Zalando SE engages in the provision of online fashion and lifestyle platform. It offers shoes, apparel, accessories, and beauty products. It operates through the following segments: Fashion Store, Offspring, and All Other Segments. The Fashion Store segment focuses on its main sales channels. The Offspring segment includes the sales channels Zalando Lounge, outlet stores, and overstock management. The All Other Segments consist of various emerging businesses. The company was founded by Robert Gentz and David Schneider on February 26, 2008, and is headquartered in Berlin, Germany.

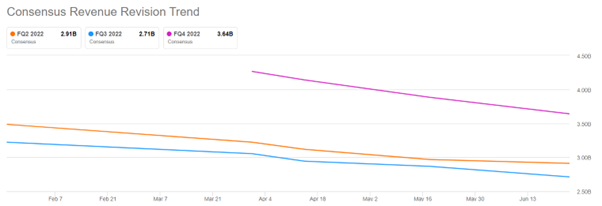

Downwards revisions

Zalando is a fast-growth e-commerce company well-known in the CEE region and western euro-area countries. The company is expanding significantly. The problem is that due to macroeconomic factors, the company faces lower growth than primarily anticipated. As the macro changed in late 2021, inflation continued to surge in the euro-area. The company faced so many negative sales revisions that it impacted stock prices.

Consensus revenue revision trend, Source: SeekingAlpha

Zalando’s stock price peak was 105€ on July 5, 2021. From that point, the stock dropped massively by 75% and currently trades at 25€. The company announced updated guidance for the rest of 2022. The company dipped on the news at 21€, more than 15%, but at the end of the day, the stock reversed all the losses and ended at 25€ per share. Why such a backset?

1W chart of Zalando, Source: Tradingview

Updated guidance

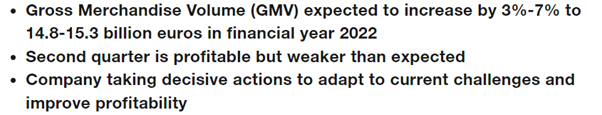

The macroeconomic environment continued to deteriorate during the second quarter of 2022, and the EU consumer confidence index declined in June. Based on anticipated difficulties and early indications of a potential rebound, the company’s previous view from early May indicated the lower end of its full-year guidance. Macroeconomic issues are now likely to endure longer and be more severe than previously thought by management. Management anticipates that revenue growth, adjusted EBIT, and Gross Merchandise Volume (GMV) growth will be well below analyst expectations for the second quarter of 2022.

You may also like: Netflix announced another round of staff layoffs

The firm is revising its projection for 2022 since it no longer anticipates a short-term increase in consumer confidence. For the fiscal year 2022, the business anticipates Gross Merchandise Volume (GMV) to increase 3–7% and reach 14.8–15.3 billion euros. 10.4–10.7 billion euros in sales are anticipated, with an adjusted EBIT of 180–260 million euros during the same time. 350–400 million euros are anticipated to be spent on capital projects.

Updated guidance, Source: Zalando

Macro outlook

Now, let’s try to look at the macro outlook. Yes, we got a direct statement from the company about lowering the guidance due to worsened consumer spending due to uncertainty in Europe (war and inflation).

The problem in Europe came from strong supply channels of inflation. The EU’s recession probability is even higher than in the US. It’s due to monetary policy in Europe. The ECB is trying to soften the increase in yields of PIGS countries. Many countries would need much higher rate hikes to stop the demand channel of inflation. And that’s not happening, but yields speak for themselves.

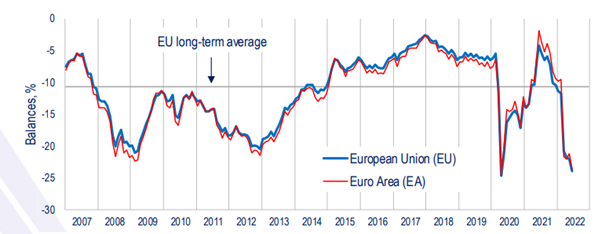

Yet, the attention should move from the inflation in Europe and thus the destruction of consumer demand (sentiment). In the next chart, we can see the key driver of the stock movement. A few days ago, the flash estimate of the European Union Consumer Confidence Indicator reached one of the worst results ever (-22.2), thus surpassing the crisis levels in 2008 (financial crisis) and 2012, the debt crisis in the euro-area.

