The housing market has been hit with elevated rates, increasing numbers of vacant properties, and now lenders going bankrupt. However, the impact of the credit crunch is now extending to commercial real estate, which is facing its own set of challenges.

The noose around the sector is tightening, and the effects are being felt by lenders and property owners alike. This article, inspired by this Twitter thread written by Joe Consorti, will explore the current state of the commercial real estate market, the factors driving the downturn, and the potential long-term consequences for the industry.

Is the real estate market about to turn south?

Banks take in deposits and subsequently use these funds to lend money to property developers who show promise of making a return on capital. However, with the recent loss of deposits, their ability to finance real estate projects is diminishing rapidly.

Related article: Owning vs. renting – what is preferred choice of younger generations?

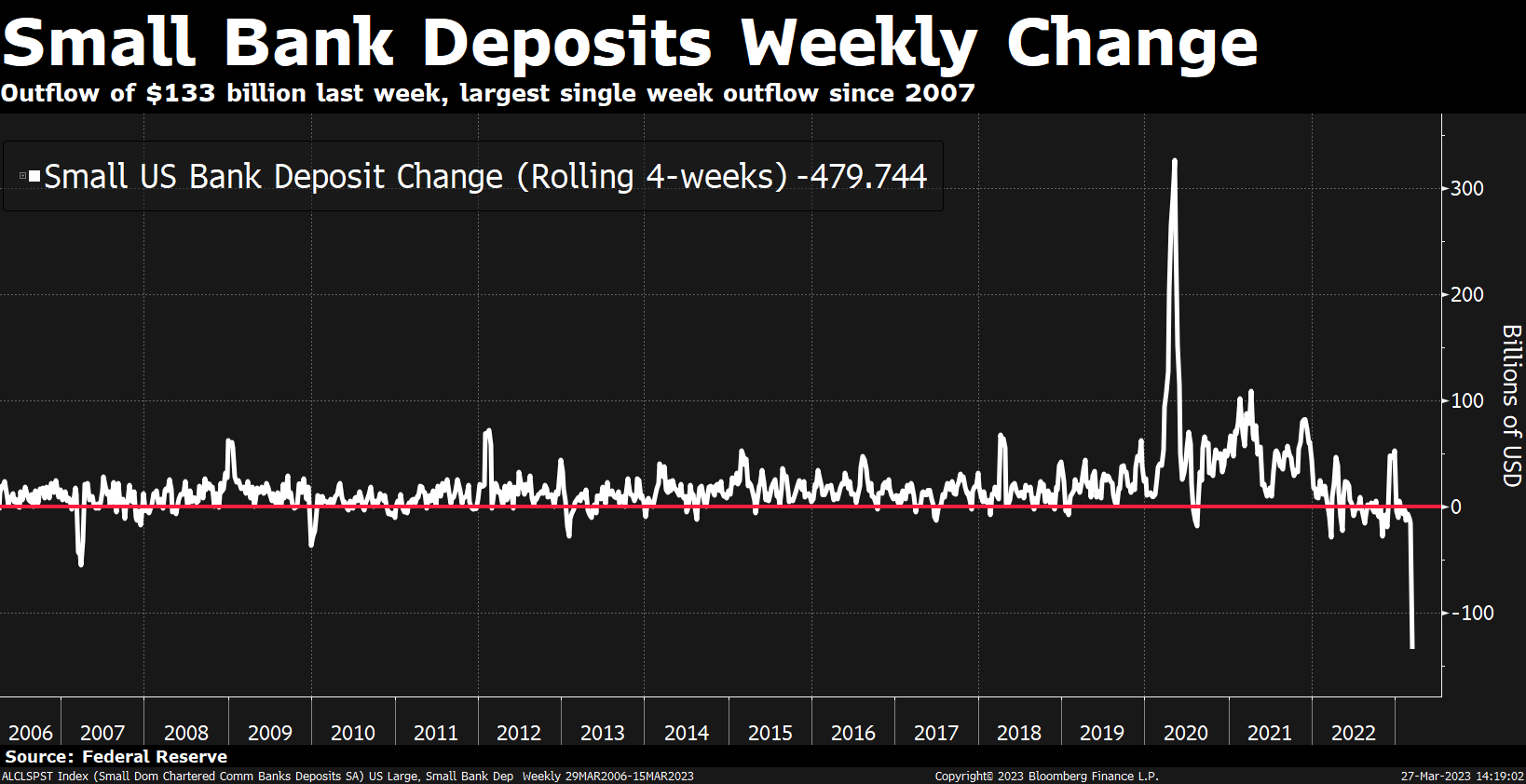

In fact, small banks have recently experienced the largest week of deposit outflows since 2007, exacerbating the challenge of creating loans. Consequently, the shortage of funding is becoming a significant obstacle to loan creation.

