With the increasing popularity of crypto in recent years, many people turned to digital assets as a form of investment. With the growth of the crypto market, the demand for crypto savings accounts has also risen.

These accounts allow users to earn interest on their crypto holdings while keeping their funds secure. In this article, we will explore some of the best crypto savings account options available in the market. But let’s clarify what it is first.

What is a crypto savings account?

A crypto savings account is exactly what the name might suggest. It is an account where people can put their cryptocurrencies while earning interest over time. The amount of interest people earn varies over time, depending on the type of savings account and cryptocurrencies they choose to use.

For example, Bitcoin, Ethereum, or Litecoin, are usually kept in most crypto savings accounts. On some platforms, people can also choose the cryptocurrency they want to invest in. The way a crypto savings account works is the same as a regular savings account.

Related article: Top 5 DeFi crypto projects you shouldn’t ignore

When people put money into a standard bank account, they give the bank permission to loan that money to other people. Once the money is paid back with interest, the bank pays them a certain percentage of interest each year.

Digital currencies are people’s investments in a crypto savings account. Their chosen platform will lend out the cryptocurrency and give them a percentage of interest in return. Depending on the platform, the interest can be paid out monthly or yearly. Even though a cryptocurrency savings account works the same way as a regular savings account, there are many differences.

Crypto savings account vs traditional savings account

Most banks get insurance from the Federal Deposit Insurance Corporation (FDIC) for up to $250,000 per person. This makes sure that the people’s money is safe even if the bank collapses. On the other hand, the money people save in crypto is not safe. The market is usually unstable, so the value of crypto investments could go down at any time.

Because of this, crypto savings are more like an investment platform than a standard way to save. With a standard bank, people can take out their money whenever they want, without any fees or limits. But with a crypto savings account, people won’t be able to get to their money for a certain amount of time after they put it in.

Some platforms may also charge a withdrawal fee. However, investing in crypto savings accounts shines where standard banks have rates of a maximum 1% annual percentage yield (APY). The yearly percentage returns on crypto savings accounts are significantly higher.

They can range from 2% to 10% at any given time on legit platforms. Suspicious and mendacious platforms can offer much higher percentage returns, but investors may never see their money again. That is why it’s important to invest in the legit ones. Let’s break down the 3 best crypto savings accounts.

1. Coinbase Earn

While most crypto exchanges and platforms that offer crypto savings accounts don’t entirely cooperate with the law, Coinbase is one of the leading crypto platforms that do. Because it’s listed on the NYSE, it’s under much higher regulatory scrutiny than other crypto companies, which makes it a safer place to invest.

Coinbase keeps things simple when it comes to investing in cryptocurrencies, which makes it great for beginners. Don’t expect the best interest rates, but it’s a great place for newcomers. With Coinbase, customers can choose from more than 50 different cryptocurrencies. It also has an easy-to-use screen for people who are new to the crypto world.

Coinbase Earn, source: coinbase.com

But the trade-off is that there aren’t many ways to make interest. On Ethereum, Coinbase can offer investors a yield of up to 5.00%. Coinbase keeps user cash in cold storage, has two-factor authentication, making it a safe crypto savings zone.

2. Binance Earn

Binance Earn is a savings program offered by Binance, the largest cryptocurrency exchange in the world. Besides trading and investing, the platform allows users to earn interest on their cryptocurrency holdings. Unlike Coinbase, Binance has much more to offer to its users in terms of the number of coins and percentage yields.