EU Consumer Confidence Indicator, Source: EU CCI (flash)

However, during the months, the market built a robust correlation between the EU CCI indicator and Zalando stock price. It is not a surprise; it’s an undoubtedly logical event as the Zalando business is based on e-commerce. Thus, consumer confidence is a crucial driver of further revenues or, let’s say, growth. As inflation surge continues in Europe, it dramatically destroys consumer confidence. The situation in Europe is different vs. the US, because Europe is the primarily commodity importer, and thus inflation is mainly impacted by the current commodity spikes. Due to monetary implications in the USA and many leading indicators, it is believed that the Fed can get inflation under control in the US. However, in the euro-area it will depend more on gas and oil prices and the subsequent development of Ukraine – Russian conflict.

Read also: Toyota unveils another production cut

The latest flash estimate EU CCI indicates that with great certainty, consumer confidence is probably bottoming in Europe. However, the problem is that it can get a little bit worse as inflation surge via commodity surge continues to be more dramatic. Nevertheless, from a historical perspective, we are below the 2008 and 2012 crisis levels, so there is not much room for further decrease. As Nathan Rothschild stated:

“The time to buy is when there’s blood in the streets.”

The motto gives us a great sense than ever and can be applied to Zalando now.

Financial side – The growth should be still achieved

It’s astounding in a positive way that the company is expecting revenue growth in 2022. Yes, there is a guidance cut in revenue and EBITDA growth and figures, which can be attractive and cheerful in such a challenging macro situation in Europe. Look at the revenue, EBITDA, and EBIT development. The company grows every year and is expected to be so in 2022.

Zalando – Income statement, Source: Tradingview

However, the overall growth numbers were lowered as strong macroeconomic drivers limited the company’s business model and financial figures. Growth in revenues, EBITDA, and EBIT, will be lower than first anticipated. The revenue in 2022 should grow only by 0 – 3 % (10.4 – 10.7 bn of EUR) and adjusted EBIT between 180 – 260 mil of EUR. As the company will reach profitability, the problem is that 2021 figures in EBIT were dramatically better than in 2022. We should not wonder as inflation (product inflation and wage pressures) is pulling the margins down. There are not many companies in e-commerce to achieve growth during 2022 in Europe. Once the macro environment in Europe improves, the profitability for Zalando and growth figures will reach positive surprises.

