Decentralized Finance, or DeFi, has been a rapidly growing sector in the crypto industry. It refers to financial systems built on blockchain technology that operates without intermediaries (e.g. banks). DeFi projects allow users to access financial services like lending, borrowing, and trading, without relying on traditional financial institutions.

In this article, we will explore the 5 best DeFi crypto projects that investors should not ignore. These projects are making significant strides in the DeFi space and have the potential to revolutionize the financial industry, forever.

1. Uniswap

Uniswap is a decentralized exchange (DEX) that allows users to trade cryptocurrencies without intermediaries. It operates on several blockchains, including Ethereum, Arbitrum, or Polygon, and uses an automated market maker (AMM) system to determine prices. Uniswap has become one of the most popular DeFi projects due to its user-friendly interface and lower fees than the competition.

Related article: Bitcoin: An extraordinary asset class defying traditional labels

What makes Uniswap one of the best DeFi projects is its unique market-making system. Unlike traditional centralized exchanges, Uniswap integrates an AMM system that uses algorithms to determine the price of assets based on the supply and demand of the assets in the liquidity pool. This system allows users to trade without relying on centralized order books or market makers, resulting in a more decentralized trading experience.

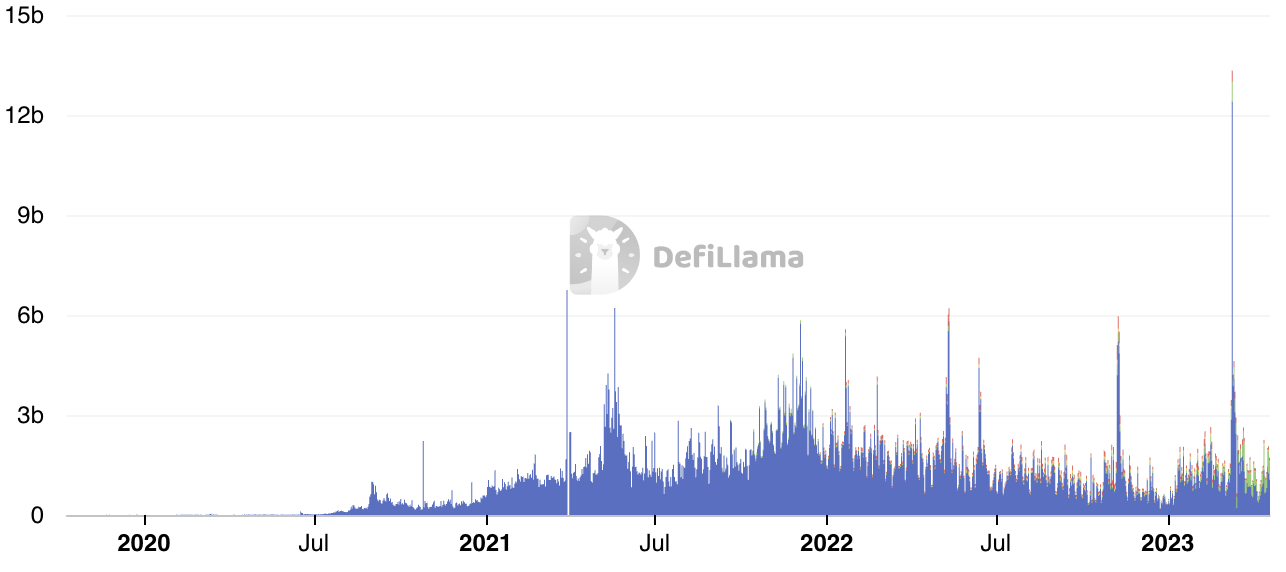

Trading volume on Uniswap, source: defillama.com

Uniswap is easily the most used DEX, with a daily trading volume of more than $1 billion. Uniswap has its own native token UNI, which is the 20th biggest cryptocurrency according to its market cap – currently around $3.4 billion. It’s listed on the most popular crypto exchanges in the world like Binance, Huobi, KuCoin, etc.

2. Compound

Compound is a DeFi lending and borrowing platform that allows users to earn interest on their cryptocurrency holdings or borrow cryptocurrency by providing collateral. The platform operates on numerous blockchains such as Ethereum, BNB Smart Chain, Avalanche, etc. It uses a governance token (COMP) to incentivize participation in the ecosystem.