Also read: Taylor Swift declined $100 million from FTX – here is why

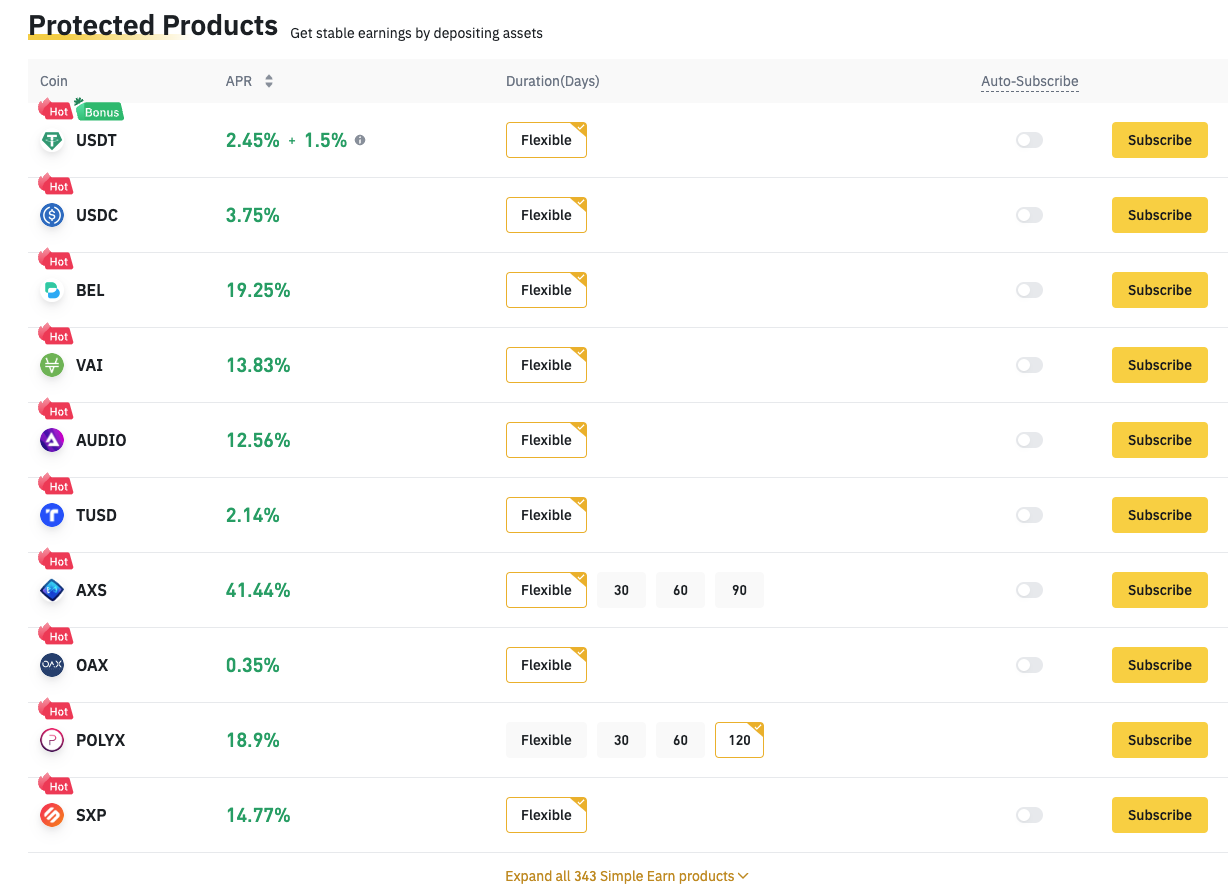

Binance Earn supports tons of cryptocurrencies, including Bitcoin, Ethereum, Axie Infinity, or even stablecoins like Tether (USDT). Binance offers flexible and fixed-term savings options. The flexible option allows users to deposit and withdraw funds at any time, while the fixed-term option locks funds in for a set period.

Binance’s offers for Binance Earn, source: binance.com

The fixed-term option usually offers higher interest rates than the flexible option. Binance also offers high-yield products like Binance Launchpool and Binance Liquid Swap, which can provide users with additional opportunities to earn interest on their crypto holdings.

3. Crypto.com Earn

Crypto Earn is a savings program offered by the Crypto.com cryptocurrency exchange. The platform allows users to earn interest on their cryptocurrency holdings, with rates ranging from 1% to 12.5%. Crypto.com Earn supports a wide range of cryptocurrencies, including Bitcoin, Ethereum, Polkadot, Cardano, etc.

The platform offers flexible and fixed-term options, similar to Binance Savings. The flexible option allows users to deposit and withdraw funds at any time, while the fixed-term option locks funds in for a set period. The fixed-term option typically offers higher interest rates than the flexible option.

Crypto Earn, source: crypto.com

Moreover, the rate is dependent on whether users choose the standard rate or the rate for private members. Crypto.com also offers a variety of staking options, where users can lock up their crypto holdings for a set period and earn additional interest.

Should you invest in crypto earn products?

There are many more crypto exchanges or crypto platforms that offer similar products, but these are the most established ones on the market. Without question, the returns on crypto savings accounts are exciting and tempting.

But you should know the risks before putting your money into a crypto savings account. It’s crucial to think about diversification. When you compare the risks to the rewards, you can get a better idea of the business and decide if it’s right for you.

Read more: TOP 10 crypto podcasts for cryptocurrency enthusiasts

With all the knowledge, benefits, and risks of crypto savings accounts, the question now is whether or not they are a good way to invest. Cryptocurrency savings accounts pay out more than normal savings accounts and high-yield savings accounts.

They are a great choice if you are comfortable with higher risks, but most of the risks can be lessened with research and experience. If you look deeply into the books, history, and reviews of the crypto platforms you’re considering investing with, you’ll get a clear picture of the savings account’s financial health and improve your chances of success.

Especially if you like to trade crypto, you should think about how a crypto savings account could give you a significant return on your crypto assets while lowering the risk.

Comments

Post has no comment yet.