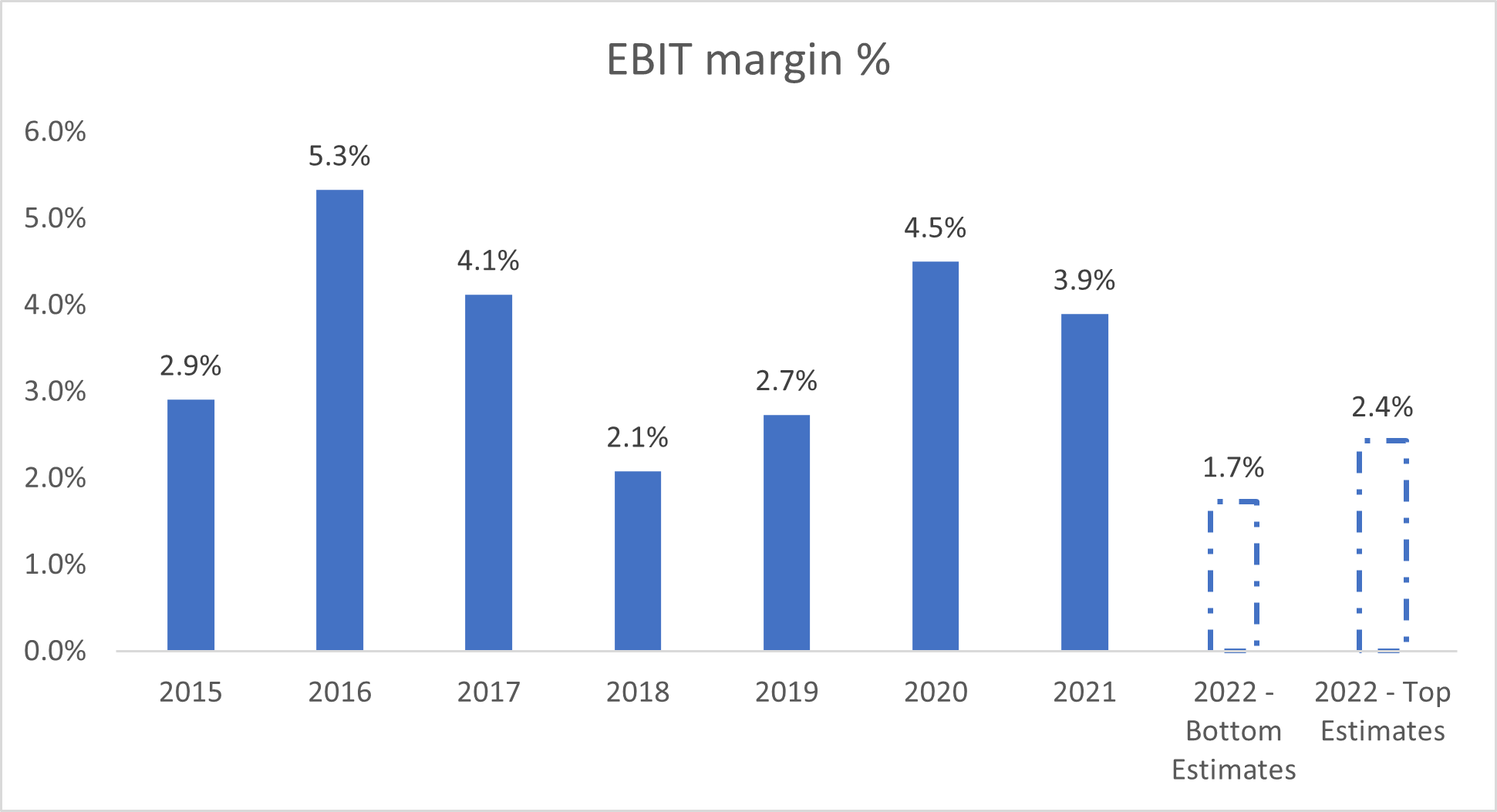

EBIT margin suffers and relative valuation

As we stated previously, the reason why the stock is trading on stretched trading multiples (or, in other words, relative valuation) is a substantial margin deceleration as well as downwards revisions during 2022. The market expected the revenue model to be more resilient. However, that was a mistake.Yet, the company can generate much more CF and revenues and improve profitability when the macro conditions and consumer confidence improve.

