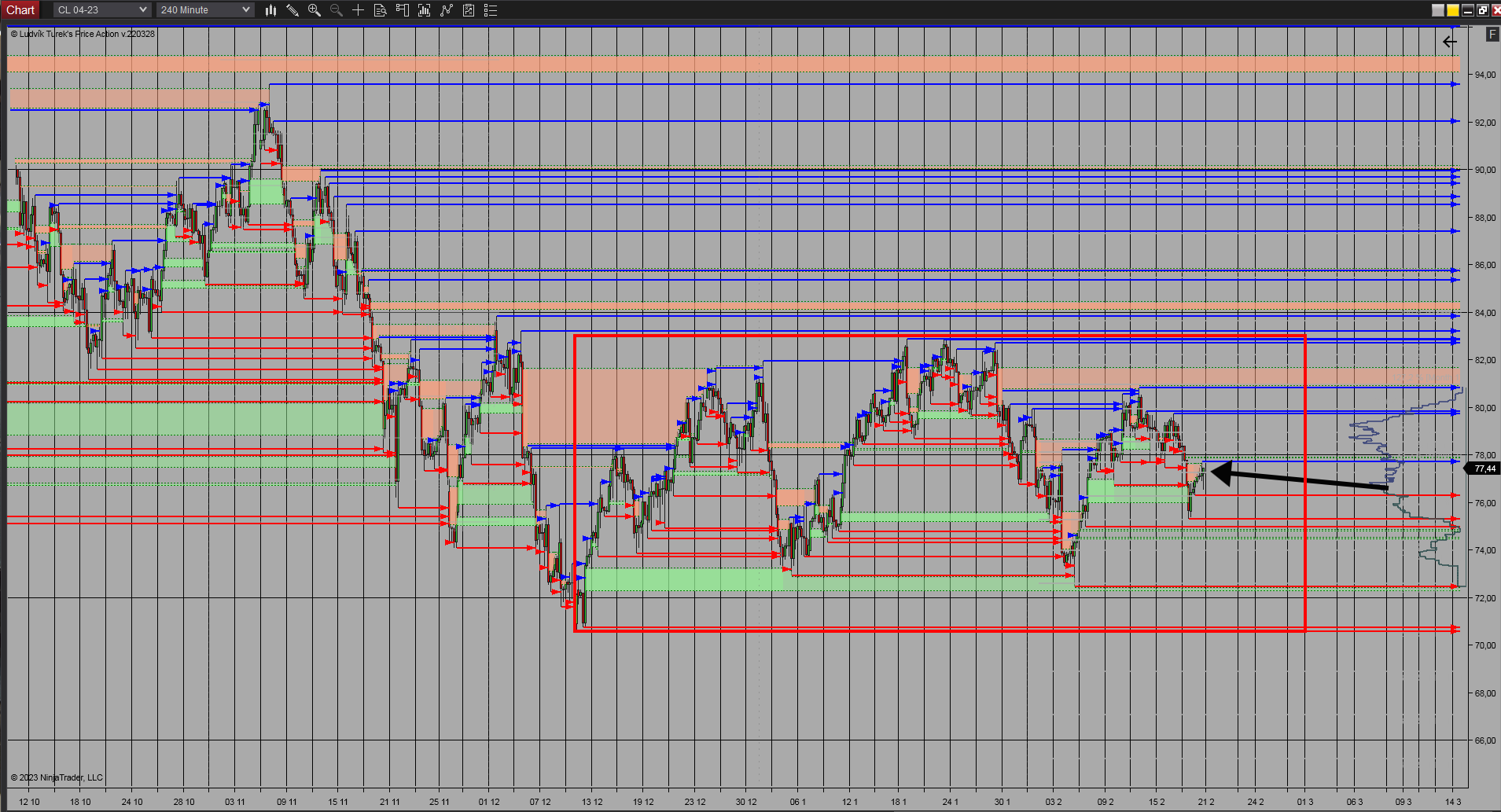

Based on the data from the chart, the technical low of the last 365 days is at the level of $70.60 from December 9th 2022. The distance from this low to the current price of $77.44 is approximately the distance from the current price to the closest stronger possible support around $83.00. It represents a 7% to 10% move volatility from today’s price.

240 minutes chart of CL (Crude Oil Futures). Volatility and price action, source: author’s analysis

Moreover, from the longer-time period the crude oil is under the 200 EMA – exponential moving average. The price of the commodity had numerous attempts to break above the line, but the trend of commodity is clear.

240 minutes chart of CL. 200 Exponential Moving Average, source: author’s analysis

Volatility is not going away

Of all inputs that have an impact on the price movement of crude oil, the demand for oil in China and the inflation fight in the US are the two strongest. The fear is literally visible in the commodity traders which change their trading strategy and try to stash the cash.

The fluctuation in crude oil prices is awaited in the next period of time and the traders’ activities are clear examples of it. Big boys fear the next development and get ready by reducing the money in the market. Be ready and watch your money management.

Comments

Post has no comment yet.