What is Shareholders Equity?

Shareholders Equity is a crucial element of a company’s financial health and a significant factor in determining a company’s value. The equity of a company represents the residual interest in its assets after liabilities have been deducted.

It is crucial for lenders and investors to evaluate the risk and potential returns associated with a business. The purpose of this article is to provide a thorough analysis of Shareholders Equity and its significance, including the calculation of key ratios for banks and investors.

Calculation of Shareholders Equity: Shareholders Equity is calculated by subtracting the total liabilities from the total assets of a company. The formula is as follows:

Shareholders Equity = Total Assets – Total Liabilities

See our deep analysis, where we use the shareholders equity as a valuation approach: Stock Research: ZIM – a new hidden gem?

Relevance of Shareholders Equity:

- Indicates a company’s financial stability: the greater the equity, the more financially stable a company is deemed to be. A high level of equity indicates that the company has adequate assets to cover its liabilities and can pay off its debts if necessary.

- Shareholders determine the value of a company: Equity is essential to determining a company’s value. In general, a high equity value indicates that a company is valuable and may attract more investors.

- Provides a buffer for creditors: Shareholders’ Equity provides a cushion for creditors because it helps to ensure that creditors will be able to recover their loans in the event of a company’s bankruptcy.

The shareholder equity can reveal whether or not the balance sheet is healthy. With the equity value of the company continuing to rise (with increasing share), the company’s value has greatly increased. The greater the proportion of equity on the balance sheet, the greater the company’s potential and proportion of assets financed by equity rather than liabilities.

Tesla is up more than 40% up since we revealed our analysis, where we discussed the sparked demand: Stock Analysis: Lowered prices for Tesla cars could spark the demand

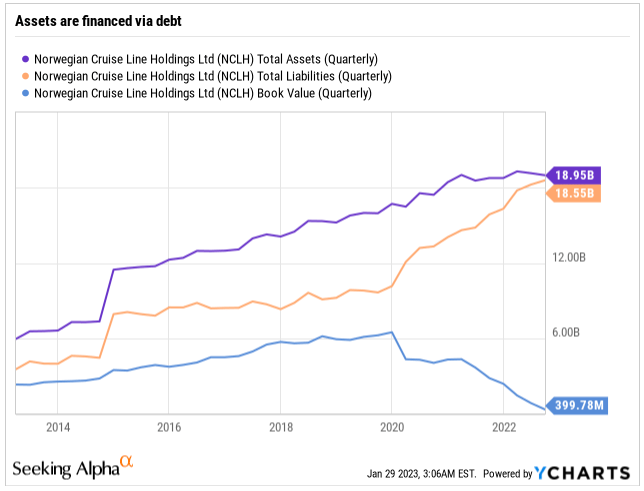

Below you can see how the unhealthy balance sheet looks like. Its impacted by still decreasing share of shareholders value (or its book value) and its replacement for the debt or liabilities. If the trend persisted without the change, the company´s probability of bankruptcy would significantly increased.

NCLH balance sheet, source: Investro Analytics Team

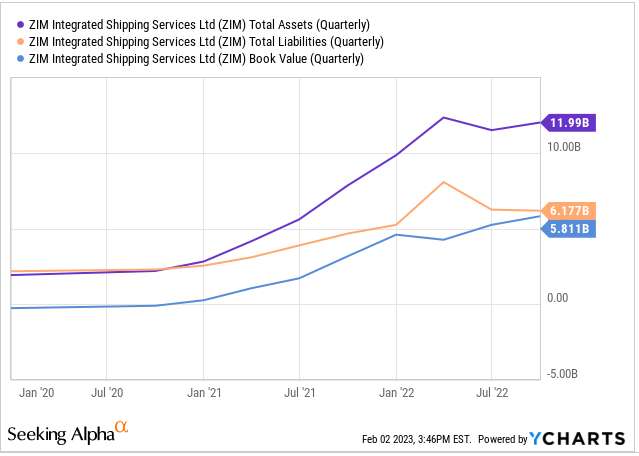

On the other hand, the healthy balance sheet seems very differently. It bears only limited debt and with still increasing shareholders value. In the chart below you can see the balance sheet of the company – ZIM, where we deeply analysed few months ago. All three areas are increasing: assets, liabilities and equity. But looking at the relative terms, more and more assets are finance by the equity. You can easily calculate it as Equity / Assets.

ZIM balance sheet, source: Investro Analytics Team

Key ratios for investors and banks:

Debt-to-Equity Ratio: The Debt-to-Equity Ratio is a crucial ratio for banks and investors, because it reveals the proportion of a company’s debt to its equity. A high Debt-to-Equity Ratio indicates that a company has substantial debt, which may increase its risk of bankruptcy.

Debt-to-Equity Ratio = Total Liabilities / Shareholders Equity

Return on Equity (ROE): ROE is a key ratio for investors, as it indicates the efficiency with which a company is using its equity to generate profits. A high ROE indicates that a company generates substantial profits relative to its equity investment.

Return on Equity = Net Income / Shareholders Equity

Price-to-Book Ratio: A high P/B Ratio suggests that the market places a higher value on a company than its book value.

P/B Ratio = Market Price per Share / Book Value per Share

Aspects influencing shareholder equity:

- Profit and Loss: The net income or loss of a company directly affects Shareholders Equity. When a company generates a profit, its equity rises, whereas when it incurs a loss, its equity falls.

- Capital contributions: Contributions of capital from shareholders affect Shareholders’ Equity as well. By investing in a company, shareholders increase its equity.

- Dividends: The payment of dividends also affects Shareholders Equity. When a company distributes dividends, its equity falls.

- Buybacks: The purchase of treasury stock also affects Shareholders Equity. When a company repurchases its own shares, its equity decreases.

Types of Shareholders Equity

Common Stock is the most prevalent form of Shareholders Equity. It represents ownership in a company and gives shareholders the right to vote on company decisions.

Shareholders Equity plays a crucial role in financing, as it provides a source of funding for a company. To raise capital, companies can use their equity to obtain loans, issue bonds, or sell shares. This enables them to invest in opportunities for growth, expand their operations, and enhance their competitiveness.

You may also like: From Great Depression to GFC – overview of worst recessions in history

Shareholders Equity also plays a significant role in mergers and acquisitions. In a merger or acquisition, the equity of the target company is usually exchanged for the equity of the acquiring company. The value of the equity exchanged determines the value of the deal and the ownership structure of the combined company.

Comments

Post has no comment yet.