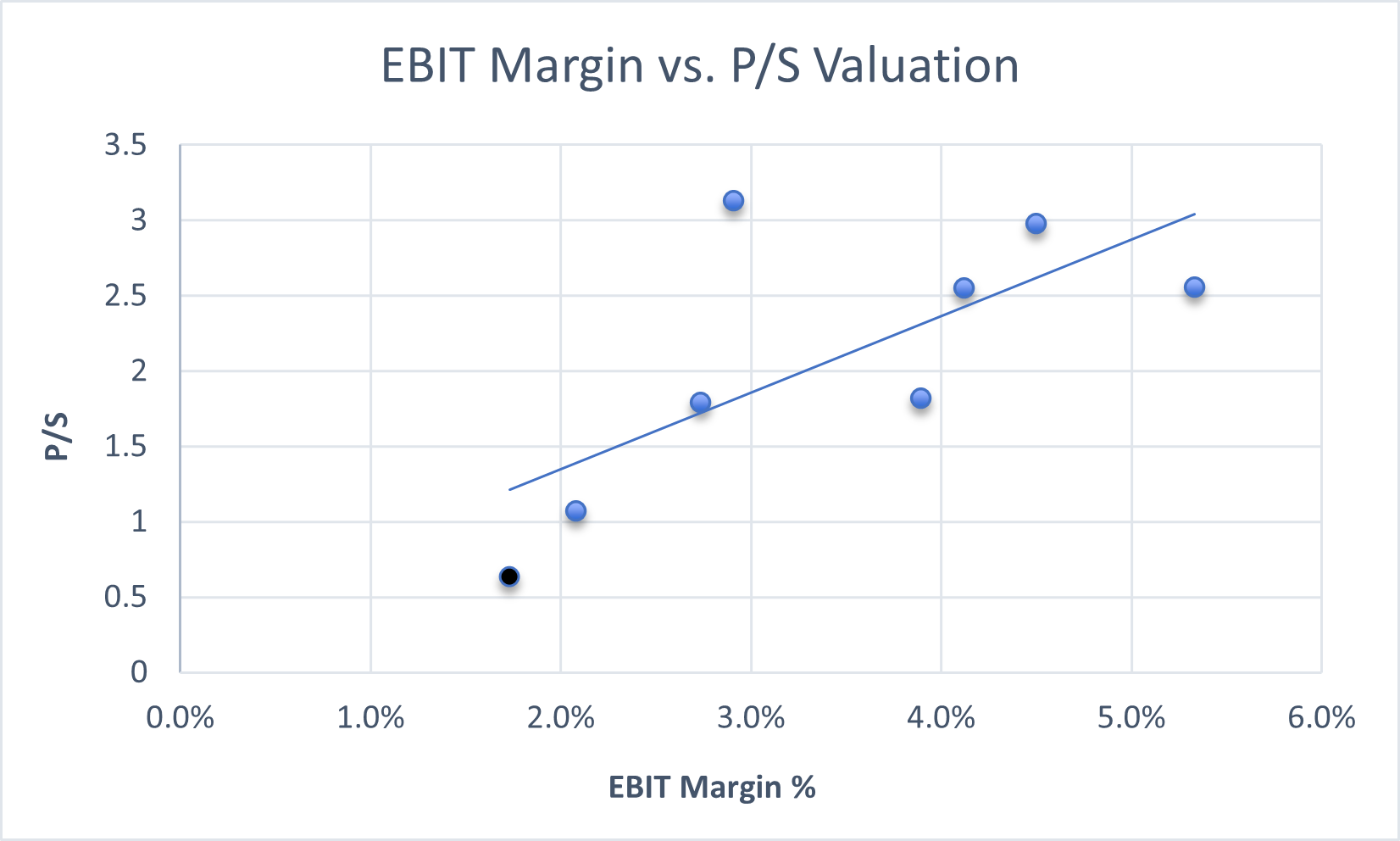

Source: Author´s calculation

We found out the macroeconomic situation in Europe harmed stock prices deeply. However, margins are expected to be pulled down, which is also a negative sign. However, due to our relative and historical P/S valuation, we believe that the market overreacted the price action and that the company is significantly undervalued. When the economic situation in Europe improves, sentiment could rapidly change in e-commerce, thus creating a potential for double or triple-digit growth in stock price.

Source: Author´s calculation

We investigated a great relationship between the company’s EBIT Margin (%) and P/S Valuation. Additionally, there is a genuine opinion that the overall P/S valuation is higher with a higher EBITDA Margin. However, the historical range is between 0.63 – 3.3. Zalando currently trades on the lowest multiple P/S valuations ever (0.63). Let’s go back to our EBITDA Margin and P/S analysis. The stock currently trades at 25€ (at 0.63 P/S 2022 ratio). According to our analysis, with such a margin, the company should trade higher, according to P/S.

Assuming the bottom line for EBIT estimates in 2022 (180 million EUR) with a margin of 1.7%, the company should trade at P/S 1.19. That represents a 88% increase in stock price and fair value at 47€.

Assuming the top line for EBIT estimates in 2022 (260 million EUR) with a margin of 2.4%, the company should trade at P/S 1.55. That represents a 144% increase in stock price and fair value at 61€.

Zalando – historical P/S ratio, Source: Tradingview

However, both scenarios represent historical pricing and seem to be overshoot. The stock is undoubtedly impacted via negative sentiment, and the market currently prices further decline in revenues. However, Zalando is a company with high beta, which is why it is falling too much. In our opinion, EU CCI is bottoming. Once the EU CCI reverses upwards, it will be a leading indicator for sentiment improvement.

Suggested for you: Airlines are not having a good time

As we stated in our valuation analysis, based on profitability (EBIT Margin) and P/S ratio, we believe the company is highly undervalued in current market conditions.

