Company profile

MercadoLibre, Inc. operates online commerce platforms in Latin America. Revenue streams consist from:

- Mercado Libre Marketplace, an automated online commerce platform that enables businesses, merchants, and individuals to list merchandise and conduct sales and purchases online,

- Mercado Pago FinTech, a financial technology solution platform, which facilitates transactions on and off its marketplaces by providing a mechanism that allows its users to send and receive payments online, as well as allows users to transfer money through their websites or on the apps. The company also offers Mercado Fondo that allows users to invest funds deposited in their Mercado Pago accounts; Mercado Credito, which extends loans to certain merchants and consumers,

- Mercado Envios logistics solution that enables sellers on its platform to utilize third-party carriers and other logistics service providers, as well as fulfillment and warehousing services for sellers. In addition, it provides Mercado Libre Classifieds, an online classified listing service, where users can list and purchase motor vehicles, real estate, and services,

- and Mercado Libre Ads, an advertising platform, which enables large retailers and brands to promote their products and services on the Internet,

- Mercado Shops, an online storefronts solution that enables users to set-up, manage, and promote their own digital stores.

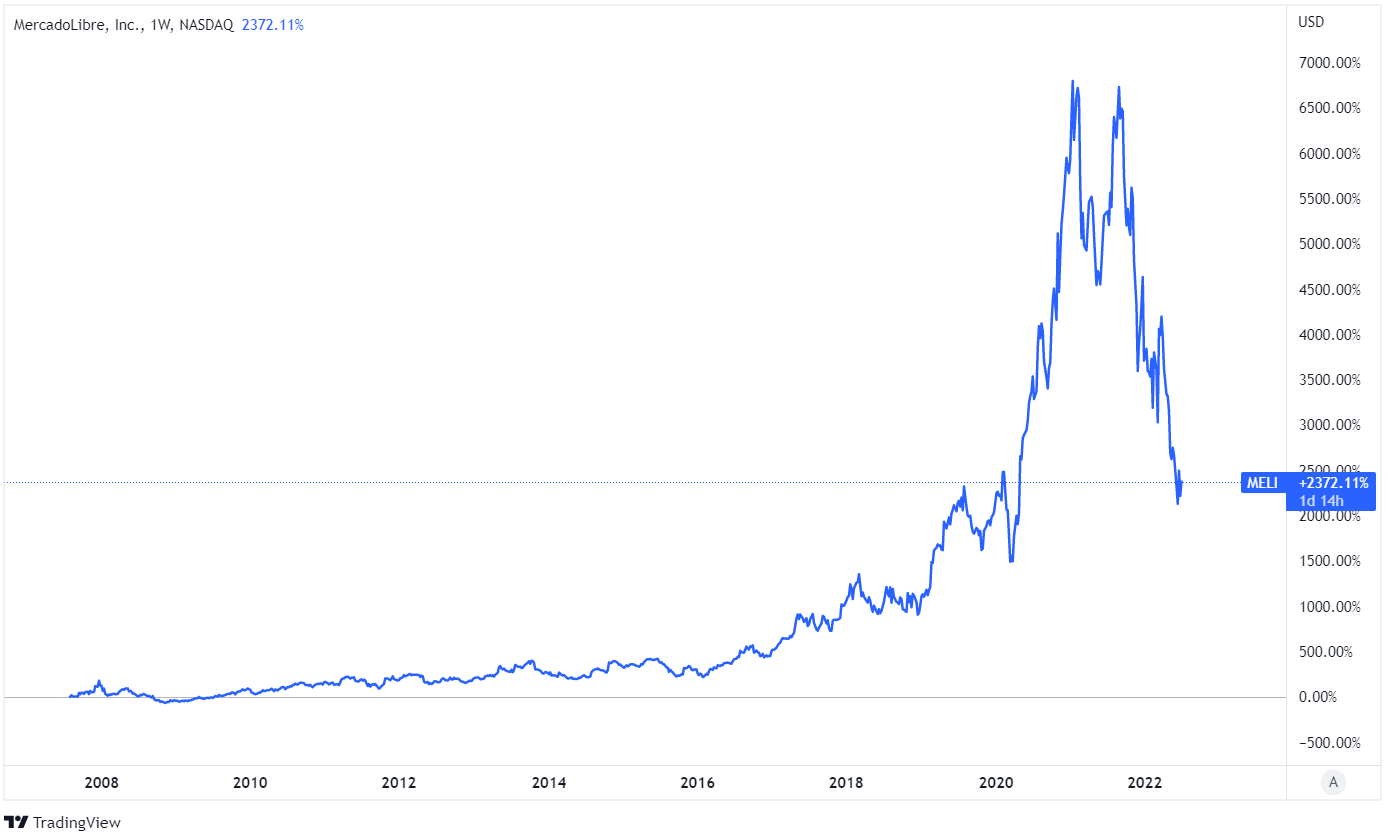

MercadoLibre (MELI) returns since IPO, Source: Tradingview

The current background

