An IPO or “initial public offering” is the initial launch of a stock on the stock market. In this step, the joint-stock company will introduce the shares to the general public and, for a set price range, will raise capital for its further development, financing, and growth. Previously, it could still be a joint-stock company, but it was, e.g., “Private,” and thus, its shares were owned by only a few shareholders. Under U.S. law, a company must register this “process” following SEC rules.

Why do companies go in the form of an IPO?

⦁ If companies are private, then only a small number of investors (founders, venture capital, private investors) participate in the business. Still, by going public, they gain new additional money needed for further development, growth, debt repayment, and so on.

⦁ Companies that go “public” will get significantly more attention as the media writes about them and their products so that they can boost their revenues.

⦁ If companies are “private,” banks will provide them less capital, which is more expensive. By going public, the company has the opportunity to get cheaper funds from the bank and a more accessible bargaining position.

⦁ An IPO can be much cheaper and more efficient than resources from banks if the company is private.

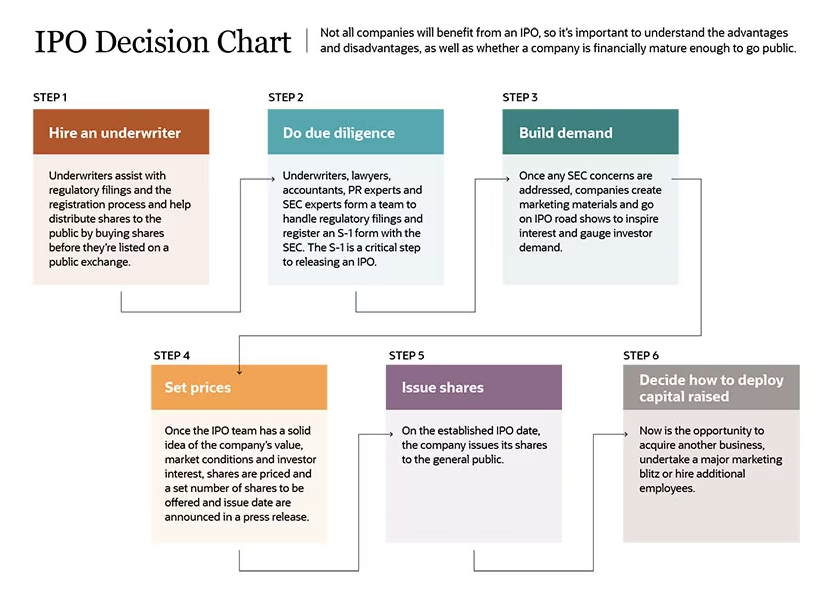

Below is an illustration for a better idea of the process (from the CFI). Initial Public Offering takes place from several consecutive steps:

Source: Initial Public Offering (IPO) Defined | NetSuite

If you are interested in this topic in more detail, I recommend you take a look at the following links (from which we also drew), which describe in detail how the IPO takes place:

Not everyone can initially invest in IPOs. These are primarily institutional investors, its clients in the “capital search” phase. However, you can also invest in some IPOs. Investing in an IPO still in the capital raising phase ties these investors’ hands in the form of a sale. There is a so-called “Lock-up period” (several months) during which investors involved in an IPO cannot sell their stake, even if the shares made hundreds of percent.

Of course, there are ways in which these investors can hedge their position, but this period must be officially adhered to. For example, if one of the brokers allows it, they will short the stock (via CFD or other derivates) or hedge the profit through options. If the IPO is successful and the stock grows over months, then at the end of the “lock-up period,” they can sell the shares. At this point, we sometimes see increased sales activity and falling prices. So if you are buying the IPO, watch out for the lock-up period date.

Comments

Post has no comment yet.