Lower economic predictions

The outlook for global growth is, generally, lower than expected. Lower economic predictions hand-in-hand with higher interest rates send signals with a negative impact on the demand for crude oil. The Fed has raised interest rates by 50 bps, the same as expectations, but interest rates now represent 4.5%, and the dot plot chart shows a possible peak of around 5.1%. Moreover, the chair of the Federal Reserve, Jerome Powell said that the higher inflation is expected to stay for a longer time.

Read more: Wall Street ends in the red after FOMC meeting

A negative impact of macro data on crude oil keeps the commodity in negative territory. Based on data from Bloomberg, the liquidity in the commodity declines before holidays and the volume is below the 30-day average.

Crude oil keeps under resistance

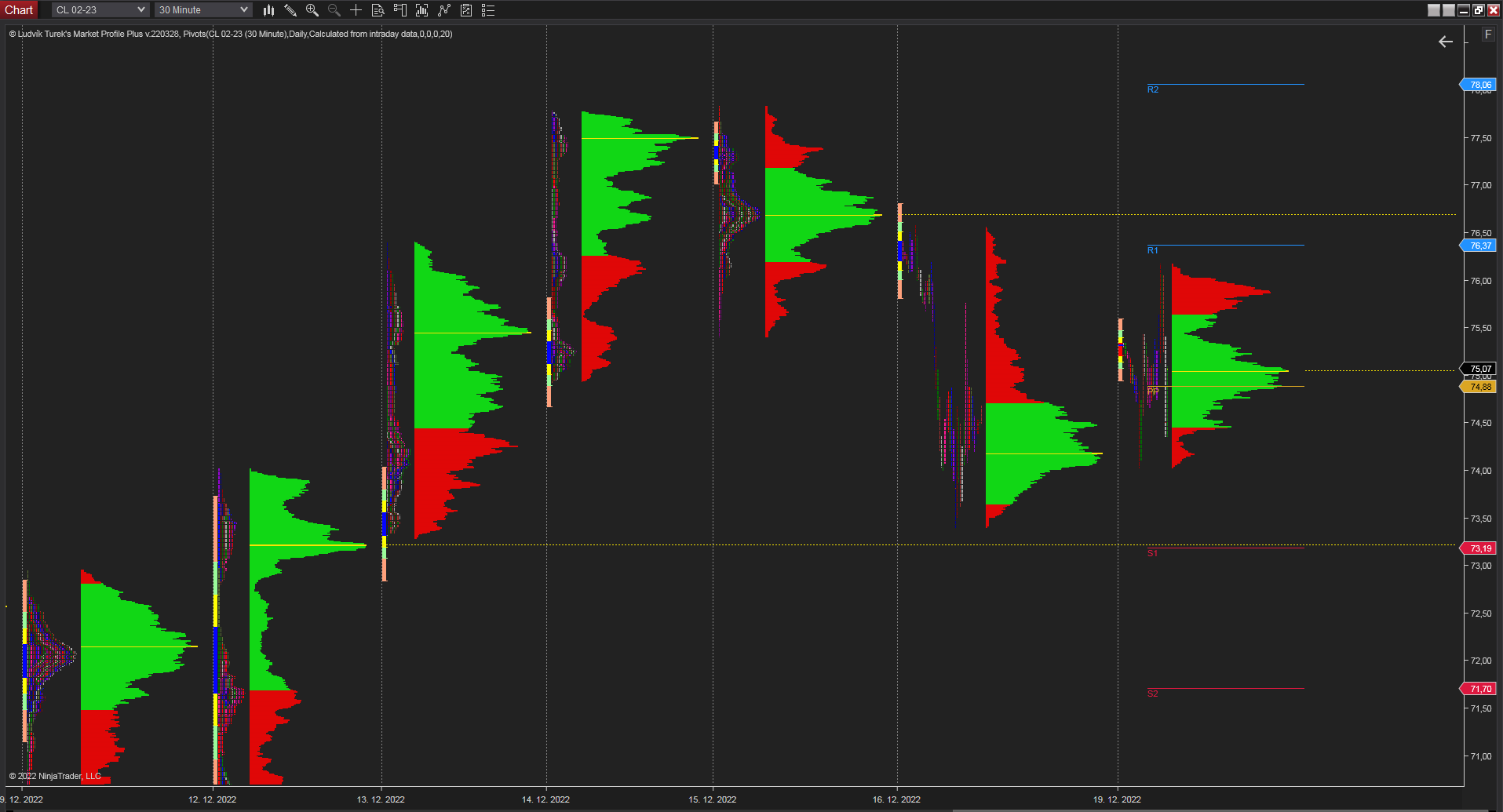

The Volume Weighted Average Price indicator shows the price of crude oil fights with the resistance representing the monthly developing VWAP price at $75.84. Crude oil heads to the second month of decline and in the last week the price fought with the mentioned level several times.

You may be interested in: Meta Platforms advances after unique upgrade

The monthly volume histogram on the right side of the chart below shows, that currently, more than 70% of the whole traded monthly volume is under $76 per barrel. The next resistance based on the monthly look could be around the level of $81 and $83.57, representing last month’s VWAP.

30 minutes chart of CL (Crude Oil Futures), The monthly VWAP, source: Author’s analysis

In the shorter time period, the daily market profile shows a resistance level of $76.70 per barrel. This level represents the highest traded volume from the 15th of December, in other words – Point of control. The support could be at $73.21 as POC from the 12th of December, which agrees with the 1st pivot point support at $73.19.

30 minutes chart of CL (Crude Oil Futures), Daily Market Profile, Source: author’s analysis

Risk-off sentiment persists

Risk-off sentiment persists in markets despite the fact that China changed the Zero-Covid policy and pledged to revive energy consumption. Moodix sentiment underwrites the negative sentiment with -0.30 points, representing risk-off sentiment. Markets simply do not believe in strong change in economic activity thanks to the persisting high inflation.

Comments

Post has no comment yet.