Since its initial public offering, MercadoLibre’s stock price has grown by leaps and bounds. One can argue that beginning an e-commerce business in Latin America would not guarantee a successful outcome due to such challenging conditions as unstable political scenarios, severe inflation pressures, persistent depreciation of indigenous currencies, and other discouraging factors. The company is aware of the rules, however, and has honed its capacity to overcome the obstacles. Because it offers more than just a market for consumers and sellers, Mercado stands apart from other e-commerce businesses. Additionally, it offers a variety of alternative income streams and cutting-edge financial technologies. In Latin America, it is more akin to Amazon.

Perhaps you want to know why the stock price is falling so much. Reclassification of value is mostly to blame. Many Technology and e-commerce companies traded at historically high valuations in 2021, exceeding peak valuations from the dot-com bubble in many cases. The Fed was obliged to implement the most forceful monetary policy in recent years during these difficult times brought on by high inflation in order to curb demand inflation and indirectly affect the supply side of inflation. Therefore, value was reclassified downward to more fair levels from a historical perspective due to rising rates, a stronger currency, and worries of a worldwide recession.

You may also like: Weekly macro report – Bonds reached some gains

Stunning growth in revenues

The goal of the business model at this moment is not to produce far more FCF. In contrast, the management made a significant number of investments in its fintech solution (digital payments, solutions, investments to funds and crypto, loans, etc.) and other distinct income channels, and those investments are now paying off.

