ZIM Integrated Shipping Services Ltd. and its subsidiaries provide container shipping and related services in Israel and around the world. It offers door-to-door and port-to-port transportation services to different types of customers, such as end users, consolidators, and freight forwarders. The company also offers ZIMonitor, a premium service for tracking reefer cargo.

As of December 31st, 2021, it ran a fleet of 118 ships, which included 110 container ships and 8 vehicle transport ships. Four of the ships were its own, and the other 114 were chartered. It also had a network of 70 weekly lines. The stock is down from its high by more than -81%, but we will look later if it is undervalued or not.

ZIM stock price, Source: Tradingview

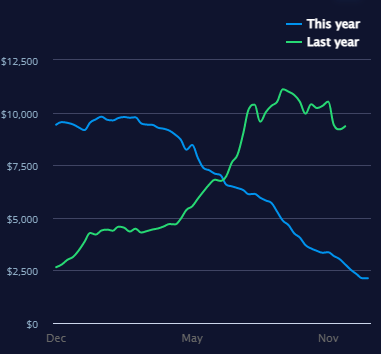

The main risk factors for the company are freight rates, which drive the profitability of the company and its carried volumes. The shipping companies took a great hit in 2022 after a stunning increase in 2021. Freight rates fell significantly in 2022 as demand tried to normalize, supply-chain bottlenecks eased, and global monetary tightening took effect. The stock price is closely following the trend in freight rates, where there is a great positive correlation.

You may also like: Investors are too bearish – time to be a contrarian?

According to Freightos Baltic Index (FBX), the index freight rate is at 2,127 USD as of December 16th, 2022. As you can see, the index price reached more than 10,000 USD in late 2021. In our view, the 2021 results were a pure exemption, which we probably won’t see anytime soon. However, if we were not to face a recession, the re-opening of economies and new demand could drive freight rates higher.

We are currently in a market stage with significant normalization of freight rates. Normal freight rates should be in the range of $1 050 to $2 000 USD. However, it is nowhere written that we will not hit such areas as we see monetary tightening and demand dropout, and it is nowhere written that rates could remain elevated due to a previous strong inflation cycle (let’s say above 2,000 USD).

FBX, Source: Freightos

Profitability and forward EPS

As we stated before, the key element for profitability and margin expansion and contraction is the freight rate. Volumes matter as well, because by multiplying the average freight rate by the volume, we can calculate expected revenues. So looking forward, it’s always great to look at it.

See also: Make more, spend less – 5 steps to wealth generation

However, we chose ZIM because the price is nearing a new low, and the balance sheet appears to be in good shape despite the EPS drop. Many great investors seek cyclical opportunities in the long term, and believe me, most of them find value when nobody wants them, a temporary driver that pulls down the stock. Currently, that factor is the freight rate and a possible weakening and contraction of the economy.

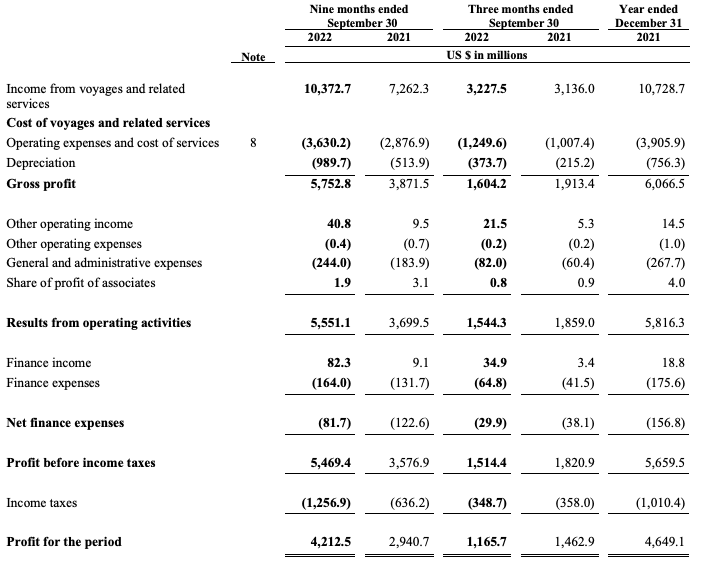

Income Statement

Let’s look at the income statement to see how the business developed in the 3Q2022:

Income from voyages and related services remained significantly high at USD 10.37 bn, significantly up from USD 7.26 bn, reflecting a 42 % increase YoY for the first nine months, primarily driven by an increase in freight rates. Carried volumes remained slightly lower compared to last year, reflecting the demand slowdown.

ZIM Q3/2022 statements, Source: ZIM

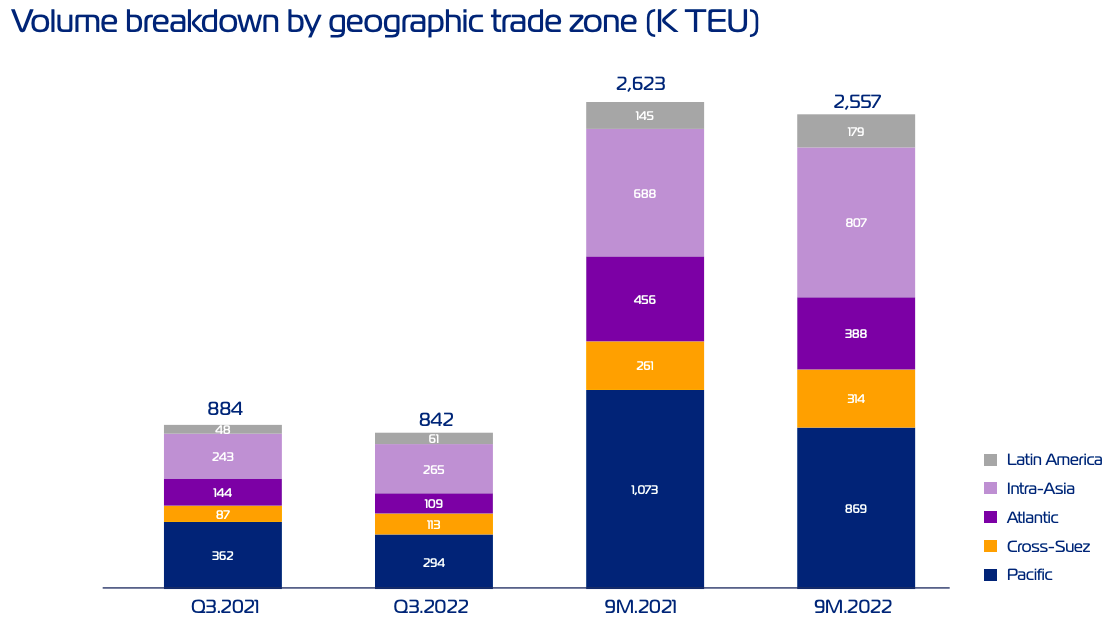

In the following chart, you can see how the carried volumes developed in Q3 as well as for the first nine months of 2022 and 2021. A slight decline can be monitored. The vast majority of volumes had been transported across the Pacific and then through Asia. However, while these volumes may fall slightly in the fourth quarter of 2022 and more significantly in 2023 due to a possible economic contraction, they are likely to remain bullish in the long run.