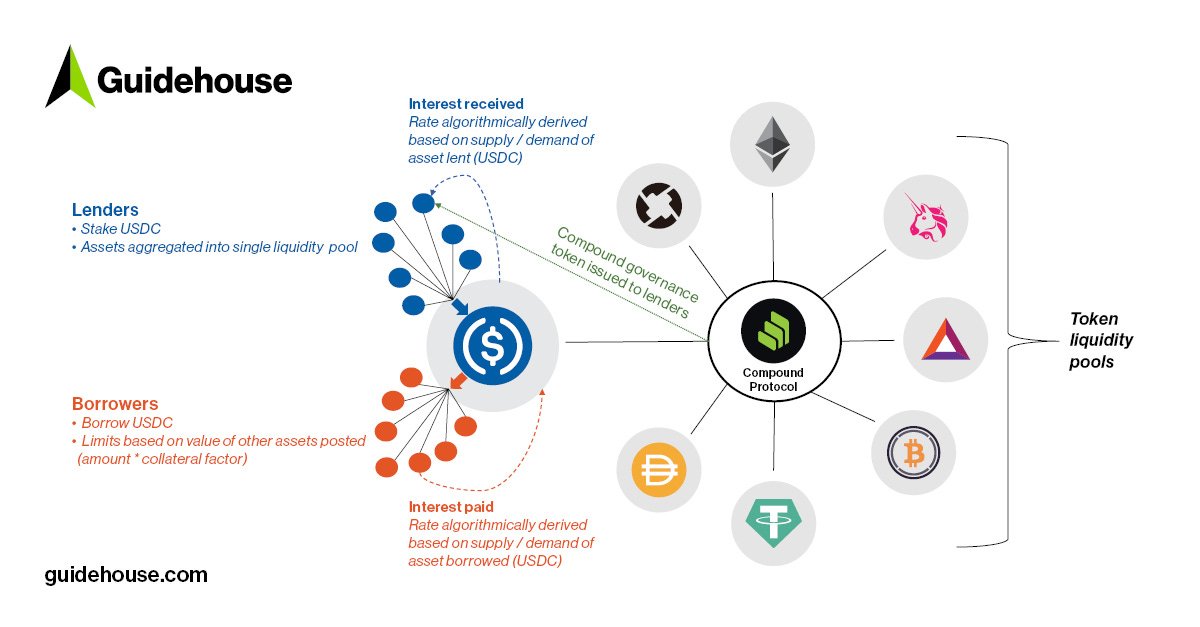

Compound has gained popularity due to its high interest rates and user-friendly interface. The ability to provide high-interest rates to its users is what makes Compound one of the best DeFi projects. The platform uses an algorithmic interest rate model that determines interest rates based on the supply and demand of the assets in the platform.

How Compound DeFi lending works, source: lex.substack.com

This model allows users to earn higher interest rates than traditional savings accounts, making Compound an attractive option for investors. The token’s market cap is currently around $300 million, with listings on the most prominent crypto exchanges, such as Binance, Coinbase, KuCoin, and more.

3. Aave

Aave is a DeFi lending and borrowing platform that operates on Ethereum, Solana, Near, and other several blockchains. It allows users to earn interest on their cryptocurrency holdings or borrow cryptocurrency by providing collateral. Aave uses a unique system called “flash loans” that allows users to borrow cryptocurrencies.

Aave has gained popularity due to its innovative features and high interest rates. What makes Aave one of the best DeFi projects is its ability to provide users with innovative features like aforementioned flash loans, or yield farming. Flash loans allow users to borrow cryptocurrency without providing collateral, which is a game-changer for the DeFi space.

There are over 80k #Bitcoin millionaires: 187% increase for Q1 2023 🔥🚀

➡ $BTC is approaching a new milestone as the recent rally above $30,000 has created over 50k #BTC millionaires.#crypto #cryptocurrency #investing #investment #investro https://t.co/T839dglckO

— Investro.com (@investrocom) April 15, 2023

This feature allows users to access capital quickly and without the need for significant capital reserves, making Aave an attractive option for traders and investors. On the other hand, yield farming is an investment option that involves locking crypto in a decentralized application to receive token rewards. Aave is currently valued at approximately $1.04 billion and is listed on major exchanges like Binance, Coinbase, Kraken, etc.

4. MakerDAO

MakerDAO is a decentralized lending platform that operates on the Ethereum, BNB Smart Chain, and Avalanche blockchains. It allows users to borrow the stablecoin DAI by providing collateral in the form of other cryptocurrencies. MakerDAO uses a governance token, MKR, to incentivize participation in the ecosystem.

Also read: Depegging of stablecoins – what does it mean and why is it happening?

MakerDAO has gained popularity due to its stability and ability to provide a decentralized stablecoin. It is one of the earliest representatives of the DeFi space and is behind creating its own stablecoin called DAI. DAI is pegged to the US dollar and can be used as a stable store of value in the DeFi space, similar to USDT or USDC. This stability is achieved through the use of collateralized debt positions (CDPs), which allow users to lock up their cryptocurrency holdings as collateral for DAI loans. Both MKR and DAI are available on the largest crypto exchanges in the world.

