The best combination is when the investor see a positive and growing CF from operations and negative CF from financing. It means that the company repays its long-term or short-term liabilities/debt, doing a stock repurchase (buybacks) programme and treasury stock, or pays dividends. These signs are usually positive signals.

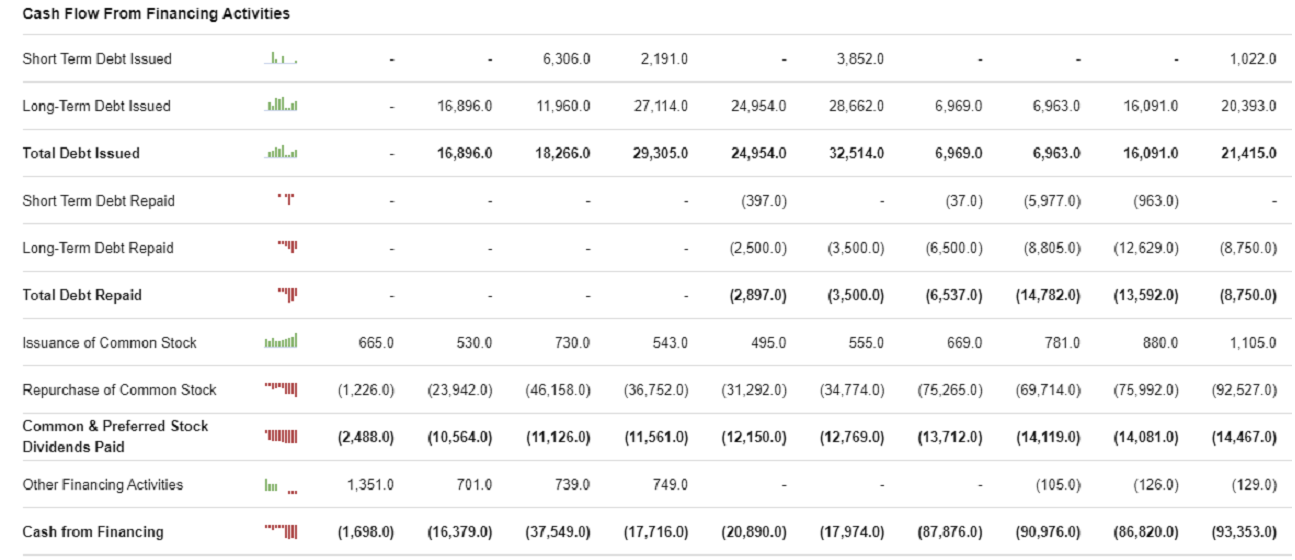

Source: SeekingAlpha

We can also analyze whether the company manages to pay dividends or expect a dividend cut in the future (which has a negative impact on the share price). It’s not always the detriment. If the company really can’t afford it, then a partial or complete reduction of the dividend will leave the company with more free CF, which can allocate elsewhere. In addition, it can “heal” its balance sheet. In the long run, this step could have a positive effect on the company’s operations and also on the share price. However, a short-term decline can be expected. But not always. For example, when a company has a negative CF from operations in the medium term and a negative CF from Financing Activities in the area of dividends.

If the company had a negative CF from FA and repaid its debt, we consider it as a good sign. If it had a negative outflow, “only on dividends” to satisfy shareholders, it is certainly not positive. The company has to raise funds to pay dividends regularly – this can be through sales, debt, the issue of shares or the sale of its investments, etc. From this point of view, we want to conclude and say that yes, in general, it is essential for a company to have a negative CF from this activity. Still, it is far from the rule and always individual, and this situation needs to be thoroughly analyzed. The situation merely depends on the company´s business stage and cycle.

In the table above, we can see CF from the Financing Activities of Apple. It is becoming more and more negative, which is overall the positive sign. If we look at the reasons why it is negative, we will see that it is mainly due to the “Repurchase of Common Stock,” i.e., buyback. No wonder its shares have been rising for a long time, as the number of outstanding shares is constantly falling. Although they still repay the debt, they continue to issue new debt, especially long-term debt. This could be a problem for some companies, but this is not a problem for Apple, which has a solid (very positive) CF from Operations. Shareholders will evaluate such a policy very positively.

Comments

Post has no comment yet.