ZIM’s presentations in Q3/2022, Source: ZIM

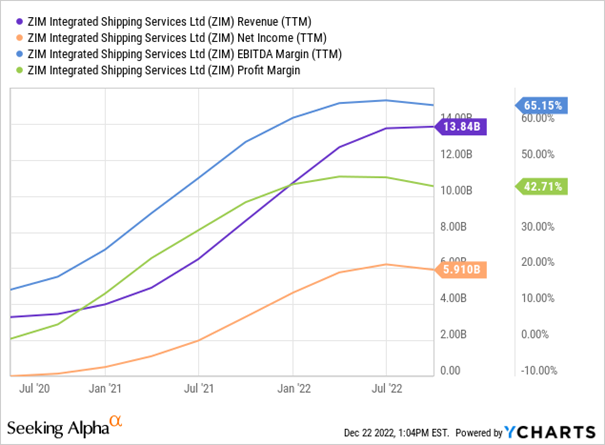

We can look at how the company’s key items, such as revenues, net income, and margin, developed during the latest three years. From this point of view, it’s very important to look at the margin development. It went hand in hand with freight rates and was a very comfortable position for ZIM in contract negotiations. The results below represent data for the trailing 12-months.

Read also: What is Santa Claus rally – explaining the famous phenomenon

Bear in mind that such high revenues and strong margin delivery will be over in 2023 due to significant freight rate reductions. ZIM is known for its very generous dividend policy because the dividend pay-out represents 40-50% of all EPS. Bear in mind that 2021 had been an extraordinary year, and now we will face normalization and perhaps not such a great outcome for EPS or dividends. So do not expect such a result in 2023 as freight rates and marine driver jobs significantly decrease.

Profitability, Source: Seeking Alpha via YCHARTS

Estimates and Valuation

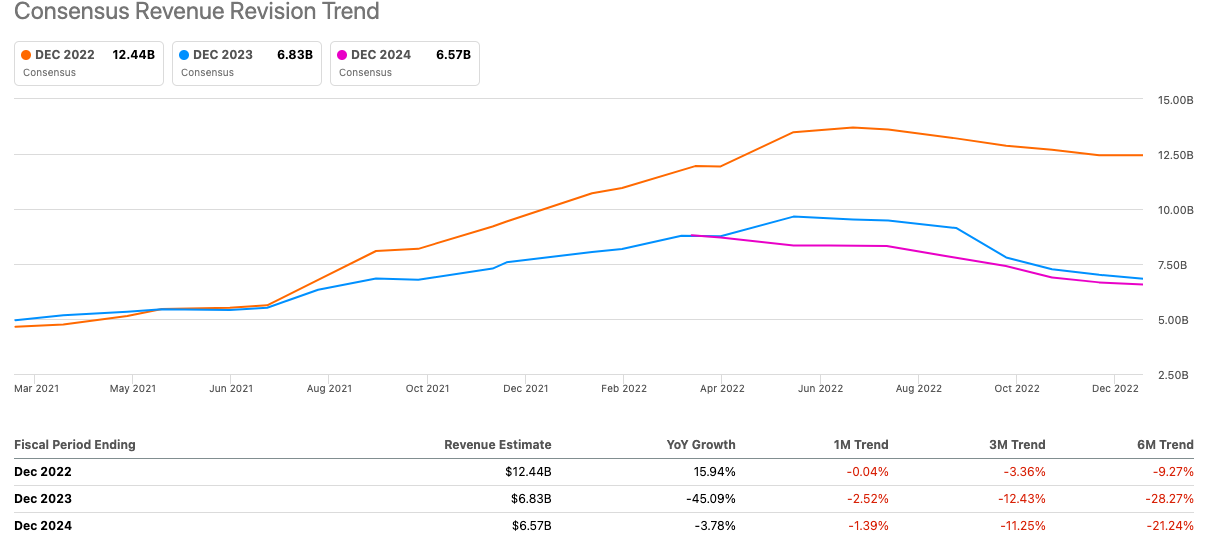

So, what does the market anticipate? Based on the revenue and EPS forecast and the most current expectations, the market analysts are expecting a strong pullback down, both in EPS and revenues, in 2023 and 2024.