Small bank deposits change, source: twitter.com

CRE lending dropped significantly

The outlook for commercial real estate (CRE) lending is grim, with projections indicating a potential decline of up to 40% this year. As a result, many banks have already started to reduce their lending to the sector.

The reasons for this downturn in CRE lending are multifaceted, with the current economic climate being a significant contributing factor. Banks are struggling to secure the necessary funding to finance loans, with deposits dwindling and loan defaults rising.

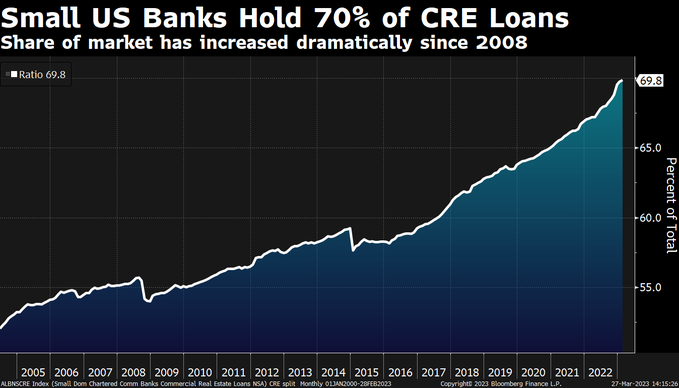

“This time, the banks most at risk are not the behemoths like in ’08. CRE loan exposure is largely concentrated within small and midsize banks, Consorti said.

These challenges have led to a sharp reduction in CRE lending, which is causing a ripple effect throughout the entire real estate industry. The long-term implications of this trend remain uncertain, but they could have significant implications for the future of commercial real estate.

Lender count, source: twitter.com

Small banks hold most of the CRE loans

The banks that are facing a loss of depositors and struggling to stay afloat are the very same ones that would be hit the hardest by defaulting CRE loans. The impact on these banks would be disproportionate and could have far-reaching consequences.

Read more: MicroStrategy buys 6,455 BTC for $150 million – are they in profit?

This is particularly concerning because small banks in the US hold approximately 70% of the $2.925 trillion in total outstanding CRE loans.

Small banks hold 70% of CRE loans, source: twitter.com

As a result, the potential damage caused by defaulting loans could be significant and may further exacerbate the existing challenges faced by these banks.

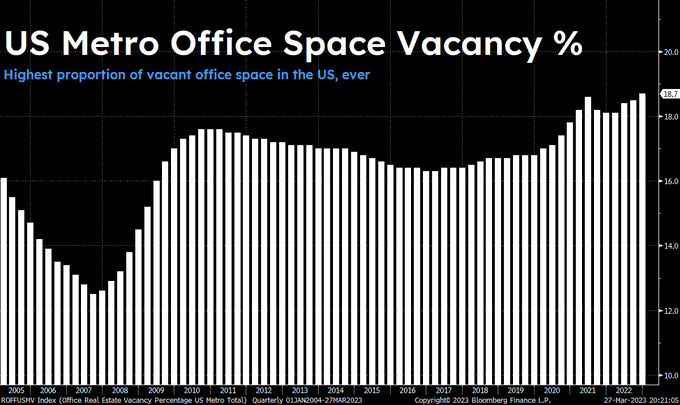

“Not only is funding stress soaring as the main CRE lenders fail, but there’s also a widening revenue hole as vacancies rise,” Consorti explained.

Historically high vacancy rates

Despite the gradual easing of pandemic-related restrictions, many US cities are experiencing an unprecedented surge in office vacancies that shows no signs of abating. As a result, the amount of vacant office space in these cities has reached a historic high of 18.7%.

