In connection with an IPO, investment activity or interest can be monitored. In other words, boom, appetite, and the desire to invest. This may involve some risk because companies want their IPO to be at a time when everything is great. There were enough investors in the market, liquidity, and enthusiasm to get as much money as possible.

On the other hand, it may be a potential indicator of overheating the economy or a significant increase in speculators. Firstly, the firm in IPO must be valued. In bubbles or booms, these valuations are highest, and the company gets enormous support from market and market participants (and receive the biggest money for its shares)

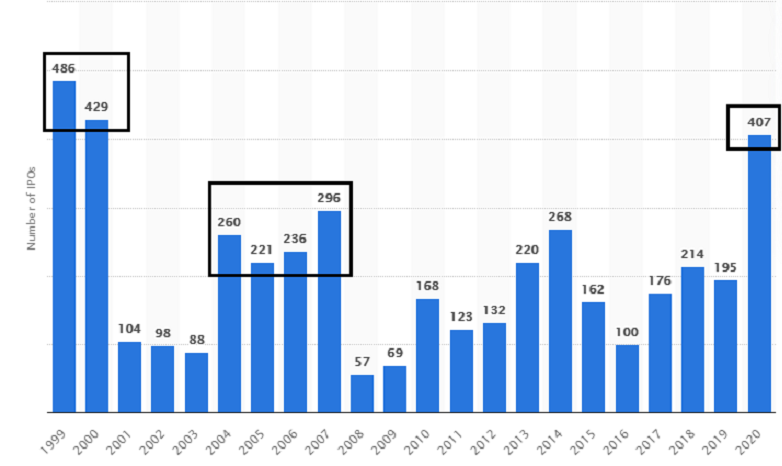

Below is a graph showing the amount of IPOs for each year. Note that in the years just before the crisis, the BOOM phase will also affect the number of IPOs. However, just because everything seems acceptable in the market doesn’t have to mean it is. Notice the number of IPOs, during the strong BOOM, just before DOT COM BUBBLE, when a similar hunt for technology companies was recorded as now (2021). And then look at the years 2001-03.

Similarly, look at the years from 2004, when the IPO rose sharply, until 2008, when the banking financial crisis erupted. Yes, we can see significantly fewer IPOs here than DOT COM, but that’s because there weren’t as many tech companies then as at the turn of the millennium. Despite COVID-19 and the crisis associated with the consequences of this virus, we can see a significant increase in IPOs in 2020. Do you ask why?

Source: Statista

In our opinion, these are the reasons:

- The first reason is the enormous increase in investors and speculators in 2020. People sat at home, received support, educated themselves, and “played” on the stock market.

- Fiscal and monetary incentives have provided excellent conditions for firms, their refinancing, and the support of households and individuals through additional liquidity in the form of “checks” and other incentives. So called “liquidity-flood” in the markets.

- Significant rise in digitization and transformation into online sectors, demand for climate change (in the context of green companies), ESG. The economy is beginning to transform into a greener one, causing demand for these companies, which are subsequently created.

- Significant increase in SPAC trend and massive valuation multiples.

Comments

Post has no comment yet.