Revenue Revision Trend, Source: Seeking Alpha

Revenue estimates have been pulled down for 2023 and 2024 due to decreases in freight rates. The market consensus is that revenues in 2023 should reach 6.83 billion USD and 6.57 billion USD, respectively. The current price to sales stands at 0.17, while the forward 2023 price to sales stands at 0.31 and the forward 2024 price to sales stands at 0.32. Both forward-based valuation metrics via multiples scream that the company is highly undervalued, even if the consensus is right with its sales calculations. Let’s look at forward EPS:

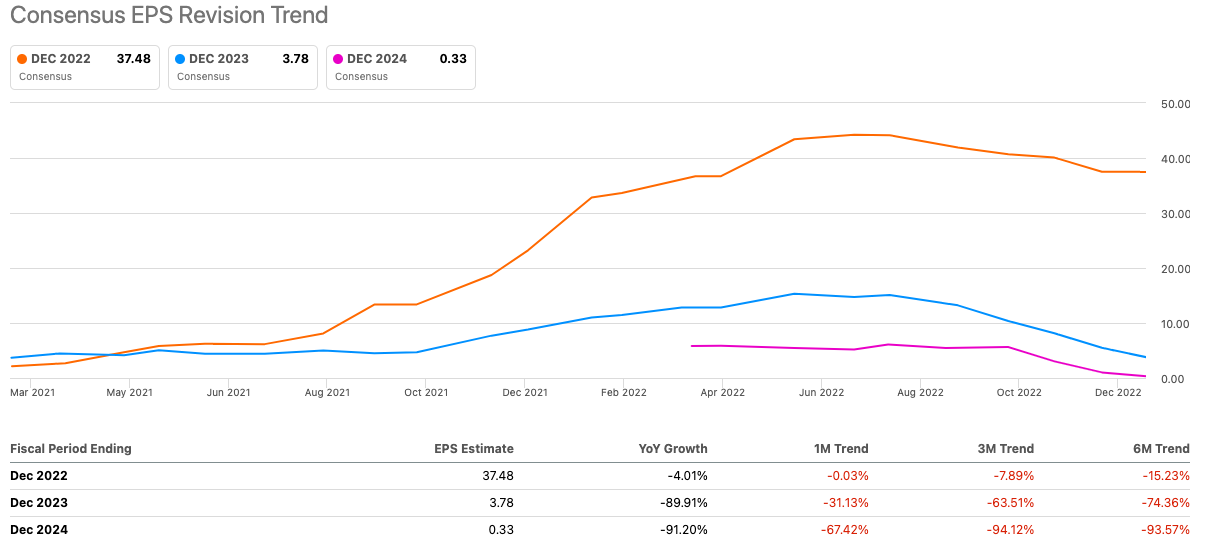

As analysts expect a significant pullback in profitability due to lower freight rates, the median estimate for 2023 EPS stands at 3.78 USD vs. the expected figure of 37.48 USD for 2022. No wonder why the stock is trading down more than 70% when expected EPS should drop more than 90%. What’s strange is how low analysts expect EPS to be in 2024, when they expect it to fall to an extreme 0.33 USD. In our view, this is nonsensical and could be a trigger in a strong-recessionary scenario. Analysts also anticipate a drop in long-term contract profitability and a return to normalcy.

We do not say it just cannot happen, but we are very doubtful about such an outcome in 2024. ZIM’s stock price is significantly correlated with such estimates. Estimating EPS more than a year in advance for a cyclical stock with such volatility in freight rates makes no sense.

You may also like: Why should you start investing right now?

Furthermore, ZIM is a very flexible shipping operator; the company has more than 80% leased vessels and does not own many. It means that the company can react quite quickly to lower market demand. Finally, fuel prices have dropped significantly in the last three months, which will help to keep the margin higher and not as low as the market predicts for 2023 and 2024. Based on the following factors, we believe that the market consensus is not right.