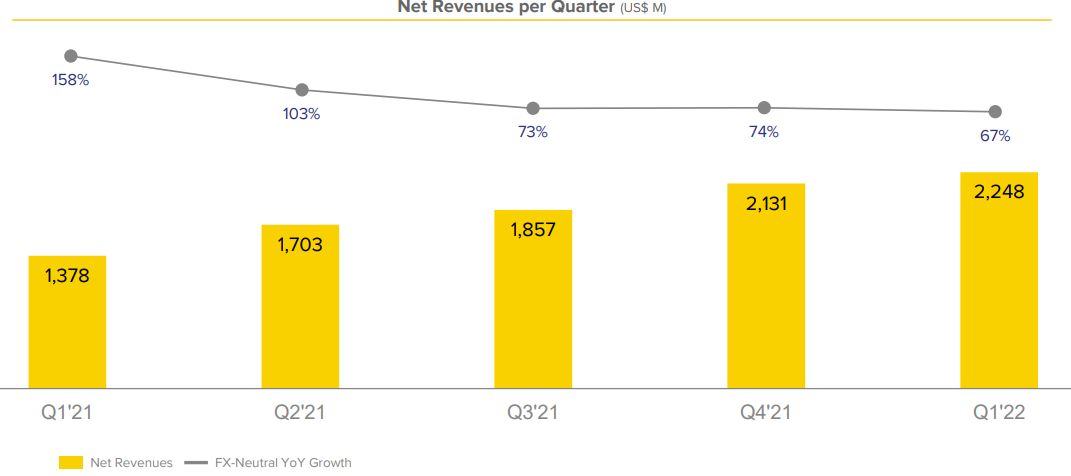

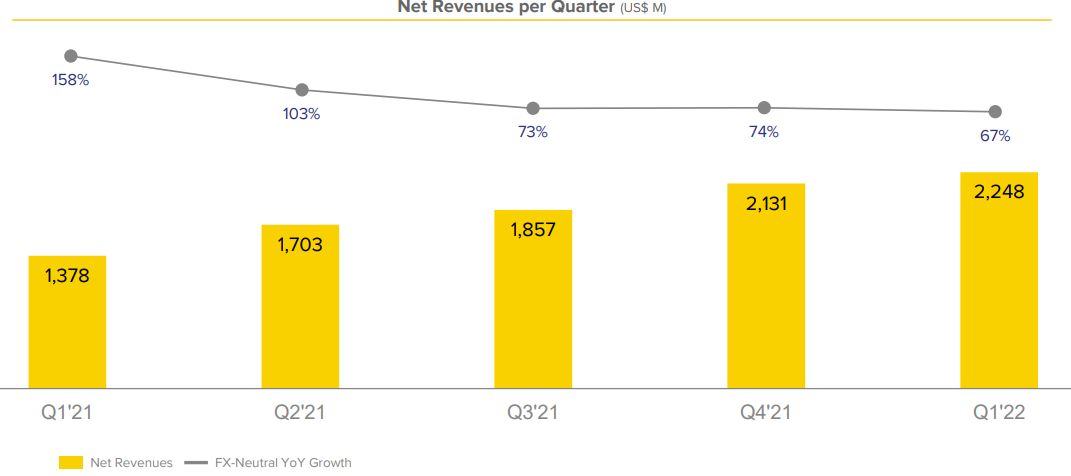

Net quarterly revenue (absolute and relative) trend and YoY % growth, Source: MercadoLibre

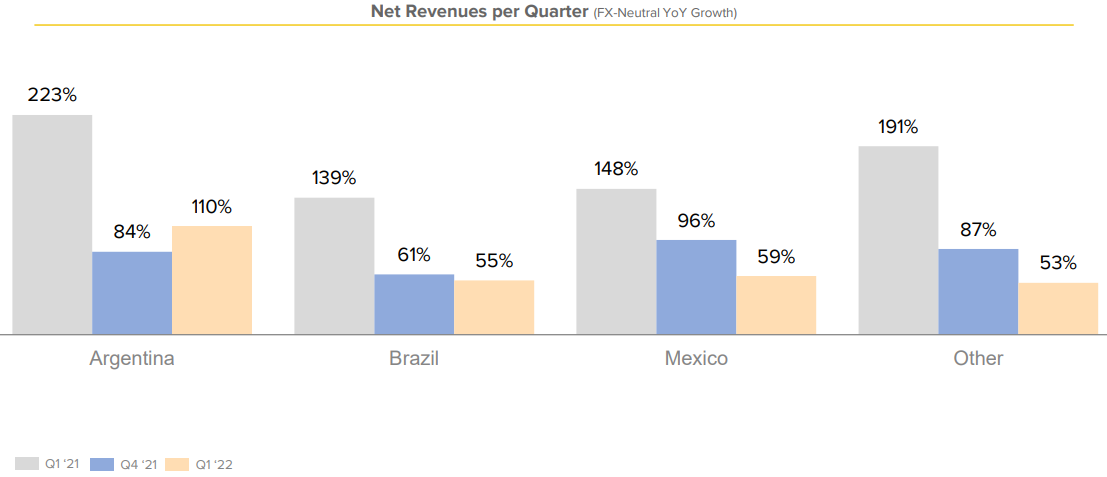

We can see geographic revenue growth (quarterly) on the chart below. These figures are astounding given that the key markets are Brazil, Argentina, and Mexico. However, Mercado is spreading to several Latin American nations and is currently the market leader in these important regions. However, because e-commerce and finance are still in their infancy in many nations, the potential is still quite great.

