Powell scared the markets

Jerome Powell, the chairman of the Fed, warned the markets that a recent surge in inflation will likely result in a greater-than-anticipated increase in interest rates. Powell made testimony to Congress that recent statistics indicated that inflation remained persistently high.

This is likely to prompt the Fed to implement more, sharper interest rate rises. An increase in the opportunity expenses associated with maintaining non-yielding assets weighs heavily on commodity markets as interest rates rise. A rise in short-term Treasury rates also contributed to this development.

More to read: Nasdaq plunges as Powells refrains from pivoting

This week’s focus has shifted to the February nonfarm payrolls report, which is coming on Friday. This could provide additional signals of labor market growth providing the Fed more macroeconomic flexibility to continue hiking rates.

The silver opportunity

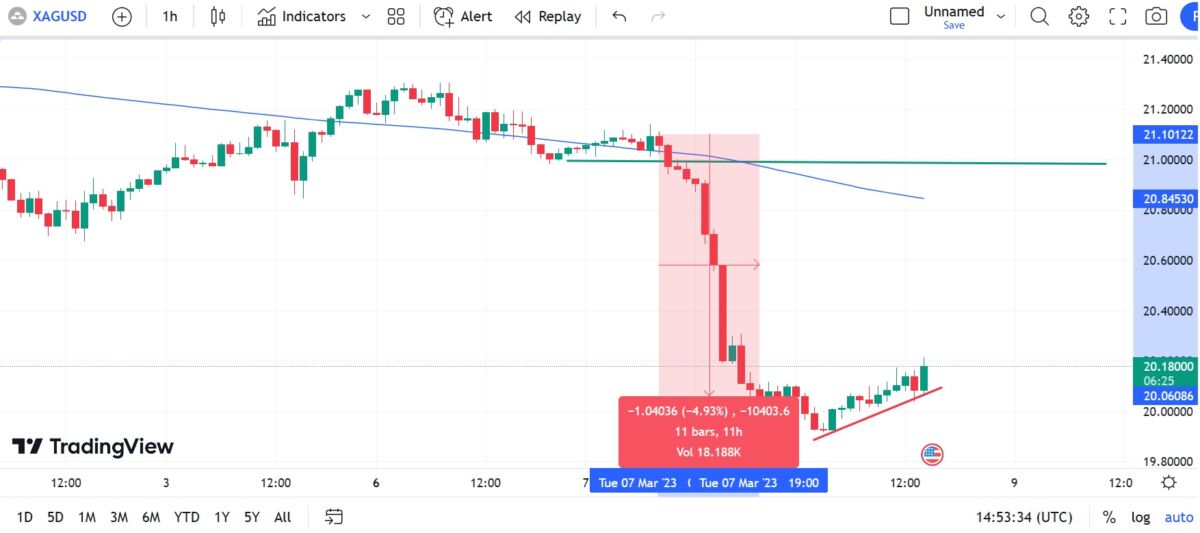

On Wednesday, silver rebounded from a multi-month low but lacked bullish confidence. The white metal dropped 5% after the Powell speech in just a few hours.

Silver demonstrates some resiliency under the $20.00 psychological threshold and stages a slight rebound from its bottom point since early November. The precious metal maintains its small advances in the region of $20.10 to $20.15.

The massive drop may be a great opportunity to buy, with a slight uptrend back towards the $21 area. The huge drop is bound to get its correction to some extent. The bulls could meet the bears in the middle, around $20.6, and in case of a positive turnaround, move up towards $21.

Silver 1H chart, source: tradingview.com, author’s analysis

Comments

Post has no comment yet.