Shockingly, this means that nearly one-fifth of all US office space is currently unoccupied, with no indication of occupancy in the near future. This trend has led to a sharp decline in rental income, with roughly one-fifth of all US office space generating no rental revenue at all.

Vacancy rate in US cities, source: twitter.com

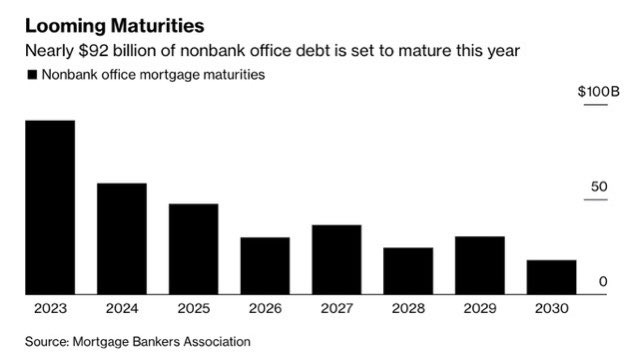

The commercial real estate industry is facing an increasingly dire situation, with plummeting revenue, sky-high interest rates, and impending refinancing deadlines. Specifically, there is a staggering $92 billion worth of office debt that is set to mature this year and must be refinanced at a spread that is approximately 750 basis points (bps) higher than previous rates.

Looming maturities by year, source: twitter.com

This daunting challenge is pushing many developers to their breaking point, as they struggle to keep their businesses afloat. As a result, many may be forced to choose between selling their properties or defaulting on their financial obligations altogether.

“This has already started happening and billions of dollars in loan payments are already past due. Of the $162 billion commercial real estate debt that matures in 2023, $35 billion of it is past due,” Consorti claimed.

The commercial real estate market currently holds a staggering $20 trillion in value, with $2.92 trillion of that total comprised of outstanding CRE debt. However, if forced selling were to occur due to the current economic situation, it could have a detrimental impact on the market.

Total CRE loans, source: twitter.com

Such a scenario would likely result in significant impairment, which could have far-reaching consequences for the entire commercial real estate industry.

Also read: Forex outlook: Current state of CAD/JPY, EUR/AUD, and AUD/JPY

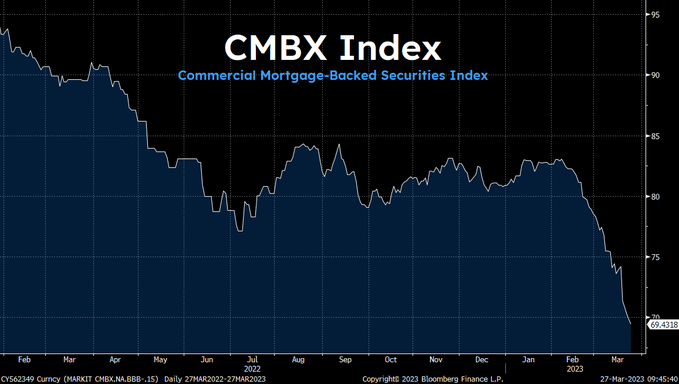

The CRE market is currently facing significant headwinds, with traders placing bets against its long-term viability. One key indicator of this trend is the recent sell-off of the BBB tranche of the Commercial Mortgage-Backed Securities Index (CMBX), which has dropped to just $0.69.

CMBX Index chart, source: twitter.com

This decline reflects a growing lack of confidence in the commercial real estate industry and its prospects for the future. Multiple factors are converging to create a perfect storm that could trigger another catastrophic crash in America’s commercial real estate market.

Final thoughts

These include the tightening of loan standards due to bank failures, a sharp increase in office vacancies that is drastically reducing revenue streams, and an upcoming maturity wall that will force commercial mortgages to be refinanced at much wider spreads.

Given the magnitude of these challenges, it is becoming increasingly clear that the CRE industry is teetering on the brink of collapse, with another market crash looming. It all depends on how long will the Fed play the game of high interest rates. If no rate cuts arrive until the end of the year, the real estate market may collapse harder than ever before.

Comments

Post has no comment yet.