Net revenues growth – quarterly at key markets, Source: MercadoLibre

Fintech and e-commerce segments

As previously mentioned, MercadoLibre Marketplace, Mercado Envios, and MercadoLibre Ads make up the e-commerce division. Due to significant investments and a strong business plan, the company experienced long-term success in this area. However, revenue is consistently increasing on a quarterly basis. Although there was QoQ negative growth in the first quarter, the business nonetheless experienced YoY growth of 44%. First off, keep in mind that e-commerce is a highly cyclical industry, with consistently larger sales during the winter or 4Q. Therefore, the 1 277 million from e-commerce in 1Q2022 is quite appealing. Despite the fact that the company earns huge returns (and even higher and higher levels of revenue), the YoY is steadily dropping.

Net revenues growth in e-commerce – quarterly at key markets, Source: MercadoLibre

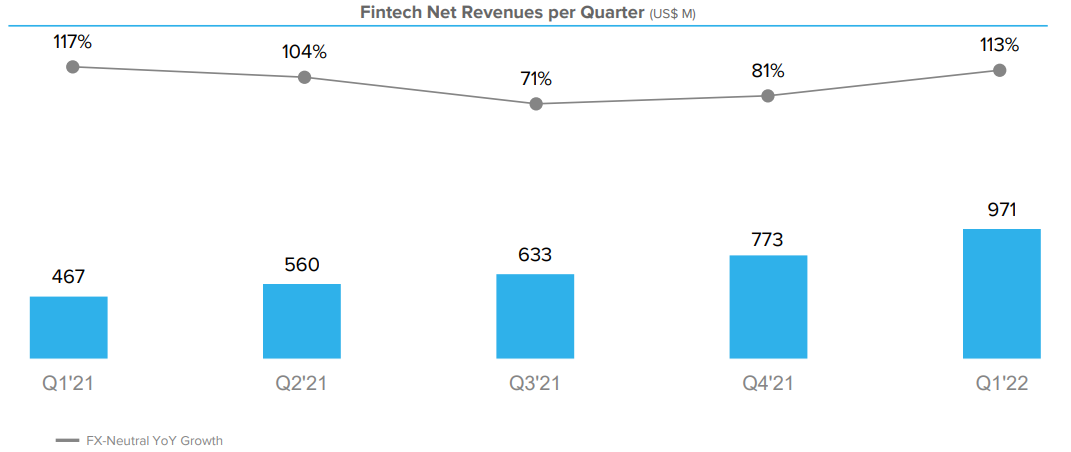

The sophisticated financial background is provided by MercadoPago (fintech). The company’s fintech is similar to Paypal in many aspects. The MercadoLibre Marketplace uses it as a digital mode of payment, so neither the corporation nor the sellers must spend exorbitant amounts of money in transaction fees. For long-term sustainability, this is fantastic. Customers can make investments through Mercado Fondo and make P2P payments via Fintech. Customers of Mercado Credito have the option of taking out a loan. However, the corporation makes an effort to introduce cryptocurrency to Latin American nations. The opportunity to purchase cryptocurrencies and stablecoins already exists in Brazil, and this feature is anticipated to spread to other nations. Due to their ongoing currency devaluations, Latin American nations are particularly in need of it.

Net revenues growth in Fintech – quarterly at key markets, Source: MercadoLibre

The growth rate in 1Q2022 was an astounding 113 percent YoY to 971 million USD. The business has successfully developed a robust and largely independent source of income and can no longer rely just on national e-commerce expansion. There is still opportunity for expansion, though, as fintech is still not widely used in Latin America and is not yet well-established in the nations where the company is present.

Have you read: Why is the price of Crude Oil so volatile?

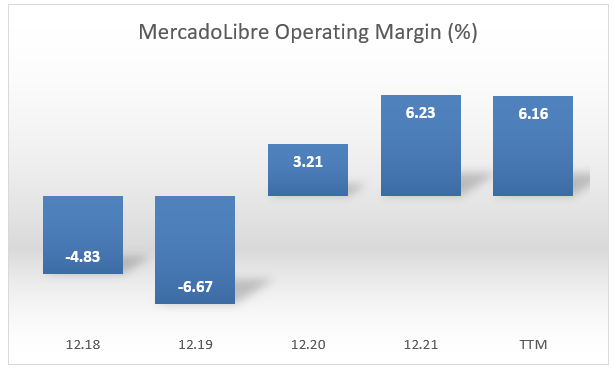

Operating margin (in %)

The company’s operating margin has been poor for many years, which is the only drawback. However, as we previously mentioned, the corporation concentrated on double-digit sales growth and sought to grow as successfully as possible. The approach is excellent, but there are problems with profitability and adding new FCF. However, according to our team, the operating margin trajectory is strong as the company reached its bottom in 2019. We are certain that operating margin will increase when the company’s expansion stage slows.

