There are many companies that go public and investors buy their stocks even though they are not profitable with promises of building profitable businesses. While some companies keep their promises, most fail doing so and end up not being profitable.

Now let’s have a look at three companies that are profitable throughout the years and now these stocks are somewhat undervalued.

PayPal Holdings

No need to introduce PayPal as well as other two companies covered in this article. This digital payment-focused company had a successful run, delivering double-digit gains yearly, until the end of 2021. PayPal delivered a massive return of almost 1,000% over the course of six years, and then fell unexpectedly by about 75%. Although the company is significantly profitable, its stock fell due to an ongoing economic crisis.

While higher interest rates could draw stocks even lower, there are some insights pointing to a future rally of this stock. PayPal allows payments and transfers in many fiat currencies, but PayPal also integrated cryptocurrencies in the end of 2020. Users of PayPal can now transfer and pay not only in euros or dollars, but also in Bitcoin, Litecoin, Bitcoin Cash, etc. This integration of fiat currencies and cryptocurrencies opens new doors for many potential customers.

You can also read: Three cryptocurrencies that did well after massive selloffs

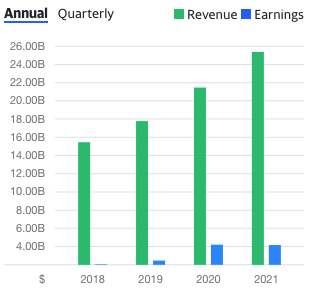

The company is currently valued at $112 billion and many indicators like P/B 5.5, P/E 54 and P/S 4.2 show the firm is still overvalued, these factors are common at tech companies. However, PayPal’s yearly revenue and profits are growing every year. As the digital world continues to emerge gradually, PayPal will probably continue to dominate the world of digital payments.

Zoom Video Communications

This company focused on online communication services was the hit of the stock market when COVID-19 came in 2020. The stock skyrocketed by an astonishing 800% in less than a year, but failed to remain high. By the end of 2021, Zoom peaked at almost $600 per share, and fell to today’s $82. Now the question remains; will it ever go up again?

Related blog: Nvidia’s net income down 72% year-on-year

Zoom is nearing a very strong support unseen in almost two years, and is offering a potentially promising buy signal. Although the company’s value decreased by 85%, it is still growing and delivering positive cash flow. Zoom does not have such an exponential growth as in 2020 or 2021, but it still averages 300 million daily active users in meetings.

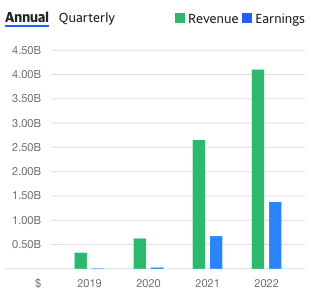

Zoom is currently valued at $25.8 billion with $4.2 billion sales and $1.2 billion income for 2021. Despite its strong stock crash in 2021, the revenue and profits are higher every year since 2019. The company is without debts, and factors like P/E 20.2, P/B 4.2 and P/S 6, it is considered fairly valued as a tech company. Zoom will not probably grow by 800% as last time, but it could easily jump by 100% or 200% the next year.

Alibaba Group Holding

Alibaba is a popular B2B e-commerce platform with 12-digit yearly revenue. It has several platforms like Alipay and AliExpress to satisfy its demanding customers. Since its IPO in 2014 at 92.7 HKD, the stock grew to about 320 HKD in the end of 2021 but later fell back below its IPO price in March this year. This begs the question whether the company is significantly undervalued.

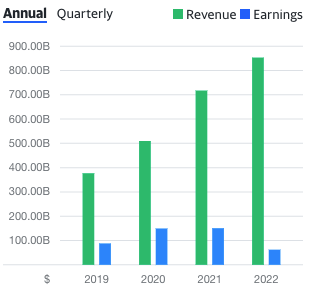

Alibaba did not do significant returns because it was one of the biggest IPOs in the history, currently valued at $248 billion. At the time of writing, the stock is already up by 8.5% for the day. Factors P/B 1.74, P/E 42.8 and P/S 1.97 are mild and point to a possible buy signal right now. While the company’s earnings fell in 2022, its sales surged to a record-breaking 853.06 billion yuan, translating to approximately 134.57 billion U.S. dollars.

This Chinese internet retail company does not offer hundreds of percent of possible return, but it could easily grow by 50% or 100% in the upcoming few years as it is well-established worldwide. Moreover, it provides positive cash flow, which is rare in today’s economic turmoil.

Conclusion

Even though each of these companies are prominent and function well, this year has been tough for every business. The selloff of 2022 offers amazing opportunities to profit as large companies like Alibaba or PayPal are trading “at a discount”.

Comments

Post has no comment yet.