5. Balancer

Balancer is a decentralized exchange that allows users to trade cryptocurrencies without intermediaries. It operates on several blockchains like Ethereum, Arbitrum, Optimism, Near, and more. It also uses an automated market maker (AMM) system to determine prices as other DEXes.

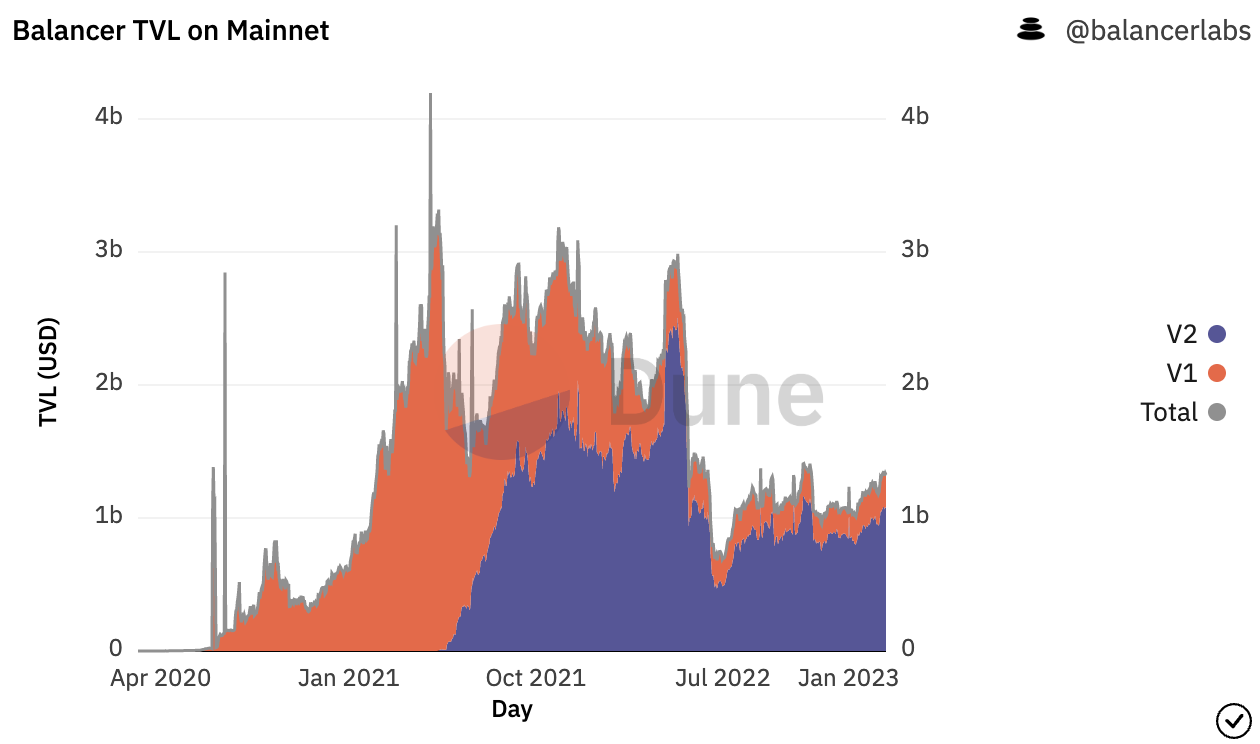

Balancer has its own native token BAL that allows users to create their liquidity pools, giving them more control over the trading process. It has gained popularity due to its flexibility and customization options. Balancer is interesting because of its ability to provide users with more control over the trading process.

Balancer’s total value locked on Mainnet, source: dune.com

Balancer allows users to create their own customized liquidity pools, allowing them to set their own fees and choose the assets in the pool. This flexibility is unique in the DeFi space, which is why Balancer got the spot in this article. BAL’s market cap is currently $312 million and is listed on Binance, Coinbase, Kraken, etc.

Conclusion

DeFi crypto projects are rapidly gaining popularity and for a good reason. They offer users access to financial services without intermediaries and provide new ways to earn interest and invest in the market.

Read more: Best crypto apps

The DeFi projects discussed in this article, including Uniswap, Compound, Aave, MakerDAO, and Balancer, are some of the best in the space and have the potential to revolutionize the financial industry.

Investors should conduct their research and due diligence before investing in any DeFi project. While these projects offer exciting new opportunities, they also come with risks, including the possibility of smart contract failures and market volatility. Nevertheless, the DeFi sector is one to watch, and investors who stay informed and up to date on the latest developments can potentially reap significant rewards.

Comments

Post has no comment yet.