Remember that the company’s 5-year CAGR is 52%, and in 2021 the YoY increase indicated an absolutely astonishing 69%. The growth is still ongoing and will continue to be double digits in the next years. But after three to five years, the business may stabilize and shift its attention to increasing margins.

MercadoLibre Operating Margin, Source: Gurufocus

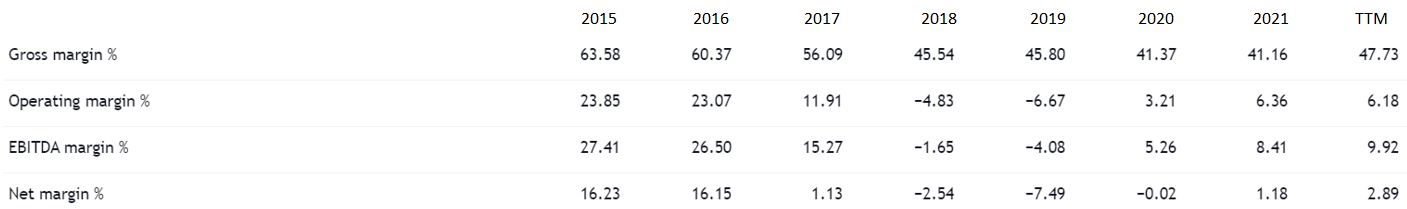

Other margin developments, including gross margin, EBITDA margin, and net margin, are shown in the table below. In 2020, the gross margin hit its lowest point. In 2019, when the turning point was achieved, other margins hit its bottom.

Margin development, Source: Tradingview

Financial health – part one

Now, let’s examine balance sheet analysis. We must first examine the liquidity ratios. In the event of unforeseen difficulties, we will closely monitor high liquid resources. From this perspective, the current ratio and quick ratio are crucial. The quick ratio, which compares the current assets that the business has on hand to its current liabilities, is more conservative.

The current ratio is 1.40, while the quick ratio is 1.36. The decreased spread is a result of MercadoLibre’s business model, which primarily acts as a marketplace for buyers and sellers rather than focusing on selling its own goods and products. Although the quick ratio of 1.36 is quite pleasing, historically, it has been considerably better. The business still has sufficient of short-term liquidity to cover its current liabilities in the event of reduced growth or a slowdown in growth.

MercadoLibre, Source: Tradingview

Financial health – part 2

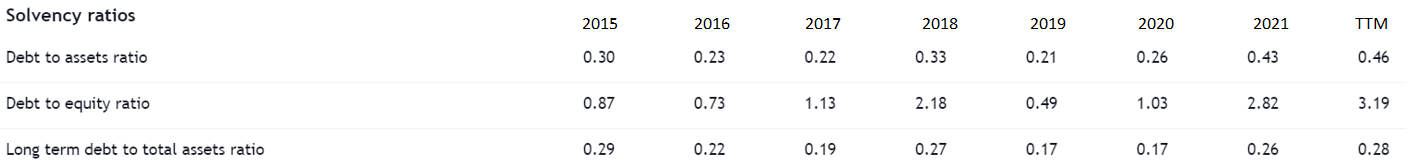

From a solvency side we need to take a look at some crucial ratios, which can give us other insights of what is “behind the wall” and could reveal some risks. From this point of view, there are crucial ratios such as the overall debt to asset ratio or debt to equity ratio.

MercadoLibre, Source: Tradingview

Looking at the debt to asset ratio, we can see a negative trend of a slight increase in this ratio. This indicates that the overall debt, which the company takes is increasing relative to its assets during the time period. It is not a positive sign, however, for the last 12 months (trailing) it stands at 0.46, which still means a relatively safe area.