EPS Revision Trend, Source: Seeking Alpha

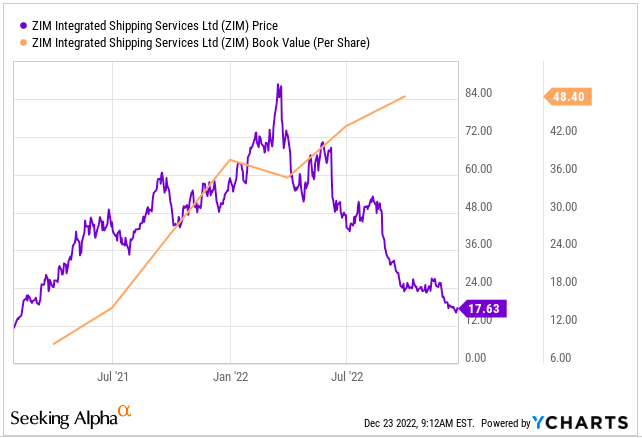

Based on very unstable EPS looking forward, the P/E and FCF valuation are not a good way to look at the company’s valuation profile currently. Instead, we recommend examining a company’s book value, which is the difference between its assets and liabilities. Let’s say equity.

The higher the equity (and its share), the higher the value of the company. It is a valuation metric from a balance sheet point of view, and we believe, it is a really good fit for such a business model in the current situation. The spread between book value and price started to significantly deviate from the first quarter of 2022, where the price continued to drop due to a pullback in freight rates.

Book Value Per Share vs. Stock Price, Source: Seeking Alpha via YCHARTS

Balance Sheet

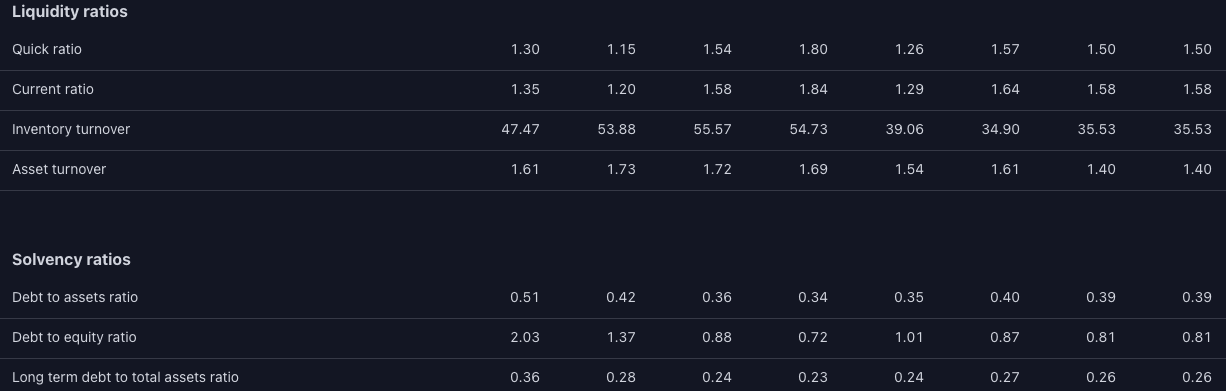

The balance sheet looks very healthy. We can look at the liquidity and leverage ratios to see if the company has no problem with short-term liquidity or further financing. The very conservative quick ratio is at very safe 1.50 levels. The current ratio (the ratio between current assets and current liabilities) is at 1.58. It means that the majority of current assets are represented by cash, which is highly positive.

In cases of solvency or leverage ratios, we see that the debt-to-asset ratio or the debt-to-equity ratio have a very decreasing trend. What is highly positive is that the company has tried to get rid of debt as fast as it could. Assets are covered mainly by shareholder equity, which is also very positive as the company will not have any issue to take on new debt (if necessary).

Liquidity and Solvency Ratios, Source: ZIM

In summary, this stock remains very attractive, mainly due to the significant drawdown, while the book value is still increasing. Despite the challenges ZIM will face, the market undervalues it by more than 50-100% (conservatively), in our opinion. Looking forward, profitability looks bad, but the stock price reflects it. Balance sheet is prepared for any economy turmoil.

Comments

Post has no comment yet.