A rally in banks was unable to break the renewed hiking fears

The S&P 500 fell on Friday as new worries about Federal Reserve rate rises coincided with data showing symptoms of a weakening consumer power. This was counteracting a gain in bank stocks on solid quarterly results. The Nasdaq dropped 0.9%. The S&P 500 decreased by 0.7% and the Dow Jones gained 0.8%.

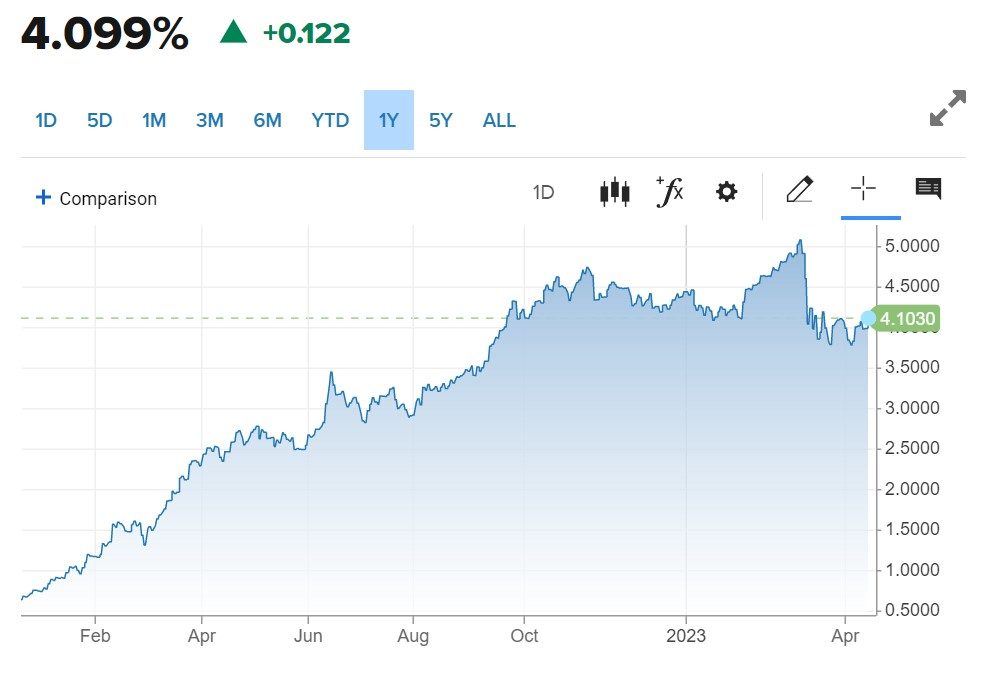

Further rate increases are still required, according to Fed Governor Christopher Waller, who also cautioned investors against anticipating a rate decline very soon. As investors increased their hopes on future Fed policy tightening when data indicated hints of consumer weakening, Waller’s hawkish comments sent the US 2-Year significantly higher.

US 2-year yield chart, source: CNBC

Except for Alphabet, which increased by 1.2%, the increasing rates had a significant impact on big tech. Microsoft had a more than 1% decline after Apple’s 0.2% drop.

More to read: Twitter to allow stock & crypto trading in new partnership with eToro

Banks were the day’s big winners despite their inability to increase stock prices overall. After announcing first-quarter earnings that were above analyst expectations, JPMorgan was up almost 7%. Following the release of better-than-expected earnings, Wells Fargo and Citigroup both experienced price increases of more than 1% and 4%, respectively.

US dollar finally rebounded from year lows

After Federal Reserve policymakers hinted that they weren’t ready to raise the white flag on additional rate hikes because inflation remained too high, the U.S. dollar recovered after hitting a one-year low as chances of a May rate hike increased.

The US dollar index increased 0.56% after sliding to its lowest point since April throughout the day at 100.47. Following a high of $1.10755, the euro dropped 0.44% to $1.0999.

Also interesting: Delta Airlines jumps to 1-mth highs amid strong guidance

In relation to the Japanese yen, the dollar increased by 0.91% to 133.78. The Aussie also lost 1% against the greenback, with the sterling not far behind. GBP/USD closed 0.83% lower.

Oil resumes the gain

Oil prices increased on Friday, securing a fourth consecutive week of increases after the West’s energy watchdog predicted that this year’s global demand will reach a new high due to a rebound in Chinese consumption.

Brent oil futures increased 22 cents or 0.3% to close at $86.31 a barrel. The price of West Texas Intermediate oil futures added 36 cents or 0.4% to end at $82.52 a barrel.

You may also like: Ethereum’s Shanghai upgrade is live – 1 million ETH to be withdrawn?

Both contracts saw advances for a fourth straight week as worries about the financial crisis that occurred last month and the unexpected decision by OPEC+ to significantly reduce output last week faded.

Gold futures finally retreated, however, the precious metals are staying strong. Gold’s June contract closed 1.78% lower with a $36 drop. Silver futures also suffered a similar 1.56% decline.

Comments

Post has no comment yet.