The long-term debt to total asset ratio is growing only very slightly. However it indicates, that company is being financed more and more via short-term debt (compare debt to assets vs. long-term debt to assets).

The debt to equity ratio, which shows a peculiar tendency for leveraging, yields the worst results. The corporation is using debt to fund its expansion. The ratio at 3.16, however, is what represents an extremely risky area under normal circumstances. The long-term pattern raises concerns. The fact that a company is still growing, nevertheless, means that the equity side may rise over time and the ratio may somewhat decline. For the balance sheet’s long-term financial stability, this would be quite advantageous. The solvency ratios will not receive a high ranking, but the liquidity ratios will.

Valuation based on trading multiples

Keep in mind that a company with the kind of revenue growth we just stated should have very high valuation ratios. We will ascertain whether the company is reasonably valued or undervalued based on previous data. P/E won’t be a particularly useful relative value metric for MercadoLibre. This is due to the company’s continued focus on growth rather than its low net income margins. For a valuation approach based on historical data, EV/sales or P/S will be considerably more beneficial.

The price to sales ratio at MercadoLibre is 4.58 right now, which is one of its lowest points ever. The company was only less expensive once, on 11/2008, when the P/S ratio was 3.01 and the price was 8.88 USD. The P/S ratio reached its maximum point (for the most recent decade) in December 2020, reaching 25.8, which indicates that prices are absolutely out of hand and unsupportable in the medium run.

MercadoLibre – Price to Sales ratio and stock price, Source: Tradingview

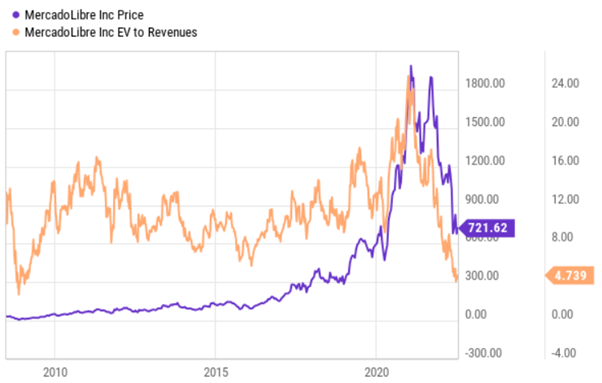

The output from EV/revenue on YChart is comparable. Because it also takes into account the development of the balance sheet, EV to Revenue is a more complicated metric to track relative valuation. At this time, the company has 4.7 levels. From a historical perspective, the business was only less expensive in 2008, at the peak of the crisis.

MercadoLibre – EV to Revenues, Source: Ycharts via SeekingAlpha

Team Opinion – Idea

If we currently trade at 4.73 EV to Revenue, the long-term range that we could target should be between 8 – 12, implying a lower long-term target vs. a higher long-term target. This targeting is based on average and median EV to Revenue development. So where is our price range (long-term target)?

The current price of MercadoLibre is at 721 USD (at 4.74 EV to Revenue), thus the lower long-term targeting should be around 1211 USD, and the top long-term targeting at 1824 USD. A range of 8 – 12 (EV to Revenues) implies a target range to 1211 – 1824 USD. However, it all depends on the future development of EV to Revenues.

Rating

Growth (in terms of revenue and EBITDA) – 10/10

Profitability, FCF, and margins – 4/10

Balance sheet (liquidity ratios) – 7/10

Balance sheet (solvency ratios) – 5/10

Valuation (based on trading multiples) – 9/10

Valuation (based on DCF) – unknown

7/10 is the overall rating for the business. The excellent possibility for further growth and potential for margin expansion is made clear by the summary grade. However, due to the company’s operations in Latin America (particular risk factors) and the process of rising leverage, the risks remain significant. From a historical viewpoint, the valuation is still strong overall, but Mercado is slightly overvalued compared to the competitors.

Did you like the analysis? Read about the next e-commerce fast-grower in Europe at great discount – Zalando

Warning: The fully covered text is not investment or trading advice. It represents only the author’s point of view and thoughts, and we do not bear responsibility for your potential loss. The article serves only for analytical and marketing purposes.

Comments

Post has no comment yet.