Balance sheet analysis

As Zalando operates in the e-commerce segment, the inventory part of the current asset will play a key role. Zalando can surely face issues with current inventories as the CCI slumps, so consumer demand is weaker. That can be why the company is forced to sell its inventories with more significant discounts than in regular times. Thus, EBITDA and EBIT margin is stretched. In comparison, in 2021, Zalando booked 10.35 bn of EUR in revenues and 403 million EUR in EBIT. Now, the company expects revenues between 10.4 – 10.7 bn of EUR with lowered EBIT in 180 – 260 million EUR. The narrative of selling inventories makes sense to me, what pushed down the margins. Now let’s move to some ratios:

Zalando – Balance sheet, Source: Tradingview

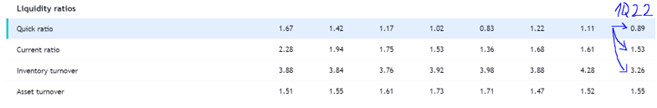

The 1Q2022 results imply some interesting facts:

- The Quick Ratio dipped to 0.89, one of the weakest ever. It’s still a safe area, but it could be much better. The quick ratio shows the very liquid assets relative to the current liabilities the company disposes of. However, suppose the conflicts and other issues in Europe would last long. In that case, the company can be forced to sell inventories with high discounts and seek another portion of financing – bank financing, bond, or dilution.

- The current ratio also includes inventories as liquid assets in the calculation. That’s the reason why it is slightly higher than the Quick Ratio. CA is satisfactory; however, as we mentioned, the solid portion of the company’s assets represent inventories, which could be a minor issue if the situation in Europe dramatically worsens.

- Inventory turnover is weakest/lowest ever – A weak inventory turnover implies that sales are weak and indicates excess inventory. In other words -> “Overstocking.” However, Inventory turnover is not so bad, but compared to its historical evidence, it’s terrible. It just confirms the bad macroeconomic situation in Europe.

Profitability analysis

In the case of profitability, it’s essential to look at the historical margins and ROA, ROE, and ROIC. Let’s start with the margins. Till 2015, the gross margin had decreased from 44% (2015) to 38.7% in 1Q2022. The company faces a long-term issue as it operates in an industry with great competition. Except for the 1Q2022 (and 2022), the EBITDA margin is stable or slightly improving. It indicates the company is efficient this way. ROA, ROE, and ROIC will be weak in 2022 due to mentioned reasons in the previous chapters. However, the long-term trend is quite positive, especially ROE.

Zalando – Profitability ratios, Source: Tradingview

Summary

The macro-environment has a negative setup here. Inflation is soaring, and with the uncertainty of war in Ukraine is destroying consumer confidence in Europe; thus, the company faces lower demand from its customers. However, we can be near the bottom from a fundamental perspective in CCI. Or there is only limited room for further decline. However, if the Ukraine-Russian conflict worsens or inflation figures increase it can cause a significantly higher unemployment rate. From long-term opportunities, we need to invest during the hard times, when sentiment is broken. I see no sign of reversion from a macro’s point of view, but an opportunity to build a long-term position (holding more than 1year). Overall macro rating is at 7/10 (due to potential of bottoming).

From a valuation point of view, the company can be thought of as an absolute bargain based on our P/S and EBIT Margin Analysis. From a conservative scenario, the company should trade at +88% and thus represent a solid margin of safety at current levels. However, P/E or EV/EBITDA ratios are still very high due to weak profitability. Overall Valuation rating stands at 8/10.

Balance sheet analysis revealed some issues with higher than average inventory levels. The quick ratio is near all-time lows, which is not satisfactory. However, the current ratio is quite solid, which means that the company will not face problems if the revenue troubles appear on a light in the short term. The medium-term disruption in the business model could harm the company’s financials. The overstocking will probably cause the lowering of margins. Overall balance sheet rating is at 5/10.

Profitability is being hit in 2022 via slower than firstly anticipated growth. However, the long-term revenue and core business model growth are very impressive. This trend will probably continue when the macro situation in Europe and UK calms down. Despite stabilizing these margins, EBITDA and EBIT margins are still very low in the long term. Due to significant pressures in competition, the company’s gross margin is declining in the long-term. Overall Profitability rating is at 6/10.

Based on our model, the total average rating for the company stands at 6.5/10. Finally, it represents a pretty solid opportunity in the long-term amid short to mid-term risks.

Comments

Post has no comment yet.