Compounding is the process through which profits from capital gains or interest on an investment are reinvested to produce new revenues over time. This growth, measured using exponential functions, is a result of the investment’s ability to create income from both its initial principal and its cumulative earnings from previous periods.

Therefore, compounding varies from linear growth, where each month, just the principle receives interest. Compounding is essential in finance, and the profits related to its effects are the impetus behind a variety of investment techniques.

Numerous firms, for instance, provide dividend reinvestment programs (DRIPs) that enable investors to reinvest their cash dividends to buy new shares. Reinvesting in additional dividend-paying shares increases investor returns because, assuming stable dividends, the increasing number of shares will continually boost future dividend payments.

You may also like: Retail investors expect the market bottom in 2023

Investing in dividend growth companies, in addition to reinvesting dividends, offers an additional layer of compounding, which some investors refer to as double compounding. In this situation, dividends are not just reinvested to purchase additional shares, but dividend growth stocks are also growing their per-share distributions.

“Compound interest is the eighth Wonder of the World. He who understands it, earns it … he who doesn’t … pays it.” Albert Einstein

Example of compound interest

How does compounding work? Suppose you had $1,000 in an investment account to start. You might invest money in something straightforward, such as an index fund that tracks the S&P 500.

Suppose the returns over three years were, respectively, 5%, 20%, and 8%. If the returns were based on the initial $1,000 each year (i.e., not compounded), they would be:

- Year one: $1,000 multiplied by 0.05 equals $50

- Year two: $1,000 multiplied by 0.20 equals $200

- Year three: $1,000 multiplied by 0.08 equals $80

Without compounding, the three-year total would be $1,330, consisting of the initial $1,000 plus $50, $200, and $80, for a total of $1,330. Using the power of compound interest, let’s observe the growth of $1,000.

More to read: How are these 3 unicorn startups doing since IPO?

In the first year, the S&P 500 increases by 5%. That is below its long-term average, but still satisfactory. Your $1,000 increases by 5%, or $50, to $1,050. The S&P 500 enjoys a tremendous year in year two, increasing 20%. Your $1,050 appreciates by 20%, or $210, to reach $1,260. Year three is a normal year for the S&P 500, with gains of 8%. Your $1,260 is increased by 8%, to $1,360.80.

Can you spot any difference? The initial year was easy. Your initial investment of $1,000 increased by 5% with the market, or $50. However, in year two, your 20% returns were not dependent on your initial $1,000 investment. Instead, they increased from the level of $1,050, which reflects your initial investment plus the $50 profit from the first year. In year three, the effect of compounding was much more obvious.

And the additional boost from compounding builds upon itself. Slowly initially, then accelerating as the years pass due to the impact of compounding.

Long-term power of compounding

The power of compounding is amplified if you start early and add new money each month. Just keep in mind that an early start can make a substantial difference by the time you reach pension age because cumulative returns have had more time to grow. The longer an investment is held, the greater its compounded returns may grow.

“Time is your friend; impulse is your enemy. Take advantage of compound interest, and don’t be captivated by the siren song of the market.” Warren Buffet

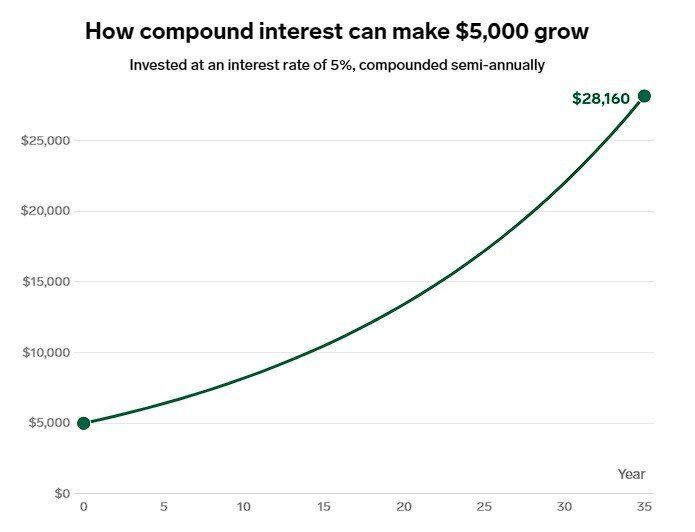

Compounding interest may really build up over time. Here is how a $5000 starting investment would increase if compounded for 35 years at an annualized interest rate of 5%

Compounding effect on $5000, source: investor.gov

How compound interest may be damaging for you

Compounding interest can be advantageous for savings, investments, and wealth growth, but it can work against you if you’re paying off debt. Truth be told, compounding is the number one factor in the high expense of holding debt on a credit card.

Read more here: US bond yields remain pressured

Imagine carrying a $10,000 debt on a credit card (let’s say at 4% compounded, despite the reality that credit card APRs are typically considerably higher). You intend to stop using the card and pay off the balance in five years. Even though you would be reducing your debt and paying an exceptionally low interest rate, you may wind up spending a significant amount in interest fees – more than $1,000.

Conclusion

Depending on whether you are borrowing or saving, compound interest might be advantageous or negative. You don’t need to be a math wiz to determine if the interest on an account will be beneficial or harmful.

You want the lowest feasible interest rate compounded as seldom as possible when you borrow money. If you are investing money, the opposite is true: you not only want a high interest rate but also early and frequent compounding.

And when comparing the returns on loans, credit card APRs, savings account APYs, and other assets, verify the frequency with which the interest accumulates and ensure that you are comparing apples to apples. Even though two nominal interest rates are identical, if they compound at different rates, there can be a significant difference.

Comments

Post has no comment yet.