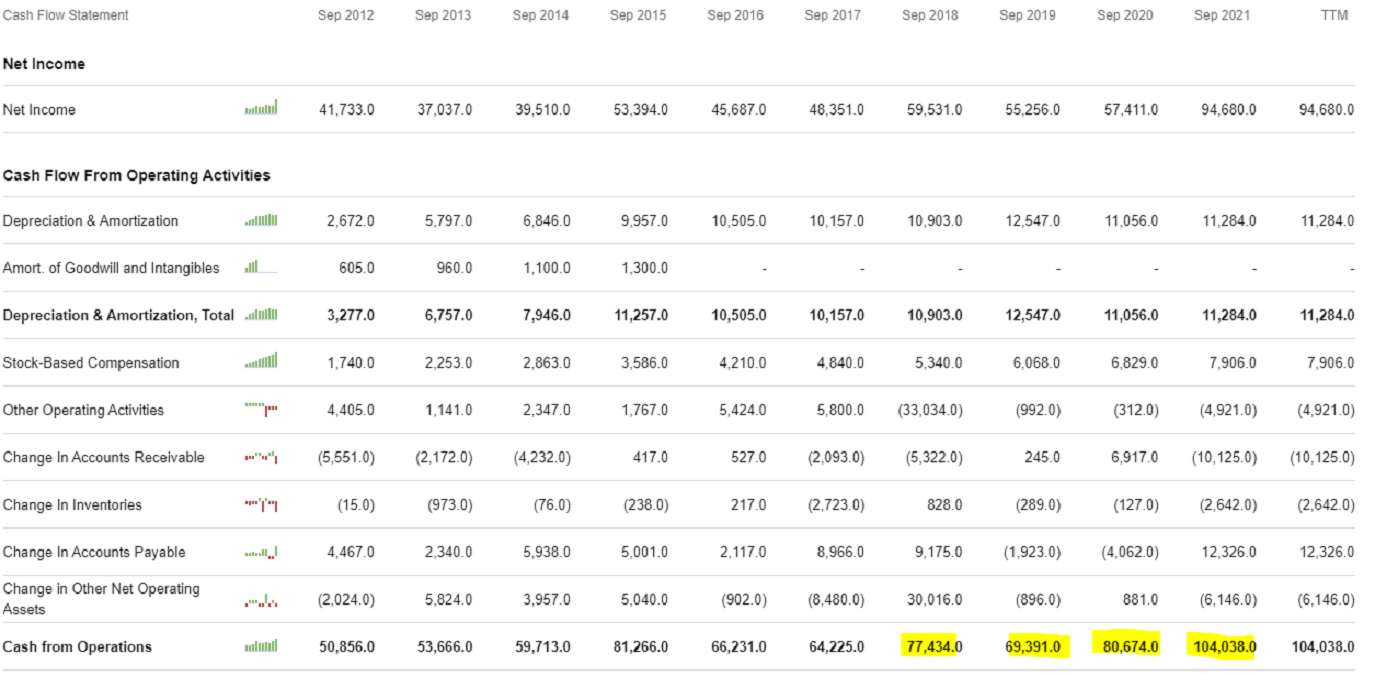

This type of CF consists of revenue generated from orders minus the operating expenses that have been incurred on them. When the final number is positive, we can say that the company has earned more from its core business than it spent on expenses. Otherwise, we are talking about a negative CF from this activity. Here, watch out the companies (except start-ups), that CFs from Operating Activities are negative in the long run. Of course, once in a while, CF from this activity can be negative, whether in crisis or due to another reason. This condition must be rare and not the rule in the medium or long term. Below you can see the CF from OA of Apple.

Source: SeekingAlpha

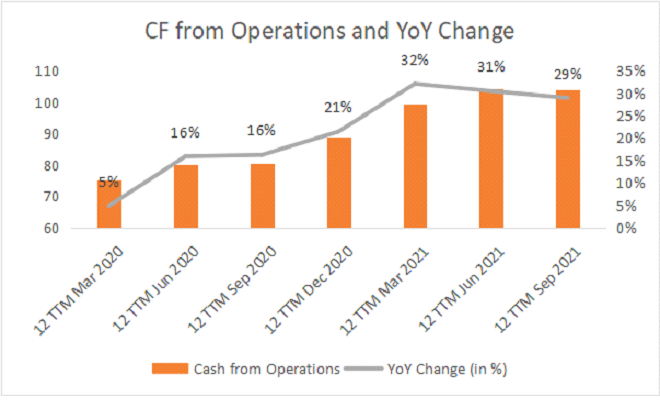

From this point of view, we can say that the company is doing great and there is nothing to complain about. Cash From Operations has been growing consistently since 2018, which is a very positive signal. Apple generates a lot of money, and we can record solid growth in the year-on-year comparison. It’s a cash cow. This is what shareholders appreciate. Below we can see year-on-year changes by quarter (12 TTM).

Source: Seeking Alpha, own calculation

If this type of CF would be negative in the long run, we do not recommend investing in the company’s shares. The exception can be a startup with a bright future. However, we can accept this for small companies whose revenue growth is enormous as well. In this case, a negative CF may not be a problem. However, we would have to look at the other sections of the CF to find out what the company has the capital from.

Comments

Post has no comment yet.