OPEC+ steps

This week’s headlines at the commodity markets belong to crude oil. The biggest volatility was seen in the second half of the week. The main fundamental news is about OPEC+ decisions on the rising output of crude oil. Another activity from OPEC was a suggestion to remove Russia from monthly supply agreements. Saudi Arabia left a message to be ready to fill the gap in supply after sanctions on Russia because of starting the war. News about possible gap filling of supply in crude oil caused a price fall of – 4.54% to 111.64$.

Weekly development of Crude oil futures. Source: tradingview.com

On Thursday, OPEC+ unveiled the output numbers for the next two months. They boosted production by 50% in comparison with recent months to 648,000 barrels a day. Overall, this step is seen negatively, because the level of production rising was lower than analysts awaited. Therefore the price of crude oil futures skyrocketed by +5.91% to 117.77$ per barrel and erased the previous easing.

Read also: USD/CHF remains pressured near 6-week low

Pressures on crude prices

The pressure on gasoline prices is significant due to higher demand ahead of summer. The USA as the customer of Saudi Arabia pressured to avoid higher prices. Crude oil stockpiles in the US declined by 5.1 million barrels, which tightens the market and pushes the price up. China eases lockdowns in several important parts of the country. That signals higher demand for crude oil as well.

Point of control

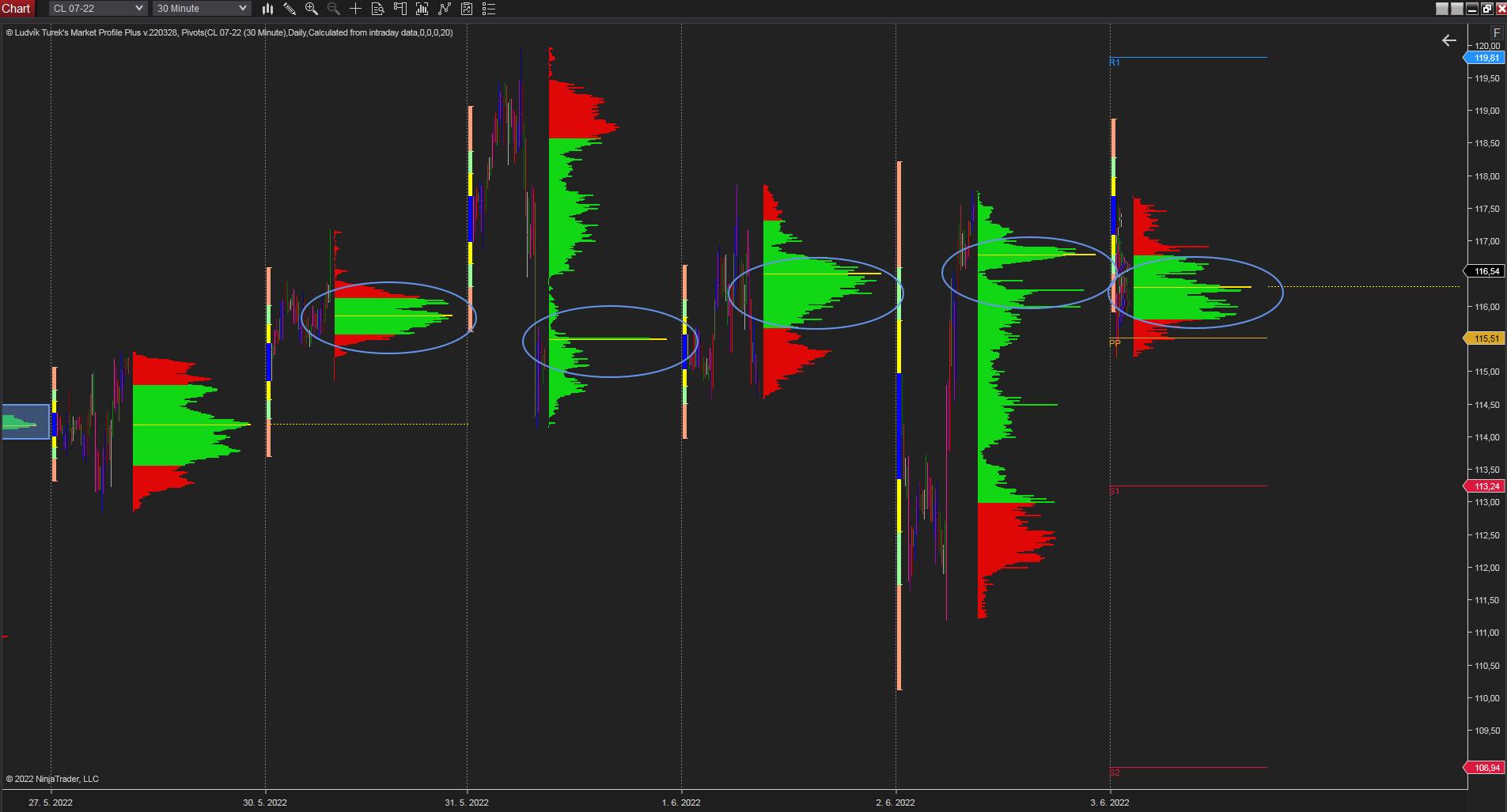

The chart below shows weekly development in crude oil futures by market profile indicator. This indicator shows where is the biggest traded volume each day. As we can see, despite the high volatility, points of control (the biggest volume) of each day are around 116$ price tag. That means that this week’s fair price is 116$ and more depending on the next fundamentals.

30 minutes chart of CL, Daily Market Profile. Source: Author’s analysis

We also analyzed: LUNA 2.0 (LUNC) is out – investors need to stay cautious

Russia and The OPEC

The biggest question is what attitude the OPEC alliance will take towards Russia. Russia is one of the partners, but because of its war against Ukraine, the position in the alliance is questionable. Moreover, the possible change of power inside the cartel could have a significant impact on the price of crude.

Comments

Post has no comment yet.